Application for Salesuse Tax Exemption 2025-2026

Understanding the Application for Sales and Use Tax Exemption

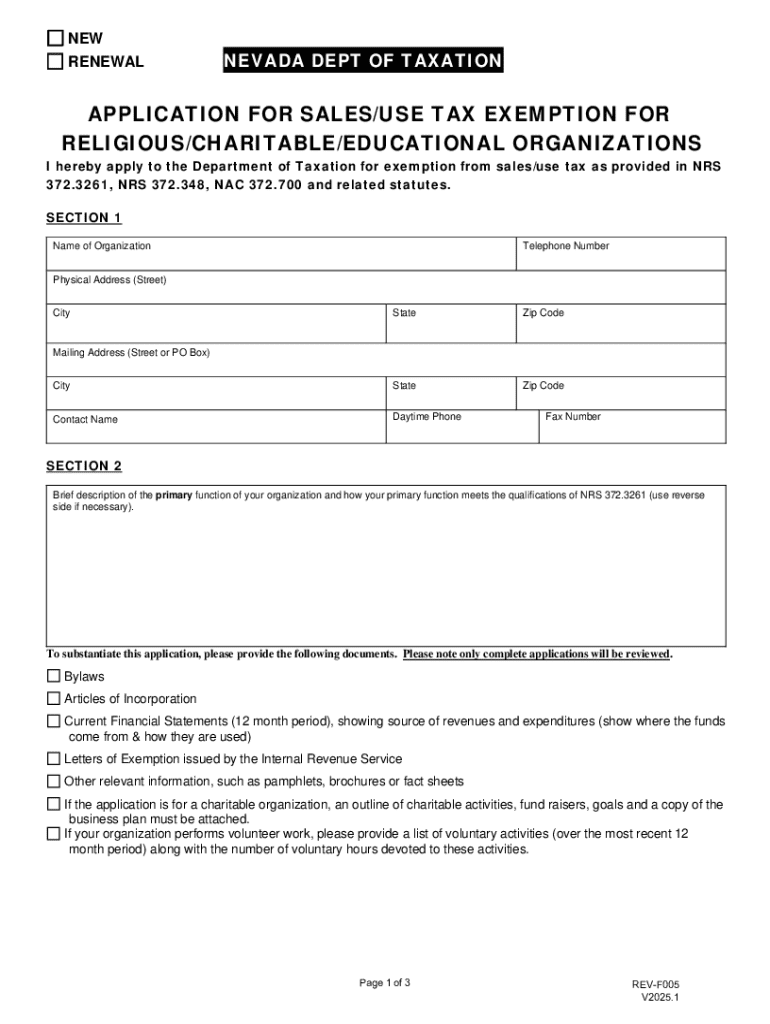

The Application for Sales and Use Tax Exemption allows eligible businesses and organizations in Nevada to apply for exemption from sales and use tax. This exemption can significantly reduce operational costs, making it essential for qualifying entities to understand its purpose. The application is primarily intended for non-profit organizations, government entities, and certain businesses that meet specific criteria outlined by the state.

Eligibility Criteria for the Sales and Use Tax Exemption

To qualify for the Nevada tax exemption, applicants must meet certain eligibility requirements. Generally, non-profit organizations must demonstrate that their activities serve a public purpose and align with the state's definition of exempt entities. Additionally, businesses may qualify if they are engaged in specific activities such as manufacturing, research and development, or providing certain services. It's crucial for applicants to review the detailed criteria to ensure they meet all requirements before submitting the application.

Steps to Complete the Application for Sales and Use Tax Exemption

Completing the Application for Sales and Use Tax Exemption involves several key steps:

- Gather necessary documentation, including proof of eligibility and financial information.

- Obtain the application form, which can be accessed online or through state offices.

- Fill out the application form accurately, ensuring all required fields are completed.

- Submit the application along with any supporting documents to the appropriate state agency.

- Await confirmation of receipt and approval from the state.

Following these steps carefully can help ensure a smooth application process.

Required Documents for the Application

Applicants must provide specific documents when submitting the Application for Sales and Use Tax Exemption. Commonly required documents include:

- Proof of non-profit status or business registration.

- Financial statements or tax returns for the previous year.

- Documentation supporting the claim for exemption, such as mission statements or descriptions of activities.

- Any additional information requested by the state agency.

Having these documents ready can expedite the application process and reduce the chances of delays.

Form Submission Methods

The Application for Sales and Use Tax Exemption can be submitted through various methods, depending on the preferences of the applicant. These methods include:

- Online submission through the state’s official website.

- Mailing a completed paper application to the designated state office.

- In-person submission at local government offices.

Each method has its own processing times, so applicants should consider their needs when choosing how to submit the application.

Legal Use of the Sales and Use Tax Exemption

The legal use of the sales and use tax exemption is strictly governed by state laws. Approved entities must ensure that they use the exemption solely for qualifying purchases related to their exempt activities. Misuse of the exemption can lead to penalties, including back taxes owed, fines, or revocation of the exemption status. It is essential for organizations to maintain accurate records of purchases and ensure compliance with all regulations to avoid legal complications.

Create this form in 5 minutes or less

Find and fill out the correct application for salesuse tax exemption

Create this form in 5 minutes!

How to create an eSignature for the application for salesuse tax exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nv tax exemption and how does it apply to my business?

The nv tax exemption refers to specific tax benefits available to businesses operating in Nevada. This exemption can signNowly reduce your tax liabilities, allowing you to allocate more resources towards growth. Understanding how to leverage the nv tax exemption can enhance your financial strategy.

-

How can airSlate SignNow help me manage documents related to nv tax exemption?

airSlate SignNow provides a streamlined platform for managing documents associated with the nv tax exemption. With our eSigning features, you can easily send, sign, and store important tax documents securely. This efficiency helps ensure compliance and timely submissions.

-

Are there any costs associated with obtaining the nv tax exemption?

While the nv tax exemption itself does not have a direct cost, there may be fees related to the application process. Utilizing airSlate SignNow can help minimize these costs by simplifying document management and reducing administrative overhead. Our platform is designed to be cost-effective for businesses of all sizes.

-

What features does airSlate SignNow offer that support the nv tax exemption process?

airSlate SignNow offers features such as customizable templates, secure cloud storage, and real-time tracking of document status. These tools are essential for managing the nv tax exemption process efficiently. Our platform ensures that you can handle all necessary paperwork with ease.

-

Can I integrate airSlate SignNow with other software to manage nv tax exemption documents?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage nv tax exemption documents. Whether you use accounting software or CRM systems, our integrations ensure that your workflow remains uninterrupted. This connectivity simplifies the overall process.

-

What are the benefits of using airSlate SignNow for nv tax exemption documentation?

Using airSlate SignNow for nv tax exemption documentation offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform allows for quick eSigning and document sharing, which can expedite the tax exemption process. This ultimately saves you time and resources.

-

Is airSlate SignNow compliant with Nevada's regulations regarding nv tax exemption?

Yes, airSlate SignNow is designed to comply with Nevada's regulations, including those related to the nv tax exemption. We prioritize security and compliance, ensuring that your documents meet all legal requirements. This commitment helps protect your business and supports your tax exemption efforts.

Get more for Application For Salesuse Tax Exemption

- Responding to a complaint maryland kramon ampamp graham form

- Cause no dc 16 07983 city of dallasin the form

- Mississippi rule of civil procedure 41b casetext form

- Comes now plaintiff 490172416 form

- And files this form

- Transferring your case to another court answers to common form

- Rule 82 jurisdiction and venue miss r civ p 82casetext form

- Responses to interrogatories arkansas legal services form

Find out other Application For Salesuse Tax Exemption

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer