Lgl 002 Form

What is the Lgl 002

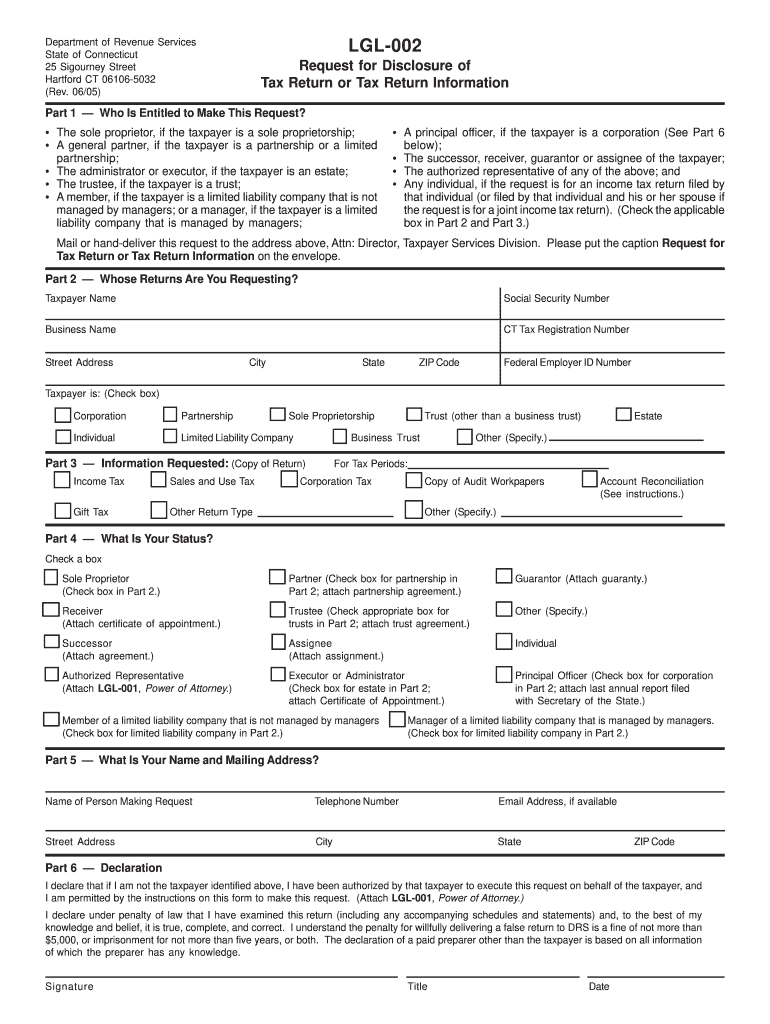

The Lgl 002 form is a specific document used in various legal and administrative contexts within the United States. It serves as a formal request or declaration that may be required for tax, legal, or compliance purposes. Understanding the exact nature and requirements of the Lgl 002 is crucial for individuals and businesses to ensure proper handling and submission.

How to use the Lgl 002

Using the Lgl 002 form involves several key steps to ensure that it is filled out correctly and submitted appropriately. First, gather all necessary information, including personal details and any relevant identifiers. Next, carefully complete each section of the form, ensuring accuracy to avoid delays or complications. Once completed, review the form for errors before submission, as inaccuracies can lead to compliance issues.

Steps to complete the Lgl 002

Completing the Lgl 002 form requires a systematic approach:

- Gather required documents and information.

- Fill out the form accurately, paying attention to all fields.

- Review the form for any mistakes or missing information.

- Sign and date the form as required.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the Lgl 002

The legal use of the Lgl 002 form is governed by specific regulations and standards. It must be completed in compliance with applicable laws to ensure its validity. This includes understanding the requirements for signatures, the importance of accurate information, and adherence to deadlines. Utilizing a reliable platform for electronic signing can enhance the legal standing of the completed form.

Key elements of the Lgl 002

Several key elements define the Lgl 002 form and its use:

- Identification of the parties involved.

- Clear description of the purpose of the form.

- Signature fields for all required parties.

- Compliance with relevant legal standards.

- Submission instructions and deadlines.

Filing Deadlines / Important Dates

Filing deadlines for the Lgl 002 form vary depending on its purpose and the specific regulations governing its use. It is essential to be aware of these deadlines to avoid penalties or complications. Keeping a calendar of important dates related to the form can help ensure timely submission and compliance with all legal requirements.

Form Submission Methods (Online / Mail / In-Person)

The Lgl 002 form can typically be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission through designated platforms.

- Mailing the completed form to the appropriate address.

- In-person submission at designated offices or locations.

Quick guide on how to complete lgl 002

Complete Lgl 002 effortlessly on any device

Digital document management has become increasingly sought after by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Lgl 002 on any device using airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

The easiest method to modify and eSign Lgl 002 without hassle

- Locate Lgl 002 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important portions of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to deliver your form, by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any preferred device. Modify and eSign Lgl 002 to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lgl 002

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is lgl 002 and how does it relate to airSlate SignNow?

Lgl 002 refers to the unique identifier for specific features within airSlate SignNow. This robust tool allows businesses to streamline document signing processes, making it efficient to eSign important documents.

-

What pricing plans are available for lgl 002 on airSlate SignNow?

airSlate SignNow offers competitive pricing options for lgl 002, which ensures businesses of all sizes can afford electronic document signing. Plans typically vary based on features and the number of users, so you can choose what fits your needs best.

-

What are the key features of lgl 002 in airSlate SignNow?

The key features of lgl 002 within airSlate SignNow include customizable workflows, real-time tracking, and extensive document management capabilities. These features enhance efficiency and ensure seamless document eSigning experiences.

-

How can lgl 002 benefit my business?

Lgl 002 can signNowly benefit your business by reducing turnaround times for document signing and enhancing collaboration among team members. This efficient process can lead to increased productivity and improved client satisfaction.

-

Does airSlate SignNow with lgl 002 offer integrations with other tools?

Yes, airSlate SignNow with lgl 002 provides numerous integration options with popular tools like Google Drive, Dropbox, and Salesforce. This feature allows for an enhanced workflow and easy management of your documents.

-

Is there a mobile app for lgl 002 within airSlate SignNow?

Absolutely! airSlate SignNow offers a mobile app that incorporates lgl 002 functionality, allowing you to send and eSign documents on-the-go. This feature ensures you can manage documents from anywhere, improving flexibility.

-

How secure is lgl 002 in airSlate SignNow?

Lgl 002 in airSlate SignNow is designed with security in mind, utilizing industry-standard encryption and authentication protocols. This ensures that your documents and data remain protected throughout the signing process.

Get more for Lgl 002

- Regis college transcript request form

- Stanislaus county clerk recorder form

- Alpine townshipmechanical permit application form

- Sample of background check form

- Texas ifta application fill and sign printable template form

- Homeowners verification of and property taxes for use with form ptr 1 homeowners verification of and property taxes for use

- Account number yeardaytime phone number before irt form

- Reset formcountyfile this form with the county tre

Find out other Lgl 002

- eSign West Virginia Rental lease agreement template Safe

- How To eSign California Residential lease agreement form

- How To eSign Rhode Island Residential lease agreement form

- Can I eSign Pennsylvania Residential lease agreement form

- eSign Texas Residential lease agreement form Easy

- eSign Florida Residential lease agreement Easy

- eSign Hawaii Residential lease agreement Online

- Can I eSign Hawaii Residential lease agreement

- eSign Minnesota Residential lease agreement Simple

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy