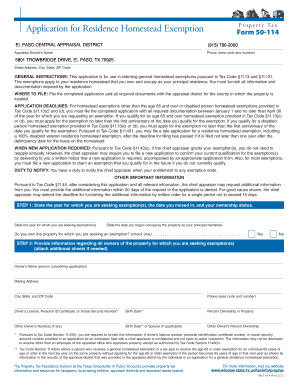

El Paso Central Appraisal District Homestead Exemption Form

What is the El Paso Central Appraisal District Homestead Exemption

The El Paso Central Appraisal District Homestead Exemption is a property tax benefit designed to reduce the taxable value of a homeowner's primary residence in El Paso, Texas. This exemption can significantly lower the amount of property taxes owed, making homeownership more affordable. To qualify, the property must be the owner's principal residence, and the homeowner must meet specific eligibility criteria set by the state of Texas.

Eligibility Criteria for the Homestead Exemption

To qualify for the El Paso homestead exemption, applicants must meet certain requirements, including:

- The property must be the applicant's primary residence.

- The applicant must be a Texas resident.

- The applicant must not have claimed a homestead exemption on another property.

- Applicants must provide proof of ownership, such as a deed or tax statement.

Meeting these criteria ensures that homeowners can benefit from the tax relief intended for primary residences.

Steps to Complete the El Paso Central Appraisal District Homestead Exemption

Completing the homestead exemption application involves several straightforward steps:

- Gather necessary documents, including proof of identity and property ownership.

- Obtain the El Paso homestead exemption form from the El Paso Central Appraisal District.

- Fill out the form accurately, ensuring all required information is provided.

- Submit the completed form to the appraisal district by the specified deadline.

Following these steps can help ensure a smooth application process and timely approval.

How to Use the El Paso Central Appraisal District Homestead Exemption

Once approved, the El Paso homestead exemption reduces the assessed value of the property, which in turn lowers property taxes. Homeowners can use the exemption to budget more effectively, knowing they will pay less in taxes each year. It is important to renew the exemption annually and keep the appraisal district informed of any changes in residency or ownership status.

Required Documents for the Homestead Exemption

When applying for the El Paso homestead exemption, homeowners must provide specific documentation, including:

- A completed homestead exemption application form.

- Proof of identity, such as a driver's license or state ID.

- Documentation proving ownership, like a deed or property tax statement.

Having these documents ready can streamline the application process and help avoid delays.

Form Submission Methods for the Homestead Exemption

Homeowners can submit their homestead exemption application through various methods:

- Online submission via the El Paso Central Appraisal District website.

- Mailing the completed form to the appraisal district's office.

- In-person submission at the appraisal district office.

Choosing the most convenient submission method can help ensure that the application is received and processed promptly.

Quick guide on how to complete el paso central appraisal district homestead exemption

Effortlessly Prepare El Paso Central Appraisal District Homestead Exemption on Any Device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage El Paso Central Appraisal District Homestead Exemption on any device with the airSlate SignNow applications for Android or iOS and simplify any document-related process today.

The Easiest Method to Modify and Electronically Sign El Paso Central Appraisal District Homestead Exemption Smoothly

- Obtain El Paso Central Appraisal District Homestead Exemption and click on Get Form to begin.

- Utilize the tools at your disposal to finish your document.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you prefer to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Adjust and electronically sign El Paso Central Appraisal District Homestead Exemption to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the el paso central appraisal district homestead exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a homestead exemption in El Paso?

A homestead exemption in El Paso is a legal provision that helps homeowners reduce their property tax burden. By applying for this exemption, eligible homeowners can lower the taxable value of their property, ultimately resulting in savings on their yearly taxes. This benefit is crucial for anyone looking to manage their finances effectively.

-

How do I apply for a homestead exemption in El Paso?

To apply for a homestead exemption in El Paso, you must complete the necessary application forms available from the local tax office or their website. The application typically requires proof of residency and ownership of the property. Once submitted, it can take several weeks for your application to be processed.

-

What are the eligibility requirements for the homestead exemption in El Paso?

Eligibility for the homestead exemption in El Paso generally includes being a resident homeowner, occupying the property as your primary residence, and not having any delinquent property taxes. Additional qualifications may pertain to age, disability status, or veteran status. It's essential to check with local authorities for specific criteria related to your situation.

-

Are there any fees associated with the homestead exemption in El Paso?

There are usually no application fees for obtaining a homestead exemption in El Paso. However, ensuring all required documentation is correctly submitted can save you from delays or the need for additional filings. Always verify with your local office for any changes to fees or processes.

-

How does the homestead exemption affect my property taxes in El Paso?

The homestead exemption can signNowly decrease the taxable value of your property in El Paso. This means that the assessed value used to determine your property tax will be lower, which directly translates to a reduced tax bill. Homeowners who utilize this exemption often see a substantial annual savings.

-

Can I apply for a homestead exemption if I own multiple properties in El Paso?

In El Paso, homeowners can only receive the homestead exemption on their primary residence. If you own multiple properties, you must determine which one qualifies based on your primary living situation. Applying for exemptions on additional properties will not provide the same tax benefits.

-

What documentation do I need for the homestead exemption in El Paso?

To apply for a homestead exemption in El Paso, you'll need documentation proving your identity and residency, such as a driver's license, property deed, and utility bills. This information helps verify that you are indeed the owner and the property is your primary residence. Ensure that all documents are current and accurately reflect your situation.

Get more for El Paso Central Appraisal District Homestead Exemption

- This is to certify that format

- Complaint form san bernardino county district attorney

- Ers 209 form

- Pwcs resicnation form

- Charge notice challenge form milton keynes council

- Form 3805z enterprise zone deduction and credit summary ftb ca

- Fifteen 15 day notice to vacate form

- Solar sale agreement template form

Find out other El Paso Central Appraisal District Homestead Exemption

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple