Form Tc 547

What is the Form TC 547

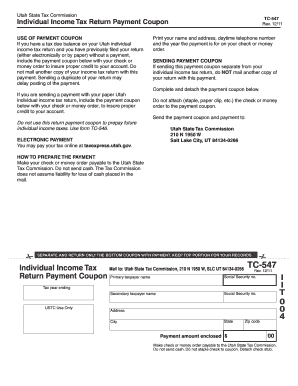

The TC 547 is a tax form used in Utah, specifically designed for individuals and businesses to report certain tax-related information. This form is essential for ensuring compliance with state tax regulations. It typically pertains to various tax credits and deductions that taxpayers may be eligible for, allowing them to accurately report their financial activities to the Utah State Tax Commission.

How to Use the Form TC 547

Using the TC 547 involves understanding the specific tax credits or deductions applicable to your situation. Taxpayers should first identify the relevant sections of the form that correspond to their financial activities. After gathering necessary documentation, such as income statements and prior tax returns, individuals can fill out the form by providing accurate information in the designated fields. It is advisable to review the completed form for accuracy before submission to avoid any potential issues with the tax authority.

Steps to Complete the Form TC 547

Completing the TC 547 requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documentation, including income statements and prior tax returns.

- Identify the specific tax credits or deductions applicable to your situation.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the form by the designated deadline, either online or via mail.

Legal Use of the Form TC 547

The TC 547 is legally recognized as a valid document for reporting tax information in Utah. To ensure its legal standing, taxpayers must adhere to state regulations regarding its completion and submission. This includes providing truthful and accurate information, as any discrepancies may lead to penalties or legal consequences. Utilizing a reliable eSignature solution can further enhance the legitimacy of the document by providing a secure method of signing and submitting the form electronically.

Filing Deadlines / Important Dates

Filing deadlines for the TC 547 are crucial for compliance with state tax laws. Typically, the form must be submitted by the tax filing deadline, which is generally April 15 for individual taxpayers. However, specific deadlines may vary based on individual circumstances, such as extensions or special provisions for businesses. It is important to stay informed about any changes to filing dates to avoid late penalties.

Form Submission Methods (Online / Mail / In-Person)

The TC 547 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Taxpayers can complete and submit the form electronically through the Utah State Tax Commission's website.

- Mail: The completed form can be printed and sent via postal service to the appropriate tax authority address.

- In-Person: Individuals may also choose to submit the form in person at designated tax office locations.

Quick guide on how to complete form tc 547

Complete Form Tc 547 effortlessly on any device

Online document management has become increasingly popular with businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle Form Tc 547 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign Form Tc 547 with ease

- Locate Form Tc 547 and click on Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize relevant portions of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your PC.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign Form Tc 547 and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form tc 547

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tc547 and how does it relate to airSlate SignNow?

tc547 is a powerful feature within airSlate SignNow that streamlines the eSigning process. It allows users to securely send, sign, and manage documents online, enhancing workflow efficiency. With tc547, businesses can experience a more organized and professional approach to document management.

-

How much does airSlate SignNow's tc547 feature cost?

The pricing for airSlate SignNow's tc547 feature varies depending on your business needs and the plan you choose. Basic plans often include essential features, while advanced plans provide enhanced functionalities. Visit our pricing page to find the best option for your organization.

-

What are the key benefits of using tc547 in airSlate SignNow?

Using tc547 in airSlate SignNow provides numerous benefits including improved document security, faster turnaround times, and ease of use. This feature not only saves time but also reduces the likelihood of errors in the signing process. Businesses can signNowly enhance their productivity by implementing tc547.

-

Can I integrate tc547 with other tools and software?

Yes, tc547 in airSlate SignNow seamlessly integrates with a variety of other tools and software that businesses commonly use. This includes CRM systems, cloud storage solutions, and project management software. By integrating tc547, you can create a more cohesive workflow overall.

-

Is tc547 suitable for all types of businesses?

Absolutely! tc547 is designed to cater to businesses of all sizes, from startups to large enterprises. Whether you need to send contracts, agreements, or any other documents, tc547 can adapt to your specific requirements. Its user-friendly interface ensures that everyone can leverage its capabilities.

-

What security features does tc547 offer?

tc547 incorporates robust security measures to protect your documents during the signing process. Features include encryption, secure cloud storage, and customizable access controls. This commitment to security ensures that your sensitive information remains protected at all times when using airSlate SignNow.

-

How can I get started with tc547 in airSlate SignNow?

Getting started with tc547 in airSlate SignNow is simple. Just sign up for an account and choose a plan that suits your needs. Once you have access, you can easily navigate through the setup process and begin utilizing the features of tc547 to enhance your document workflows.

Get more for Form Tc 547

- Stanislaus county temporary custody forms

- Blank schedule form west liberty university westliberty

- College application washington print outs form

- Admission form fill up

- Cw l 041 att access card request form cw l 041 att access card request form

- Hearing to review the fire season and long form

- Standard care agreement template 787747815 form

Find out other Form Tc 547

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free