Indemnity Bond Format for Release of Payment

What is the indemnity bond format for release of payment?

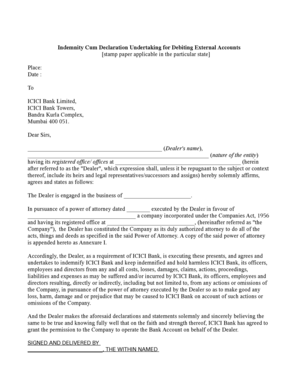

The indemnity bond format for release of payment is a legal document that serves to protect a financial institution, such as ICICI Bank, from potential losses when releasing funds. This bond outlines the obligations of the party requesting the payment and ensures that the bank is indemnified against any claims that may arise from the transaction. Typically, it includes essential details such as the names of the parties involved, the amount of money being released, and the specific conditions under which the payment is authorized.

How to use the indemnity bond format for release of payment

Using the indemnity bond format for release of payment involves several key steps. First, ensure that you have the correct form, which can often be obtained from your bank or legal advisor. Next, fill in the required details accurately, including the names and addresses of the parties involved, the amount of the payment, and any relevant dates. Once completed, both parties should sign the document, and it may need to be notarized depending on state requirements. After signing, submit the bond to the bank along with any other required documentation to facilitate the payment process.

Key elements of the indemnity bond format for release of payment

Several key elements must be included in the indemnity bond format for it to be effective. These elements typically include:

- Identifying information: Names and addresses of the indemnifier and the indemnified party.

- Amount: The specific amount of money being released.

- Conditions: Clear conditions under which the indemnity applies.

- Signatures: Signatures of all parties involved, along with the date of signing.

- Notarization: A notary public's signature, if required by law.

Steps to complete the indemnity bond format for release of payment

Completing the indemnity bond format involves a series of straightforward steps:

- Obtain the correct indemnity bond format from your bank or legal advisor.

- Fill in the necessary details, ensuring accuracy in names, addresses, and amounts.

- Review the document for completeness and clarity.

- Sign the document in the presence of a notary public, if required.

- Submit the completed bond to the bank along with any additional documents needed for the payment release.

Legal use of the indemnity bond format for release of payment

The legal use of the indemnity bond format for release of payment is crucial for ensuring that all parties are protected. This bond is legally binding, provided it meets the necessary requirements under state law. It serves as a safeguard for the bank against any future claims related to the payment. By signing the bond, the indemnifier agrees to hold the bank harmless and indemnifies it against any losses or damages that may arise from the transaction.

How to obtain the indemnity bond format for release of payment

To obtain the indemnity bond format for release of payment, you can follow these steps:

- Visit your local ICICI Bank branch and request the form from a representative.

- Check the bank's official website for downloadable versions of the indemnity bond format.

- Consult with a legal advisor who can provide a customized version of the indemnity bond format tailored to your needs.

Quick guide on how to complete indemnity bond format for release of payment 202762578

Effortlessly Prepare Indemnity Bond Format For Release Of Payment on Any Device

The management of online documents has become increasingly favored by both businesses and individuals. It serves as an excellent environmentally friendly substitute for traditional printed and signed materials, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without delays. Manage Indemnity Bond Format For Release Of Payment across any platform using the airSlate SignNow apps available for Android or iOS and simplify any document-related process today.

How to Modify and Electronically Sign Indemnity Bond Format For Release Of Payment with Ease

- Obtain Indemnity Bond Format For Release Of Payment and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that function.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you'd like to send your form, whether via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Indemnity Bond Format For Release Of Payment to maintain excellent communication throughout every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indemnity bond format for release of payment 202762578

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ICICI bank indemnity bond format?

The ICICI bank indemnity bond format is a legally binding document that outlines the terms and conditions under which indemnity is provided by the bank. This format is essential for securing loans and other financial transactions where guarantees are required. Utilizing the correct format ensures compliance with legal standards.

-

How can I obtain the ICICI bank indemnity bond format?

You can obtain the ICICI bank indemnity bond format from the ICICI bank's official website or by visiting your nearest branch. Additionally, airSlate SignNow provides templates that can be customized to match the ICICI bank indemnity bond requirements, making the process easier for users.

-

What are the key features of airSlate SignNow for creating an indemnity bond?

airSlate SignNow offers features such as document editing, eSignature capabilities, and secure cloud storage, enabling users to create and manage the ICICI bank indemnity bond format effortlessly. The platform allows for easy collaboration and quick turnaround times for document signing.

-

Are there any fees associated with using airSlate SignNow for the ICICI bank indemnity bond format?

Yes, while airSlate SignNow provides an affordable solution, there may be fees associated with subscription plans depending on your usage. However, the cost-effectiveness of creating and managing the ICICI bank indemnity bond format through this platform often outweighs traditional methods.

-

Is it safe to use airSlate SignNow for my ICICI bank indemnity bond format?

Absolutely. airSlate SignNow employs robust security measures, including encryption and multi-factor authentication, to ensure that your ICICI bank indemnity bond format and other sensitive documents are kept secure. This commitment to security allows users to confidently manage their documents online.

-

Can I customize the ICICI bank indemnity bond format in airSlate SignNow?

Yes, you can easily customize the ICICI bank indemnity bond format in airSlate SignNow. The platform provides intuitive tools that allow you to edit text, add signatures, and modify terms to fit your specific needs. This flexibility ensures that the document adheres to your requirements.

-

What benefits does using airSlate SignNow provide for my ICICI bank indemnity bond?

Using airSlate SignNow to manage your ICICI bank indemnity bond format streamlines the signing process, enhances efficiency, and reduces turnaround time. The platform's electronic signature feature allows for quick approvals, which can be crucial in financial dealings requiring immediate action.

Get more for Indemnity Bond Format For Release Of Payment

- State of wisconsin hereinafter referred to as the trustor and the trustee form

- State of wisconsin hereinafter referred to as the trustor whether one or more form

- Grant of conservation form

- Individual easement form

- Wi et30 form

- Control number wi evic pkg form

- Fillable online instruction sheet nursing home administrators form

- Name the other party is form

Find out other Indemnity Bond Format For Release Of Payment

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form