Eic Table Form

What is the EIC Table

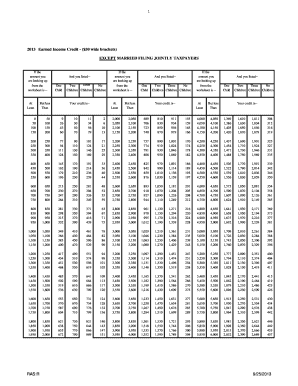

The Earned Income Credit (EIC) table is a crucial resource for taxpayers in the United States. It outlines the income thresholds and credit amounts available to eligible individuals and families. The table is designed to help filers determine their eligibility for the earned income tax credit, which can significantly reduce their tax liability or increase their refund. The EIC is aimed primarily at low to moderate-income earners, providing financial relief and encouraging workforce participation.

How to Use the EIC Table

Using the EIC table involves a few straightforward steps. First, taxpayers must identify their filing status, as the table varies based on whether one is filing as single, married filing jointly, or head of household. Next, filers should locate their earned income on their tax return and find the corresponding row in the EIC table. This row will indicate the amount of credit they may qualify for based on their income level and number of qualifying children. It is essential to ensure that all figures are accurate to maximize the potential credit.

Eligibility Criteria

To qualify for the earned income credit, taxpayers must meet specific criteria. These include having earned income from employment or self-employment, meeting certain income limits based on filing status, and having a valid Social Security number. Additionally, filers must be U.S. citizens or resident aliens for the entire tax year. For those with qualifying children, the children must meet age, relationship, and residency tests. Understanding these criteria is vital for determining eligibility and ensuring compliance with IRS regulations.

Steps to Complete the EIC Table

Completing the EIC table requires careful attention to detail. Begin by gathering all necessary documents, such as W-2 forms and other proof of income. Next, determine your filing status and locate the appropriate section in the EIC table. Input your earned income and number of qualifying children to find the corresponding credit amount. It is advisable to double-check all entries for accuracy before finalizing your tax return. Ensuring that the EIC table is filled out correctly can lead to significant tax savings.

IRS Guidelines

The IRS provides specific guidelines for using the EIC table effectively. Taxpayers should refer to the IRS website or the instructions accompanying their tax forms for detailed information on eligibility, income limits, and how to claim the credit. It is also important to stay updated on any changes to the tax code that may affect the EIC, as these can vary from year to year. Following IRS guidelines helps ensure that taxpayers receive the correct credit and remain compliant with tax laws.

Filing Deadlines / Important Dates

Taxpayers should be aware of key deadlines related to the EIC and their overall tax filings. The typical deadline for filing federal income tax returns is April fifteenth, unless it falls on a weekend or holiday, in which case the deadline may be extended. It is crucial to file on time to avoid penalties and ensure that any potential refunds, including the EIC, are processed promptly. Keeping track of these important dates can help taxpayers manage their filing responsibilities effectively.

Examples of Using the EIC Table

Examples can illustrate how to utilize the EIC table effectively. For instance, a single parent with two qualifying children and an earned income of $30,000 would refer to the EIC table to find the corresponding credit amount for their income level and filing status. Another example might involve a married couple filing jointly with one child, where their combined income is $40,000. By consulting the EIC table, they can determine their eligibility and the amount of credit they can claim. These examples highlight the practical application of the EIC table in real-life scenarios.

Quick guide on how to complete eic table

Prepare Eic Table easily on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents rapidly without delays. Manage Eic Table on any platform using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The simplest method to adjust and eSign Eic Table with ease

- Locate Eic Table and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to preserve your changes.

- Choose your preferred method for sharing your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Eic Table while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the eic table

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2020 EIC chart and how does it affect my tax filing?

The 2020 EIC chart provides valuable information regarding the Earned Income Tax Credit, which can signNowly impact your tax refund. Understanding this chart allows you to maximize your eligibility for the credit, helping you save money when filing taxes. For more tailored financial decisions, utilize our documents and eSign features to manage tax-related paperwork.

-

How can airSlate SignNow help me with my tax documents in relation to the 2020 EIC chart?

airSlate SignNow simplifies the process of preparing and signing tax documents by allowing users to seamlessly eSign important forms related to the 2020 EIC chart. Our platform ensures that all your documents are securely stored and easily accessible, promoting efficient tax filings. Maximize your refunds by efficiently managing your tax-related paperwork using our services.

-

Are there any costs associated with using airSlate SignNow for 2020 EIC chart documentation?

Yes, airSlate SignNow offers a cost-effective solution for managing documents, with various pricing plans that cater to different needs. Most plans provide essential features to help you handle your tax-related documentation efficiently, including those related to the 2020 EIC chart. You can choose a plan based on your usage without unnecessary expenses.

-

What features does airSlate SignNow provide for working with tax documents like the 2020 EIC chart?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking that are especially useful for handling tax documents related to the 2020 EIC chart. These tools streamline your process, ensuring that you can effectively manage multiple documents. Additionally, the intuitive interface makes it accessible for anyone to use.

-

Can I integrate airSlate SignNow with other software for better management of the 2020 EIC chart documents?

Yes, airSlate SignNow offers numerous integrations with popular software such as Google Drive and Dropbox, making it easier to manage your documents related to the 2020 EIC chart. This integration allows for seamless storage and retrieval of your essential tax documents. Coupled with our eSigning capabilities, it enhances your overall workflow.

-

Is airSlate SignNow secure for signing and storing documents like those related to the 2020 EIC chart?

Absolutely! airSlate SignNow takes the security of your documents very seriously. Our platform uses advanced encryption protocols to ensure that your sensitive documents, including those pertaining to the 2020 EIC chart, are protected from unauthorized access. This commitment to security gives you peace of mind while managing your critical tax documents.

-

How does airSlate SignNow improve collaboration for teams dealing with the 2020 EIC chart?

airSlate SignNow enhances team collaboration by allowing multiple users to access, edit, and eSign documents related to the 2020 EIC chart in real-time. This feature is essential for companies working on tax projects, enabling clearer communication and expedited processes. As a result, teams can efficiently complete their objectives without delays.

Get more for Eic Table

- Download a rental application form ray white ballarat

- Form 1058sf freddie mac

- North carolina division of air quality i certify by my ncair form

- Information questionnaire for children or youth worker daniels road baptist church this information will remain confidential

- Settlement agreement pursuant to rule 11 trcp and 154071 tx civil practice amp remedies code form

- Texas police report codes 444576581 form

- Sublet tenancy agreement template form

- Subletter agreement template form

Find out other Eic Table

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation