Nationwide Destination Dom SM Variable Annuity 2017

What is the Nationwide Destination dom SM Variable Annuity

The Nationwide Destination dom SM Variable Annuity is a financial product designed to provide individuals with a means of long-term investment and retirement savings. This annuity allows policyholders to allocate their funds among various investment options, which can include stocks, bonds, and mutual funds. The primary purpose of this product is to offer growth potential while also providing a level of security through guaranteed income options in retirement. Understanding the features and benefits of this annuity is essential for making informed financial decisions.

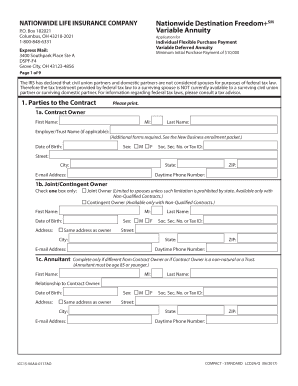

Steps to complete the Nationwide Destination dom SM Variable Annuity

Completing the Nationwide Destination dom SM Variable Annuity involves several key steps to ensure accuracy and compliance. First, gather all necessary personal and financial information, including identification and income details. Next, carefully review the terms and conditions associated with the annuity to understand the investment options and fees involved. After that, fill out the application form with precise information, ensuring that all sections are completed. Once the form is filled out, review it for any errors before submitting it to the issuing company. Finally, retain a copy of the completed form for your records.

Legal use of the Nationwide Destination dom SM Variable Annuity

The legal use of the Nationwide Destination dom SM Variable Annuity is governed by regulations that ensure its compliance with financial laws and consumer protection standards. It is essential to understand that this annuity must be used in accordance with both federal and state regulations. This includes adhering to guidelines for disclosures, investment limits, and the treatment of funds. By following these legal requirements, policyholders can ensure that their annuity is valid and enforceable, providing peace of mind regarding their investment.

Eligibility Criteria

To qualify for the Nationwide Destination dom SM Variable Annuity, applicants must meet specific eligibility criteria. Generally, individuals must be at least eighteen years old and a resident of the United States. Additionally, applicants may need to demonstrate a minimum initial investment amount, which can vary based on the specific annuity product chosen. It is also important for potential policyholders to assess their financial situation and investment goals to determine if this annuity aligns with their overall retirement strategy.

Form Submission Methods

Submitting the Nationwide Destination dom SM Variable Annuity form can be done through various methods to accommodate different preferences. Applicants may choose to submit their forms online, which offers a quick and efficient way to complete the process. Alternatively, forms can be mailed directly to the issuing company, ensuring that all required documentation is included. In some cases, individuals may also have the option to submit their forms in person at designated locations. Each method has its own advantages, and choosing the right one depends on the applicant's comfort level and urgency.

Key elements of the Nationwide Destination dom SM Variable Annuity

The Nationwide Destination dom SM Variable Annuity includes several key elements that are crucial for understanding its functionality. These elements typically encompass investment options, which allow policyholders to select from a range of portfolios based on their risk tolerance. Additionally, the annuity may offer features such as death benefits, which provide financial protection for beneficiaries in the event of the policyholder's passing. Another important aspect is the fee structure, which outlines any charges associated with managing the annuity. Familiarity with these key elements helps individuals make informed choices about their investment.

Quick guide on how to complete nationwide destination freedom sm variable annuity

Finalize Nationwide Destination dom SM Variable Annuity effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can easily locate the appropriate form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Nationwide Destination dom SM Variable Annuity on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The simplest way to alter and eSign Nationwide Destination dom SM Variable Annuity without any hassle

- Retrieve Nationwide Destination dom SM Variable Annuity and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow has specifically designed for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Nationwide Destination dom SM Variable Annuity to guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nationwide destination freedom sm variable annuity

Create this form in 5 minutes!

How to create an eSignature for the nationwide destination freedom sm variable annuity

The way to generate an electronic signature for your PDF online

The way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is the Nationwide Destination dom SM Variable Annuity?

The Nationwide Destination dom SM Variable Annuity is a flexible investment vehicle designed to help individuals save for retirement. It offers various investment options and features that allow for customizable strategies to meet individual financial goals.

-

What are the main benefits of the Nationwide Destination dom SM Variable Annuity?

This annuity offers several key benefits, including tax-deferred growth, a variety of investment choices, and the potential for lifetime income. Its features are designed to provide security and flexibility for your retirement planning.

-

How does pricing work for the Nationwide Destination dom SM Variable Annuity?

Pricing for the Nationwide Destination dom SM Variable Annuity includes underlying investment costs and possible fees for optional benefits. It's important to review the specific fee structure in your contract to fully understand the costs associated with your investment.

-

Can I customize my investment strategy with the Nationwide Destination dom SM Variable Annuity?

Yes, the Nationwide Destination dom SM Variable Annuity allows for customization of your investment strategy. You can choose from various funds and options that align with your risk tolerance and financial objectives.

-

What features are included in the Nationwide Destination dom SM Variable Annuity?

The Nationwide Destination dom SM Variable Annuity includes key features such as flexible withdrawal options, guaranteed living benefits, and access to a range of investment portfolios. These features can help enhance your retirement savings strategy.

-

How do I integrate the Nationwide Destination dom SM Variable Annuity into my existing retirement plan?

Integrating the Nationwide Destination dom SM Variable Annuity into your retirement plan can enhance your overall savings strategy. We recommend consulting with a financial advisor to determine the best approach based on your unique financial situation.

-

What are the tax implications of the Nationwide Destination dom SM Variable Annuity?

The Nationwide Destination dom SM Variable Annuity offers tax-deferred growth, meaning you won't pay taxes on your earnings until you withdraw funds. This can be advantageous for long-term retirement savings, but it's essential to understand potential tax consequences upon withdrawal.

Get more for Nationwide Destination dom SM Variable Annuity

Find out other Nationwide Destination dom SM Variable Annuity

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple