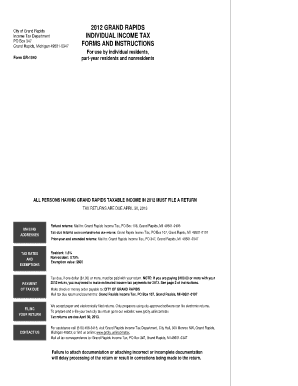

Grand Rapids 1040 Form

What is the Grand Rapids 1040 Form

The Grand Rapids 1040 Form is a tax document specifically designed for residents of Grand Rapids, Michigan, to report their annual income to the state and federal government. This form is a variation of the standard IRS Form 1040, tailored to meet local tax regulations and requirements. It captures essential financial information, including wages, interest, dividends, and other sources of income, allowing taxpayers to calculate their tax liability accurately.

How to use the Grand Rapids 1040 Form

Using the Grand Rapids 1040 Form involves several steps to ensure accurate reporting. First, gather all necessary financial documents, such as W-2s, 1099s, and other income statements. Next, fill out the form by entering your personal information, including your name, address, and Social Security number. Follow the instructions carefully to report your income and deductions. Finally, review the completed form for accuracy before submitting it to the appropriate tax authority.

Steps to complete the Grand Rapids 1040 Form

Completing the Grand Rapids 1040 Form requires a systematic approach:

- Collect all relevant financial documents.

- Fill in personal information accurately.

- Report all sources of income, including wages and investment earnings.

- Claim applicable deductions and credits to reduce taxable income.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the Grand Rapids 1040 Form

The Grand Rapids 1040 Form is legally binding when filled out correctly and submitted on time. To ensure its legal validity, it must comply with both state and federal tax laws. This includes accurate reporting of income and adherence to deadlines. Additionally, using a reliable eSignature solution can enhance the security and authenticity of the submission process, ensuring that the form is recognized by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Grand Rapids 1040 Form typically align with the federal tax deadlines. Generally, individual tax returns are due on April fifteenth each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes in deadlines and to file the form on time to avoid penalties.

Required Documents

To complete the Grand Rapids 1040 Form, taxpayers must gather several key documents:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Receipts for deductible expenses.

- Records of any tax credits claimed.

- Previous year’s tax return for reference.

Quick guide on how to complete grand rapids 1040 form

Complete [SKS] effortlessly on any device

Digital document management has surged in popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to modify and electronically sign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to share your form, through email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Grand Rapids 1040 Form

Create this form in 5 minutes!

How to create an eSignature for the grand rapids 1040 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Grand Rapids 1040 Form?

The Grand Rapids 1040 Form is a personal income tax return used by residents of Grand Rapids to report their earnings. This form is essential for calculating your local and state tax obligations. Understanding how to correctly fill out the Grand Rapids 1040 Form can help ensure compliance and avoid penalties.

-

How can airSlate SignNow help with the Grand Rapids 1040 Form?

airSlate SignNow simplifies the process of completing and eSigning the Grand Rapids 1040 Form. Our platform allows you to efficiently fill out, sign, and send your forms securely online. This not only saves time but also enhances accuracy when submitting your tax documents.

-

What are the pricing options for using airSlate SignNow to manage the Grand Rapids 1040 Form?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes. Our plans start at a competitive rate, providing access to key features for managing the Grand Rapids 1040 Form without breaking the bank. Additionally, you can take advantage of our free trial to experience the benefits firsthand.

-

What features does airSlate SignNow offer for handling the Grand Rapids 1040 Form?

Our platform includes features like document templates, eSignature capability, and cloud storage, tailored for the Grand Rapids 1040 Form. These tools streamline the filing process, ensuring you can complete and submit your form efficiently. Furthermore, we provide real-time collaboration features for team access and input.

-

Is airSlate SignNow suitable for businesses of all sizes when dealing with the Grand Rapids 1040 Form?

Yes, airSlate SignNow is designed to meet the needs of both small businesses and large enterprises managing the Grand Rapids 1040 Form. Our user-friendly interface ensures that teams can easily navigate the application, regardless of their technical expertise. This flexibility makes it an ideal solution for varied business requirements.

-

Can I integrate airSlate SignNow with other applications for managing the Grand Rapids 1040 Form?

Absolutely! airSlate SignNow offers integration options with numerous applications, allowing you to manage the Grand Rapids 1040 Form seamlessly. Popular CRM and productivity tools can be connected, enhancing your workflow and ensuring all your necessary data is in one place.

-

What are the benefits of using airSlate SignNow for the Grand Rapids 1040 Form compared to traditional methods?

Using airSlate SignNow for the Grand Rapids 1040 Form presents numerous benefits over traditional paper methods. Digital filing reduces the risk of errors and speeds up the submission process. Additionally, you can track document status and maintain secure records effortlessly with our platform.

Get more for Grand Rapids 1040 Form

- Excess flood insurance application arlington roe form

- Instructions for completion of statement of historical use form

- To apply under the provisions of the illinois professional geologist licensing act read and follow each of the steps form

- Underground storage tanks of the natural resources and environmental protection act 1994 pa 451 as amended for the purpose of form

- Department of citywide administrative new york city form

- Mdl section 286 12 sales recordform a nycgov

- Private investigator forms package investingzzcom

- Site identification form state of michigan

Find out other Grand Rapids 1040 Form

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure