Maryland Repair Shop Bond Form Surety Bond

What is the Maryland Repair Shop Bond Form Surety Bond

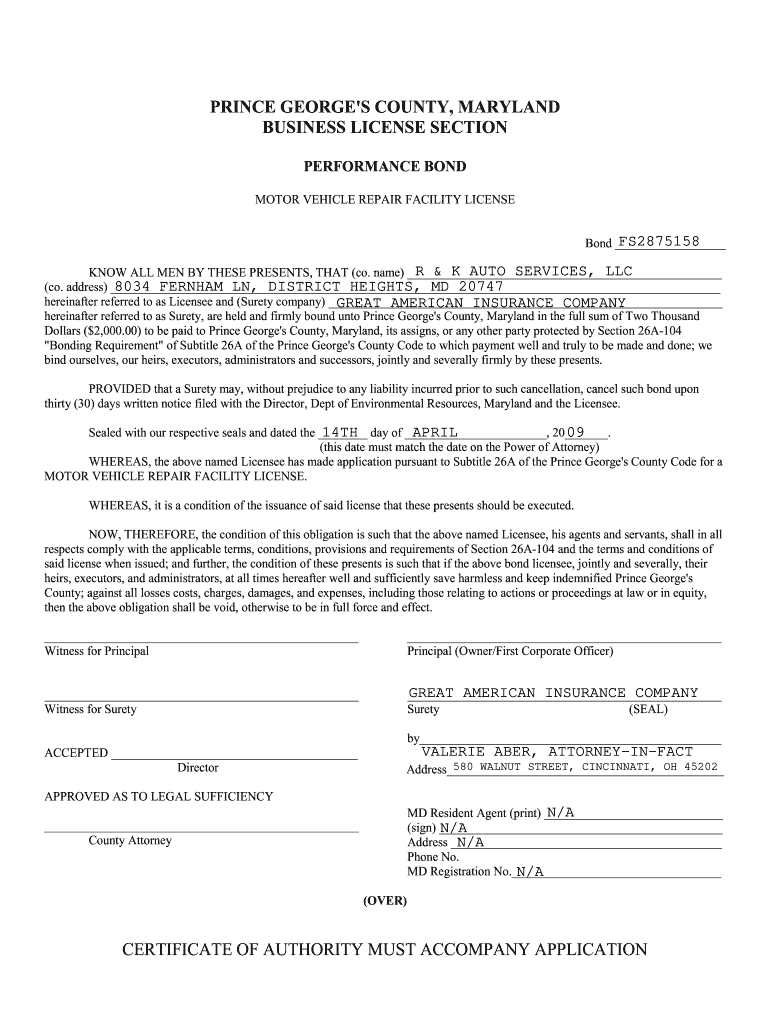

The Maryland Repair Shop Bond Form is a legally binding document that ensures compliance with state regulations for repair shops operating within Maryland. This surety bond serves as a guarantee that the repair shop will adhere to the laws governing their business practices, protecting consumers from potential fraud or malpractice. The bond amount typically reflects the financial responsibility of the repair shop and is a prerequisite for obtaining a business license in the state.

How to use the Maryland Repair Shop Bond Form Surety Bond

Using the Maryland Repair Shop Bond Form involves several steps to ensure that it is completed accurately and submitted in accordance with state requirements. First, the repair shop owner must fill out the bond form with necessary details, including the business name, address, and the bond amount. Next, the form must be signed by the principal, often the owner or authorized representative of the repair shop. After completing the form, it should be submitted to the relevant state authority along with any required documentation and fees.

Steps to complete the Maryland Repair Shop Bond Form Surety Bond

Completing the Maryland Repair Shop Bond Form requires careful attention to detail. Here are the steps to follow:

- Gather required information, including business details and the bond amount.

- Fill out the bond form accurately, ensuring all fields are completed.

- Obtain signatures from all necessary parties, including the principal and surety.

- Review the completed form for accuracy and completeness.

- Submit the form to the appropriate state agency along with any required fees.

Key elements of the Maryland Repair Shop Bond Form Surety Bond

The Maryland Repair Shop Bond Form includes several key elements that are essential for its validity. These elements typically include:

- The name and address of the repair shop.

- The name of the surety company providing the bond.

- The bond amount, which reflects the financial responsibility of the repair shop.

- The signatures of the principal and surety representatives.

- The effective date of the bond and any expiration date, if applicable.

Legal use of the Maryland Repair Shop Bond Form Surety Bond

The legal use of the Maryland Repair Shop Bond Form is critical for ensuring compliance with state regulations. This bond acts as a safeguard for consumers, ensuring that repair shops operate within the law. In the event of a claim against the bond, the surety company is responsible for compensating the affected party, up to the bond amount. This legal framework helps maintain trust in the repair industry and protects consumers from potential losses.

Eligibility Criteria

To be eligible for the Maryland Repair Shop Bond Form, the repair shop must meet specific criteria set forth by the state. These criteria often include:

- Possession of a valid business license in Maryland.

- Compliance with all local and state regulations governing repair shops.

- Demonstration of financial stability, which may involve providing financial statements.

- Submission of the bond form and payment of any associated fees.

Quick guide on how to complete maryland repair shop bond form surety bond

Effortlessly Prepare Maryland Repair Shop Bond Form Surety Bond on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and keep it safely stored online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents promptly without any delays. Manage Maryland Repair Shop Bond Form Surety Bond on any device with the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to Modify and eSign Maryland Repair Shop Bond Form Surety Bond with Ease

- Locate Maryland Repair Shop Bond Form Surety Bond and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal significance as a conventional handwritten signature.

- Verify all the details and click the Done button to finalize your changes.

- Select your preferred method of delivering your form, be it via email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any chosen device. Modify and eSign Maryland Repair Shop Bond Form Surety Bond and ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What is a simple way to find out how many hydrogen bonds a molecule can form?

Look at the Lewis structure. Every O-H or N-H hydrogen can be a hydrogen bond donor, and every lone pair on O or N can be a hydrogen bond acceptor. So, for instance, a water molecule, with two O-H bonds and two lone pairs, can form four hydrogen bonds, while CH3NH2, with two N-H bonds and one lone pair can form three hydrogen bonds.

Create this form in 5 minutes!

How to create an eSignature for the maryland repair shop bond form surety bond

How to generate an eSignature for the Maryland Repair Shop Bond Form Surety Bond online

How to make an electronic signature for the Maryland Repair Shop Bond Form Surety Bond in Chrome

How to make an eSignature for signing the Maryland Repair Shop Bond Form Surety Bond in Gmail

How to make an electronic signature for the Maryland Repair Shop Bond Form Surety Bond from your mobile device

How to make an eSignature for the Maryland Repair Shop Bond Form Surety Bond on iOS devices

How to generate an eSignature for the Maryland Repair Shop Bond Form Surety Bond on Android OS

People also ask

-

How do I get a surety bond?

You'll need to find an independent insurance broker or agent near you to purchase a surety bond from these insurance companies. The Small Business Administration also guarantees some types of surety bonds. This way, the SBA will reduce the risk for a surety company so that it can offer bonds to more small businesses.

-

How much does a $5000 surety bond cost?

For applicants with good credit, surety bonds usually cost between 1% and 5% of their value. Therefore, for a surety bond of $5,000, an applicant with a strong credit history can expect to pay between $50 and $250.

-

Are surety bonds hard to get?

One thing to note is that getting a surety bond may be difficult for certain individuals. If you have a history of claims made against any previous bonds, or if you have a low credit score, it may be more difficult to get a surety bond since surety companies see this as a signal of increased risk.

-

What is the process of getting a surety bond?

Provide the business details and financial information needed for your quote. Receive your bond quote. Sign all policy paperwork and pay the premium to get your surety bond. Provide your bond information to the state official or industry organization that requires it.

-

How much will a surety bond cost?

On average, the cost for a surety bond falls somewhere between 1% and 15% of the bond amount. That means you may be charged between $100 and $1,500 to buy a $10,000 bond policy. Most premium amounts are based on your application and credit health, but there are some bond policies that are written freely.

-

Do banks issue surety bonds?

Most surety bonds are created on behalf of those contractors by insurance companies (either directly or through brokers), or by banks in the form of bank guarantees.

-

What is a surety bond for DME?

A DMEPOS surety bond is a bond issued by an entity (the surety) guaranteeing that a DMEPOS supplier will fulfill an obligation or series of obligations to a third party (the Medicare program). If the obligation is not met, the third party will recover its losses via the bond.

-

What is a surety bond Maryland?

Surety bonds are similar to insurance in that they provide a kind of guarantee to one of the parties involved. If the terms of the bond agreement are not fulfilled, then a claim can be made, and the party making the claim can recover losses sustained.

Get more for Maryland Repair Shop Bond Form Surety Bond

- Tenants maintenance repair request form virginia

- Guaranty attachment to lease for guarantor or cosigner virginia form

- Amendment to lease or rental agreement virginia form

- Warning notice due to complaint from neighbors virginia form

- Lease subordination agreement virginia form

- Apartment rules and regulations virginia form

- Va cancellation form

- Amendment of residential lease virginia form

Find out other Maryland Repair Shop Bond Form Surety Bond

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA