Form 5695

What is the Form 5695

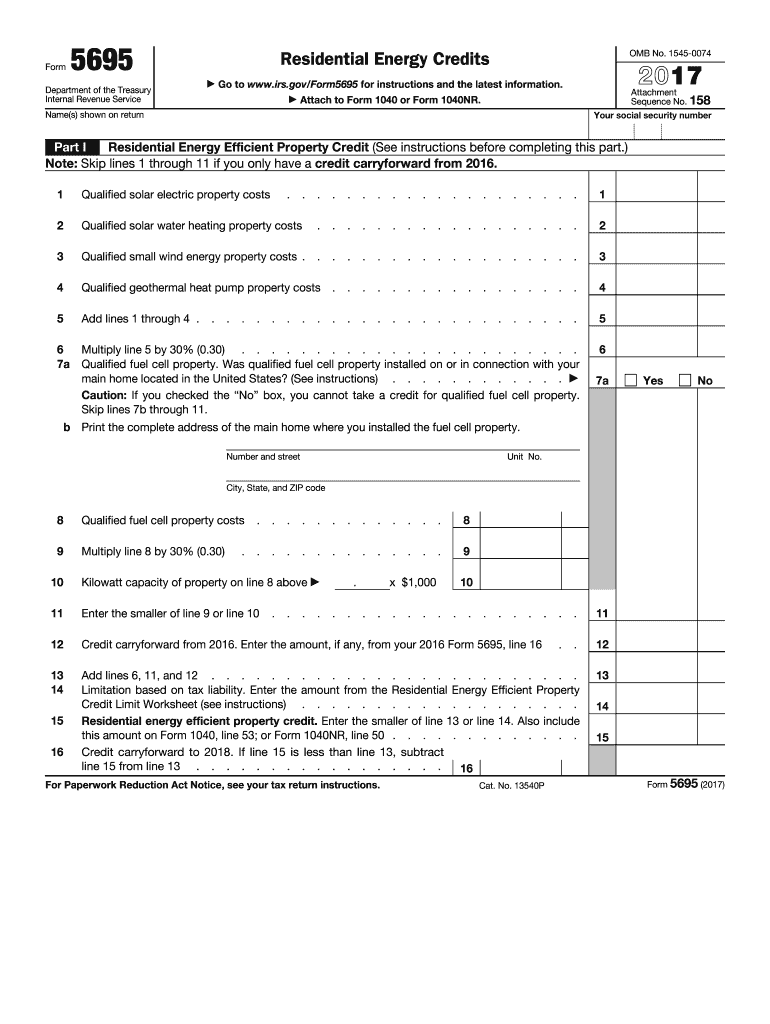

The Form 5695, also known as the Residential Energy Credits form, is utilized by taxpayers in the United States to claim tax credits for energy-efficient home improvements. This form allows individuals to report expenditures on qualified energy-saving installations, such as solar panels, solar water heaters, and energy-efficient windows. The credits can significantly reduce the overall tax liability, making energy-efficient upgrades more financially accessible for homeowners.

How to use the Form 5695

To effectively use the Form 5695, taxpayers need to gather documentation of the energy-efficient improvements made to their homes. This includes receipts, invoices, and any manufacturer certifications that verify the products meet the necessary energy efficiency standards. Once the required information is collected, individuals fill out the form by providing details about the improvements and calculating the eligible tax credits. It is essential to ensure accuracy to avoid delays or issues with the IRS.

Steps to complete the Form 5695

Completing the Form 5695 involves several key steps:

- Gather necessary documentation, including receipts and certifications for energy-efficient products.

- Fill out the personal information section at the top of the form.

- Complete Part I to calculate the Residential Energy Efficient Property Credit.

- Complete Part II for the Nonbusiness Energy Property Credit, if applicable.

- Review the form for accuracy and completeness before submitting.

Legal use of the Form 5695

The legal use of the Form 5695 is governed by IRS guidelines, which stipulate the eligibility criteria for claiming energy credits. Taxpayers must ensure that the improvements made meet the specific energy efficiency standards set forth by the IRS. Proper documentation is crucial, as it serves as proof of compliance and eligibility for the credits claimed. Failure to adhere to these guidelines may result in penalties or disallowance of the credits.

Eligibility Criteria

To qualify for the credits on the Form 5695, certain eligibility criteria must be met:

- The improvements must be made to a primary residence located in the United States.

- The products installed must meet specific energy efficiency requirements established by the IRS.

- Taxpayers must have the necessary documentation to support their claims, including receipts and certifications.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the Form 5695. The form must be submitted along with the federal income tax return by the standard tax filing deadline, which is typically April 15 of each year. If taxpayers require additional time, they may file for an extension, but they must still pay any taxes owed by the original deadline to avoid penalties.

Quick guide on how to complete form 5695

Access Form 5695 effortlessly on any device

Digital document management has surged in popularity among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and without interruptions. Manage Form 5695 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Form 5695 effortlessly

- Find Form 5695 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Form 5695 to ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5695

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 5695 form and how is it used?

The 5695 form is a crucial document for businesses that need to handle specific processes efficiently. It allows for streamlined eSigning, ensuring that your documents are both secure and compliant. By utilizing airSlate SignNow to manage your 5695 form, businesses can save time and reduce errors in documentation.

-

What features does airSlate SignNow offer for managing the 5695 form?

airSlate SignNow provides a range of features designed to simplify the handling of the 5695 form. Users can take advantage of electronic signatures, real-time tracking, and customizable templates. These features enhance the efficiency of document management for both senders and recipients.

-

Is airSlate SignNow a cost-effective solution for the 5695 form?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing the 5695 form. The platform offers multiple pricing plans to accommodate businesses of all sizes, ensuring that you get the best value. With its affordable pricing structure, you can reduce operational costs while improving workflow efficiency.

-

How can I integrate airSlate SignNow with other applications for the 5695 form?

Integrating airSlate SignNow with other applications is straightforward when it comes to working with the 5695 form. The platform supports numerous integrations with popular tools such as CRM systems, project management software, and cloud storage. This allows you to automate workflows and enhance productivity effortlessly.

-

What benefits can my business expect from using the 5695 form with airSlate SignNow?

Using the 5695 form with airSlate SignNow provides several benefits, including faster document turnaround times and improved accuracy. The platform's user-friendly interface makes it easy for anyone to eSign documents. Additionally, you gain peace of mind knowing that your documents are secure and compliant with regulatory standards.

-

Can I customize the 5695 form in airSlate SignNow?

Absolutely, airSlate SignNow allows you to customize the 5695 form to meet your specific needs. You can add fields, adjust formatting, and incorporate company branding. This customization ensures that the document aligns with your corporate identity and business requirements.

-

What is the turnaround time for processing the 5695 form with airSlate SignNow?

The turnaround time for processing the 5695 form using airSlate SignNow is signNowly reduced compared to traditional methods. Most forms can be sent, signed, and returned within minutes. This speed is essential for businesses needing quick resolutions and efficient communication.

Get more for Form 5695

Find out other Form 5695

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney