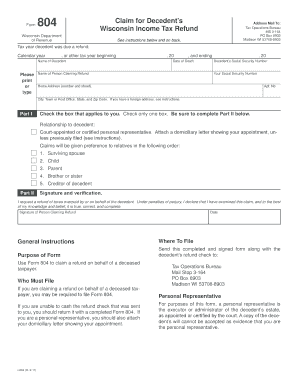

Form 804

What is the Form 804

The Form 804 is a Wisconsin tax form specifically designed for individuals and businesses to report certain tax-related information to the state. This form is essential for ensuring compliance with Wisconsin tax regulations and is often used to report income, deductions, and credits. Understanding the purpose of the Form 804 is crucial for accurate tax filing and to avoid potential penalties.

How to use the Form 804

Using the Form 804 involves several key steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, including income statements and receipts for deductions. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is important to double-check your entries for any errors before submission. Finally, choose your preferred method of submission, whether online, by mail, or in person.

Steps to complete the Form 804

Completing the Form 804 requires attention to detail. Start by entering your personal information, including your name, address, and Social Security number. Next, report your total income for the year, followed by any deductions you are eligible for. After filling in all required sections, review the form for accuracy. Once satisfied, sign and date the form before submitting it to the appropriate tax authority.

Legal use of the Form 804

The legal use of the Form 804 is governed by Wisconsin tax laws. It is important to ensure that all information provided is truthful and accurate, as any discrepancies can lead to penalties or audits. The form must be submitted within the designated filing period to maintain compliance with state regulations. Understanding the legal implications of using the Form 804 helps taxpayers avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form 804 are crucial for compliance. Typically, the form must be submitted by the tax deadline, which is usually April 15 for individual taxpayers. However, specific deadlines may vary based on individual circumstances, such as extensions. Keeping track of these important dates ensures that taxpayers can avoid late fees and penalties associated with late submissions.

Form Submission Methods (Online / Mail / In-Person)

There are several methods available for submitting the Form 804. Taxpayers can choose to file online through the Wisconsin Department of Revenue's website, which offers a convenient and efficient way to submit the form. Alternatively, the form can be mailed to the appropriate tax office, or it can be submitted in person at designated locations. Each method has its advantages, and taxpayers should select the one that best suits their needs.

Quick guide on how to complete form 804

Complete Form 804 seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly without interruptions. Handle Form 804 on any device using airSlate SignNow Android or iOS applications and streamline any document-driven procedure today.

How to modify and eSign Form 804 effortlessly

- Acquire Form 804 and click on Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure confidential information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to finalize your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing out new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 804 and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 804

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 804 Wisconsin and why is it important?

Form 804 Wisconsin is a crucial document used for various business and personal transactions within the state. It is often required for compliance and record-keeping purposes. Understanding how to properly fill out and submit form 804 Wisconsin can save businesses from potential legal issues.

-

How can airSlate SignNow help with form 804 Wisconsin?

AirSlate SignNow streamlines the process of sending and electronically signing form 804 Wisconsin. Our easy-to-use platform allows users to upload, sign, and share this form securely. This not only saves time but also enhances accuracy and efficiency in document management.

-

Is there a cost associated with using airSlate SignNow for form 804 Wisconsin?

Yes, airSlate SignNow offers various pricing plans that are cost-effective for businesses handling form 804 Wisconsin. We provide tiered pricing options based on the features and number of users, ensuring you only pay for what you need. Signing up for a free trial can help you assess its value for your needs.

-

What features does airSlate SignNow offer for handling form 804 Wisconsin?

AirSlate SignNow provides features like template creation, advanced editing tools, and automated workflows specifically for managing form 804 Wisconsin. Users can also track signers’ progress in real-time and access comprehensive analytics. These features enhance productivity and ensure documents are managed efficiently.

-

Can I integrate airSlate SignNow with other applications for managing form 804 Wisconsin?

Absolutely! AirSlate SignNow offers integrations with a wide range of applications, making it easy to manage form 804 Wisconsin alongside your other business tools. This includes CRM software, storage solutions, and project management apps, allowing for seamless workflows and data handling.

-

What are the benefits of using airSlate SignNow over traditional methods for form 804 Wisconsin?

Using airSlate SignNow for form 804 Wisconsin offers numerous benefits, including faster turnaround times, reduced paperwork, and enhanced security. Digital signatures are legally binding and provide a more efficient alternative to printed forms. Additionally, our platform helps conserve resources and streamline compliance processes.

-

Is airSlate SignNow secure for submitting sensitive form 804 Wisconsin data?

Yes, airSlate SignNow employs advanced security measures to protect your sensitive data when submitting form 804 Wisconsin. We utilize encryption and secure servers to ensure that all documents remain confidential and safe from unauthorized access. You can trust our platform for your data security needs.

Get more for Form 804

- Eclipse phase 2e character sheet form

- Qp401k distribution due to death request form

- Rmo agreement form

- Pdf golf club rental reservation form aamga aamga

- Wld 34 a 1116 form

- Cancellation of lease by landlord agreement template form

- Capital lease agreement template form

- Car lease transfer agreement template form

Find out other Form 804

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template