Form 1040 Schedule F

What is the Form 1040 Schedule F

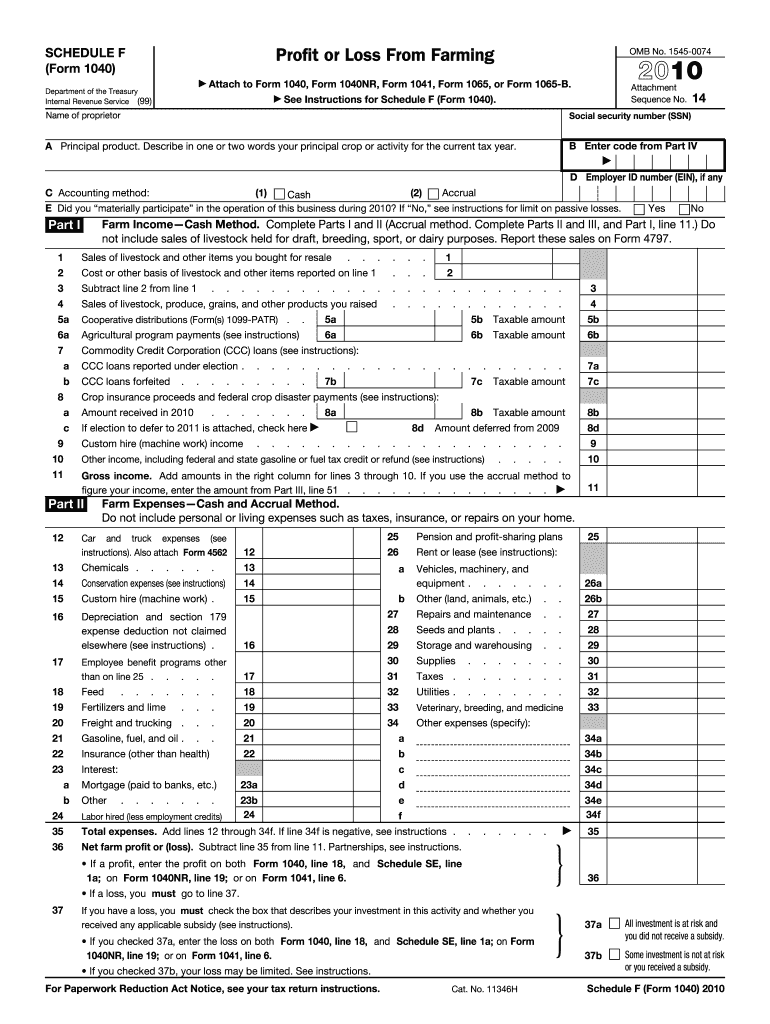

The Form 1040 Schedule F is a tax form used by farmers and ranchers in the United States to report their income and expenses from farming activities. This form is essential for individuals who earn a significant portion of their income from agricultural operations. It allows taxpayers to detail their earnings, costs, and any deductions related to their farming business, ultimately impacting their overall tax liability. Understanding the Schedule F is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Form 1040 Schedule F

Using the Form 1040 Schedule F involves several steps to ensure accurate reporting of farming income and expenses. First, gather all relevant financial records, including sales receipts, invoices, and expense documentation. Next, fill out the form by entering your gross income from farming on the appropriate lines. Then, list all allowable expenses, such as feed, seed, and equipment costs. After completing the form, transfer the net income or loss to your main Form 1040. It is advisable to consult IRS instructions or a tax professional to ensure compliance and accuracy.

Steps to complete the Form 1040 Schedule F

Completing the Form 1040 Schedule F involves a systematic approach:

- Start by entering your name and Social Security number at the top of the form.

- Report your gross income from farming in Part I, including sales of livestock, produce, and other products.

- In Part II, list all deductible expenses related to your farming operations, such as utilities, repairs, and labor costs.

- Calculate your net profit or loss by subtracting total expenses from total income.

- Transfer the net amount to your Form 1040 and ensure all figures are accurate before submission.

Legal use of the Form 1040 Schedule F

The legal use of the Form 1040 Schedule F is governed by IRS regulations, which outline the requirements for reporting farming income and expenses. To be considered valid, the information provided must be truthful and substantiated by proper documentation. This includes maintaining records of income sources, receipts for expenses, and any relevant financial statements. Failure to comply with IRS guidelines can result in penalties, so it is crucial to adhere to legal standards when completing and submitting this form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 Schedule F typically align with the annual tax filing deadline for individual taxpayers. For most taxpayers, this is April 15 of the following year. However, if you are a farmer and your income is subject to special rules, you may be eligible for an extension. It is important to stay informed about specific deadlines to avoid late filing penalties. Always check the IRS website for the most current information regarding deadlines and any potential changes to filing requirements.

Examples of using the Form 1040 Schedule F

Examples of using the Form 1040 Schedule F can include various scenarios in farming operations. For instance, a small-scale farmer selling vegetables at local markets would report their sales as gross income. Similarly, a rancher raising livestock would detail income from sales of cattle or sheep. Each example highlights the importance of accurately recording all income and expenses to ensure compliance and maximize allowable deductions. These examples can serve as a guide for farmers in similar situations to effectively utilize the Schedule F.

Quick guide on how to complete 2010 form 1040 schedule f

Complete Form 1040 Schedule F effortlessly on any device

Online document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form 1040 Schedule F on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Form 1040 Schedule F with ease

- Obtain Form 1040 Schedule F and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to submit your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Modify and eSign Form 1040 Schedule F and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

How can I fill up my own 1040 tax forms?

The 1040 Instructions will provide step-by-step instructions on how to prepare the 1040. IRS Publication 17 is also an important resource to use while preparing your 1040 return. You can prepare it online through the IRS website or through a software program. You can also prepare it by hand and mail it in, or you can see a professional tax preparer to assist you with preparing and filing your return.

-

Why hasn't federal government mailed out 1040 tax forms for 2010 tax year? When will they?

Because of the explosion in E-filed returns the IRS has stopped mailing tax packets entirely unless the taxpayer specifically requests that they be mailed. If you need paper forms you need to call 800-829-3676.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

Do I need to attach the tax form 1099-B to the form 1040 Schedule D?

This sort of question should be resolved by looking at the IRS’ official instructions for the tax form and year in question. You only need to attach such items as the IRS’ official instructions direct you to attach. Recently there has been a trend of requiring fewer attachments.For the sake of answering this specific question for this specific year, there appears to be no such requirement. The Form 1099-B was already reported to the IRS and the Schedule D instructions make no mention of attaching it. You may need to attach a “statement required under Regulations section 1.1(h)-1(e).” Id. lines 10 and 18.For actual advice on filling in your forms, consult a tax attorney or accountant.

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

Create this form in 5 minutes!

How to create an eSignature for the 2010 form 1040 schedule f

How to generate an electronic signature for the 2010 Form 1040 Schedule F online

How to generate an electronic signature for your 2010 Form 1040 Schedule F in Chrome

How to create an electronic signature for putting it on the 2010 Form 1040 Schedule F in Gmail

How to create an eSignature for the 2010 Form 1040 Schedule F straight from your mobile device

How to create an eSignature for the 2010 Form 1040 Schedule F on iOS

How to make an eSignature for the 2010 Form 1040 Schedule F on Android devices

People also ask

-

What is a schedule f spreadsheet and how can I use it with airSlate SignNow?

A schedule f spreadsheet is a specific financial tool used for reporting farm income and expenses on your tax returns. With airSlate SignNow, you can easily sign and send your completed schedule f spreadsheets securely, ensuring your financial documents are efficiently managed.

-

How does airSlate SignNow accommodate the creation of a schedule f spreadsheet?

AirSlate SignNow allows users to upload, fill, and edit their schedule f spreadsheets effortlessly. You can utilize our document templates and eSignature features to streamline your workflow, making it easier to handle your agricultural financial documentation.

-

What are the pricing options for using airSlate SignNow to manage my schedule f spreadsheet?

AirSlate SignNow offers flexible pricing plans designed to fit various business needs, ensuring you can manage your schedule f spreadsheet without breaking the bank. Our plans include features such as unlimited document signing, storage, and template creation to enhance your efficiency.

-

Can I integrate other tools with airSlate SignNow for managing my schedule f spreadsheet?

Yes! AirSlate SignNow supports integrations with various applications, allowing you to import and export your schedule f spreadsheets seamlessly. Whether you use accounting software or document management systems, our integrations enhance your workflow and productivity.

-

What are the benefits of using airSlate SignNow for my schedule f spreadsheet?

Using airSlate SignNow for your schedule f spreadsheet provides a secure and user-friendly platform for managing financial documents. The eSignature capabilities ensure that you can sign and send documents quickly, improving turnaround time and keeping your operations efficient.

-

Is it safe to store my schedule f spreadsheet on airSlate SignNow?

Absolutely! AirSlate SignNow prioritizes the security of your data. Our platform uses advanced encryption methods to ensure that your schedule f spreadsheet and other sensitive documents are protected from unauthorized access.

-

How do I get started with airSlate SignNow for my schedule f spreadsheet?

Getting started with airSlate SignNow is simple! Sign up for an account, and you can begin uploading your schedule f spreadsheet right away. Our intuitive interface guides you through every step, making it easy to send and sign documents instantly.

Get more for Form 1040 Schedule F

- Temporary on premises sign application form

- Application for licensure new jersey division of consumer form

- Ots 2 go screening form hamilton health sciences

- Faculty of nursing student academic appeals committee form

- Access and overview for new personnel english form

- Occupational therapist job description salary skills ampampamp more form

- Student registration and attestation form confidential

- Application to degree program for alumni ocad university form

Find out other Form 1040 Schedule F

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors