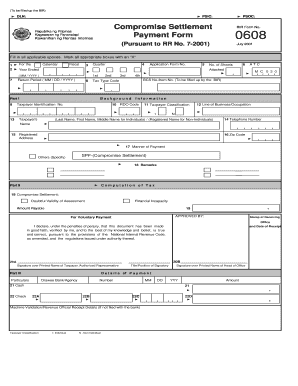

Bir Form 2107 Application for Compromise Settlement

What is the Bir Form 2107 Application For Compromise Settlement

The Bir Form 2107 is an official document used in the United States for individuals or businesses seeking a compromise settlement with the Bureau of Internal Revenue (BIR). This form allows taxpayers to propose a settlement for outstanding tax liabilities, which may be beneficial for those facing financial difficulties. By submitting this application, taxpayers can negotiate a reduced payment amount that satisfies their tax obligations, thereby avoiding more severe penalties or legal actions.

How to use the Bir Form 2107 Application For Compromise Settlement

To effectively use the Bir Form 2107, start by gathering all necessary financial documentation that supports your request for a compromise settlement. This may include income statements, asset valuations, and any relevant tax returns. Once you have the required documents, fill out the form accurately, ensuring that all information is complete and truthful. After completing the form, submit it to the appropriate BIR office, either electronically or via mail, depending on the submission methods available.

Steps to complete the Bir Form 2107 Application For Compromise Settlement

Completing the Bir Form 2107 involves several important steps:

- Gather all necessary financial documents, including income statements and tax returns.

- Fill out the form with accurate and complete information.

- Review the form for any errors or omissions.

- Submit the completed form to the appropriate BIR office.

- Keep a copy of the submitted form for your records.

Key elements of the Bir Form 2107 Application For Compromise Settlement

The Bir Form 2107 contains several key elements that must be completed for the application to be valid. These include:

- Taxpayer Information: Basic details about the individual or business submitting the form.

- Financial Information: A comprehensive overview of the taxpayer's financial situation, including income, expenses, and assets.

- Proposed Settlement Amount: The amount the taxpayer is willing to pay to settle their tax liabilities.

- Signature: The taxpayer's signature is required to validate the application.

Eligibility Criteria

To be eligible for submitting the Bir Form 2107, taxpayers must meet specific criteria set by the BIR. Generally, eligibility includes demonstrating an inability to pay the full tax liability due to financial hardship. Taxpayers must also be compliant with filing all required tax returns and must not be currently undergoing any legal proceedings related to their tax obligations. Meeting these criteria increases the likelihood of a successful compromise settlement.

Form Submission Methods (Online / Mail / In-Person)

The Bir Form 2107 can be submitted through various methods, depending on the preferences of the taxpayer and the regulations in place. Common submission methods include:

- Online Submission: Many taxpayers prefer to submit the form electronically through the BIR's online portal, which can expedite processing times.

- Mail Submission: Taxpayers can also print and mail the completed form to the designated BIR office.

- In-Person Submission: For those who prefer face-to-face interaction, submitting the form in person at a local BIR office is an option.

Quick guide on how to complete bir form 2107 application for compromise settlement

Finalize Bir Form 2107 Application For Compromise Settlement effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Bir Form 2107 Application For Compromise Settlement on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and electronically sign Bir Form 2107 Application For Compromise Settlement without hassle

- Locate Bir Form 2107 Application For Compromise Settlement and click Retrieve Form to commence.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Finish button to save your modifications.

- Choose your delivery method for your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form retrieval, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Bir Form 2107 Application For Compromise Settlement to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bir form 2107 application for compromise settlement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a bir form 2107 and how is it used?

The bir form 2107 is a tax form used in specific jurisdictions to report income and other relevant financial information. Businesses often utilize this form to ensure compliance with tax regulations, making it essential for accurate financial reporting.

-

How can airSlate SignNow help with completing a bir form 2107?

airSlate SignNow provides an intuitive platform for businesses to fill out and sign the bir form 2107 electronically. The easy-to-use interface simplifies the completion of the form, ensuring that all necessary fields are accurately filled out.

-

What are the pricing options for using airSlate SignNow to manage bir form 2107?

Pricing for airSlate SignNow varies based on subscription plans that cater to different business sizes and needs. Each plan offers features that facilitate the seamless management of documents, including the bir form 2107, at a cost-effective rate.

-

Can airSlate SignNow integrate with other software for handling the bir form 2107?

Yes, airSlate SignNow can integrate with various software applications, enhancing your workflow for managing the bir form 2107 and other documents. This integration allows for a more streamlined process by connecting your existing tools with our eSigning platform.

-

What features does airSlate SignNow offer for managing documents like bir form 2107?

airSlate SignNow includes features such as templates, form fields, and secure eSigning capabilities specifically designed for documents like the bir form 2107. These tools ensure a user-friendly experience while maintaining compliance with applicable laws.

-

What benefits does airSlate SignNow provide for businesses needing to manage the bir form 2107?

By using airSlate SignNow, businesses can save time, reduce errors, and enhance the overall efficiency of managing the bir form 2107. The platform promotes a paperless environment, making document retrieval and processing quicker and more effective.

-

Is airSlate SignNow secure for handling sensitive information on the bir form 2107?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. This ensures that any sensitive information entered on the bir form 2107 remains protected while being processed electronically.

Get more for Bir Form 2107 Application For Compromise Settlement

- A 0522 oa form

- Certificate of service email form

- Yellow ribbon program agreement 22 0839 vba va form

- California department public health address change form

- Gp 6 v1 forwebpe doc form

- Condominium lease agreement template form

- Connecticut lease agreement template form

- Hay lease agreement template form

Find out other Bir Form 2107 Application For Compromise Settlement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement