Nc 5500 Fillable Form

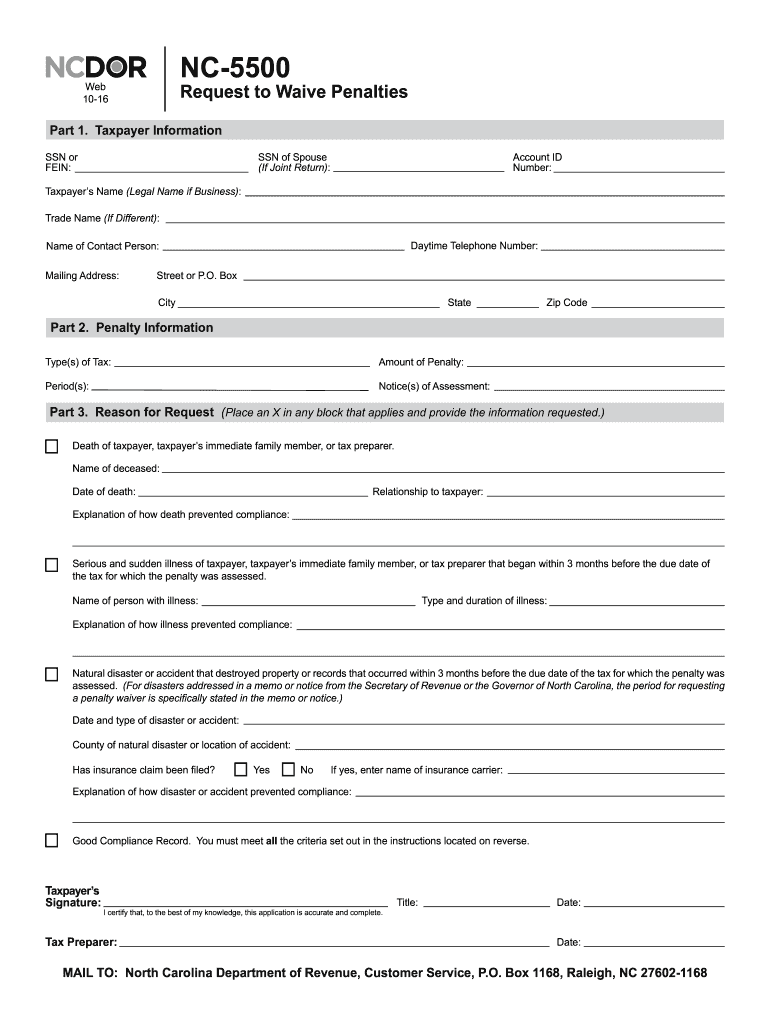

What is the Nc 5500 Fillable Form

The Nc 5500 Fillable Form is a document used primarily for reporting certain financial information regarding employee benefit plans. This form is essential for compliance with federal regulations and is often required by the Employee Benefits Security Administration (EBSA). It helps organizations provide necessary details about their benefit plans, including funding, investment performance, and participant information. Understanding its purpose is crucial for businesses that offer retirement or health benefits to employees.

How to use the Nc 5500 Fillable Form

Using the Nc 5500 Fillable Form involves several straightforward steps. First, ensure that you have the latest version of the form, which can typically be downloaded from official sources. Next, fill in the required fields, including information about the plan sponsor, plan details, and financial data. It is important to provide accurate and complete information to avoid penalties. Once completed, the form can be electronically signed and submitted according to the specified guidelines.

Steps to complete the Nc 5500 Fillable Form

Completing the Nc 5500 Fillable Form requires careful attention to detail. Here are the steps to follow:

- Download the latest Nc 5500 Fillable Form from an official source.

- Gather necessary documents, such as financial statements and participant information.

- Fill in the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions.

- Sign the form electronically, if applicable.

- Submit the completed form through the designated submission method, whether online or by mail.

Legal use of the Nc 5500 Fillable Form

The Nc 5500 Fillable Form is legally binding when completed and submitted according to federal regulations. To ensure its legal validity, it must be filled out accurately and submitted by the required deadlines. Failure to comply with the legal requirements associated with this form can result in penalties or fines. It is essential for organizations to maintain proper records and documentation related to the information submitted on the form.

Filing Deadlines / Important Dates

Filing deadlines for the Nc 5500 Fillable Form are critical to ensure compliance with federal regulations. Generally, the form must be filed annually, with the deadline typically falling on the last day of the seventh month after the plan year ends. For example, if a plan year ends on December 31, the Nc 5500 must be filed by July 31 of the following year. Extensions may be available under certain circumstances, but it is important to file on time to avoid penalties.

Who Issues the Form

The Nc 5500 Fillable Form is issued by the Employee Benefits Security Administration (EBSA), a division of the U.S. Department of Labor. This agency oversees the administration and enforcement of employee benefit plans, ensuring compliance with applicable laws and regulations. Organizations must adhere to the guidelines set forth by the EBSA when completing and submitting the Nc 5500 Fillable Form.

Quick guide on how to complete nc 5500 fillable form

Complete Nc 5500 Fillable Form effortlessly on any device

Managing documents online has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the required form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Handle Nc 5500 Fillable Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

The easiest way to modify and eSign Nc 5500 Fillable Form with ease

- Locate Nc 5500 Fillable Form and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Nc 5500 Fillable Form and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nc 5500 fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nc 5500 Fillable Form?

The Nc 5500 Fillable Form is a digital version of the official form used for annual report submissions for certain businesses in North Carolina. It allows users to fill out, save, and submit their information electronically, streamlining the filing process. This form is essential for businesses to comply with state regulations while maintaining accurate records.

-

How can I use the Nc 5500 Fillable Form with airSlate SignNow?

With airSlate SignNow, you can easily upload, edit, and sign the Nc 5500 Fillable Form online. The platform simplifies the process by providing easy-to-use tools for filling out forms, obtaining signatures, and sending documents securely. This ensures your submissions are completed accurately and on time.

-

Is there a cost associated with using the Nc 5500 Fillable Form through airSlate SignNow?

AirSlate SignNow offers various pricing plans that can cater to different business needs, including features for using the Nc 5500 Fillable Form. Whether you need basic functionality or advanced features, you can choose a plan accordingly. This makes it a cost-effective solution for managing your document workflow.

-

What features does airSlate SignNow offer for the Nc 5500 Fillable Form?

AirSlate SignNow provides a range of features for the Nc 5500 Fillable Form, including electronic signatures, form templates, and automated workflows. These features help you save time and increase productivity by allowing multiple users to collaborate on the document in real-time. You can also track the status of your form submissions easily.

-

Can I share the Nc 5500 Fillable Form with my clients or team members?

Absolutely! AirSlate SignNow allows you to share the Nc 5500 Fillable Form with clients and team members via secure links. This facilitates collaboration and ensures that everyone can access, fill out, or provide necessary signatures on the document without any hassle.

-

How does airSlate SignNow ensure the security of my Nc 5500 Fillable Form data?

AirSlate SignNow prioritizes the security of your data, including the Nc 5500 Fillable Form, by implementing advanced encryption protocols. All documents are stored securely in the cloud, and access is controlled through user permissions. This guarantees that your sensitive information remains protected throughout the whole signing process.

-

What integrations are available for the Nc 5500 Fillable Form with airSlate SignNow?

AirSlate SignNow offers seamless integrations with various applications that can enhance your experience with the Nc 5500 Fillable Form. These integrations allow you to import/export data from CRM systems, cloud storage services, and other tools, streamlining your operations and ensuring everything works together efficiently.

Get more for Nc 5500 Fillable Form

Find out other Nc 5500 Fillable Form

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document