Form MO 1065 Partnership Return of Income 2022

What is the Form MO 1065 Partnership Return of Income

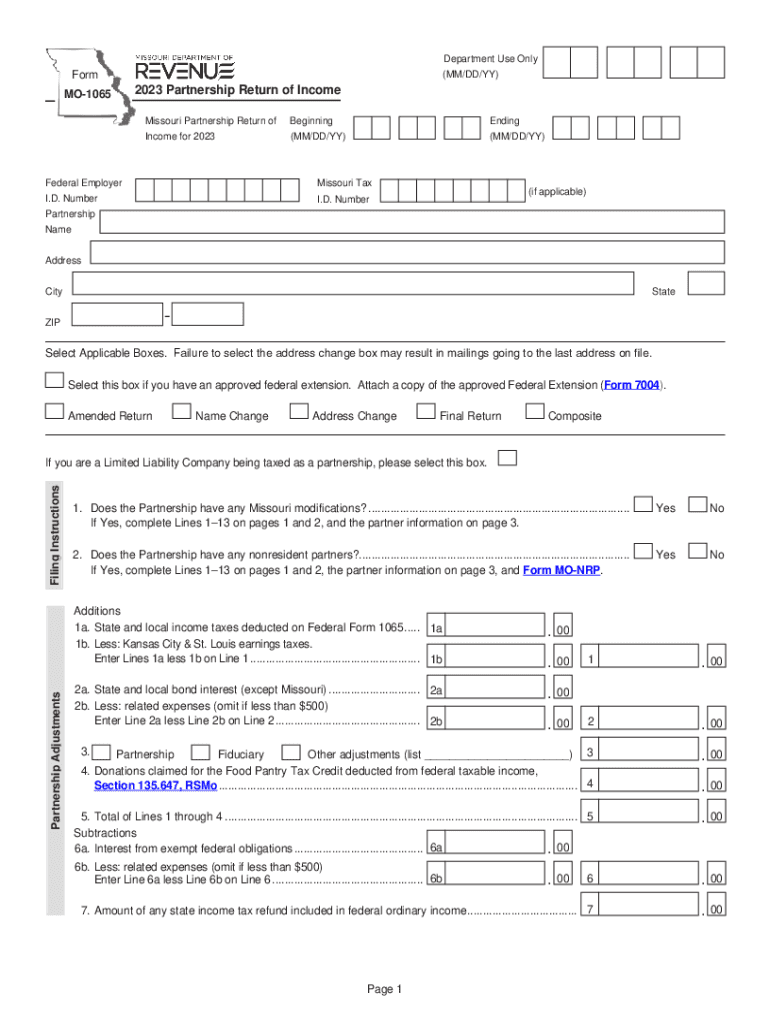

The Form MO 1065 is the official Partnership Return of Income for partnerships operating in Missouri. This form is essential for reporting the income, deductions, and credits of partnerships. It is used by partnerships to file their state income tax returns, ensuring compliance with Missouri tax regulations. The form captures vital financial information, including the partnership's total income, expenses, and the distribution of income among partners.

How to Use the Form MO 1065 Partnership Return of Income

To effectively use the Form MO 1065, partnerships must gather all necessary financial data for the tax year. This includes income statements, expense reports, and partner information. The form requires accurate reporting of total income, allowable deductions, and each partner's share of income or loss. Partnerships must ensure that all fields are completed accurately to avoid delays or penalties. Once filled out, the form can be submitted electronically or via mail, depending on the partnership's preference.

Steps to Complete the Form MO 1065 Partnership Return of Income

Completing the Form MO 1065 involves several key steps:

- Gather financial documents, including income statements and expense records.

- Fill out the partnership's basic information, including name, address, and federal employer identification number (EIN).

- Report total income and deductions on the appropriate lines of the form.

- Allocate income or losses to each partner based on their agreement.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

The filing deadline for the Form MO 1065 typically coincides with the federal tax return deadline, which is usually the fifteenth day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by March 15. It is important for partnerships to be aware of these dates to avoid late filing penalties and interest charges.

Required Documents

To complete the Form MO 1065, partnerships need to prepare several documents, including:

- Income statements detailing all sources of revenue.

- Expense reports outlining all business-related costs.

- Partner agreements that specify income distribution among partners.

- Any relevant tax credits or deductions documentation.

Penalties for Non-Compliance

Failing to file the Form MO 1065 or submitting it late can result in significant penalties. Missouri imposes fines for late filings, and partnerships may also face interest on any unpaid taxes. Additionally, inaccurate reporting may lead to audits and further penalties. It is crucial for partnerships to ensure compliance with all filing requirements to avoid these consequences.

Quick guide on how to complete form mo 1065 partnership return of income

Complete Form MO 1065 Partnership Return Of Income effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and safely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents quickly without any delays. Manage Form MO 1065 Partnership Return Of Income on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and electronically sign Form MO 1065 Partnership Return Of Income without hassle

- Obtain Form MO 1065 Partnership Return Of Income and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Form MO 1065 Partnership Return Of Income and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mo 1065 partnership return of income

Create this form in 5 minutes!

How to create an eSignature for the form mo 1065 partnership return of income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 mo 1065 form and when is it required?

The 2022 mo 1065 form is used by partnerships in Missouri to report their income, deductions, and credits. It is required annually and must be filed by the 15th day of the third month after the end of the partnership's tax year. Utilizing airSlate SignNow can streamline this process, making it easier to collect eSignatures and submit documents promptly.

-

How can airSlate SignNow help me with eSigning the 2022 mo 1065?

AirSlate SignNow provides a user-friendly platform for electronically signing your 2022 mo 1065 form. This simplifies the process by allowing you to send the document to all necessary parties for eSignature, ensuring quick completion and compliance with filing deadlines.

-

What features does airSlate SignNow offer for managing the 2022 mo 1065?

AirSlate SignNow offers features such as customizable templates, automated workflows, and secure storage that can streamline the preparation and submission of the 2022 mo 1065 form. These tools can save you time and reduce errors, making your document management more efficient.

-

Is airSlate SignNow a cost-effective solution for filing the 2022 mo 1065?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to manage their documents, including the 2022 mo 1065 form. The platform provides affordable pricing plans that cater to various business needs, ensuring you get value while handling important tax documentation.

-

What are the benefits of using airSlate SignNow for tax documentation like the 2022 mo 1065?

Using airSlate SignNow for tax documents such as the 2022 mo 1065 provides several benefits, including faster processing times, improved accuracy, and enhanced security. It allows for a seamless eSignature experience, ensuring that all involved parties can sign documents easily and securely.

-

Does airSlate SignNow integrate with accounting software for the 2022 mo 1065?

Yes, airSlate SignNow integrates with various accounting software, making it easier to manage and file the 2022 mo 1065 form. These integrations help streamline the data transfer process, reducing manual entry and potential errors.

-

How secure is the document handling for the 2022 mo 1065 using airSlate SignNow?

AirSlate SignNow prioritizes security with features such as data encryption, secure server storage, and compliant eSignature processes for your 2022 mo 1065 form. You can confidently manage sensitive tax documents knowing that your information is protected.

Get more for Form MO 1065 Partnership Return Of Income

Find out other Form MO 1065 Partnership Return Of Income

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed