Iht411 2014-2026

What is the Iht411

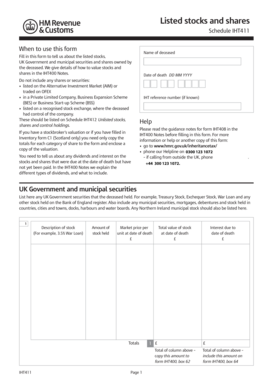

The Iht411 form, also known as the HMRC form IHT411, is a crucial document used in the United Kingdom for inheritance tax purposes. It is primarily utilized to report the value of an estate when someone passes away. This form helps to determine whether inheritance tax is due and, if so, how much. The Iht411 form is a part of the wider inheritance tax process, which includes various forms and documentation that ensure compliance with tax regulations.

How to use the Iht411

Using the Iht411 form involves several steps to ensure accurate reporting of an estate's value. First, gather all necessary information about the deceased's assets, liabilities, and any gifts made prior to death. Next, complete the Iht411 form by providing detailed information about these assets, including property, bank accounts, and investments. Once completed, the form must be submitted to HMRC, either online or by mail, depending on the preferences of the executor or administrator handling the estate.

Steps to complete the Iht411

Completing the Iht411 form requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial documents, including bank statements, property deeds, and investment records.

- Calculate the total value of the estate, including all assets and liabilities.

- Fill out the Iht411 form accurately, ensuring all information is correct and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form to HMRC, keeping a copy for your records.

Legal use of the Iht411

The Iht411 form is legally binding when completed and submitted in accordance with HMRC guidelines. It is essential to ensure that the information provided is accurate, as any discrepancies may lead to penalties or legal issues. The form must be signed by the executor or administrator of the estate, confirming that the details are true to the best of their knowledge. Compliance with legal requirements is critical to avoid complications during the inheritance tax assessment process.

Required Documents

To complete the Iht411 form, several documents are necessary. These may include:

- Death certificate of the deceased.

- Proof of identity for the executor or administrator.

- Financial statements detailing all assets and liabilities.

- Any previous inheritance tax returns, if applicable.

Having these documents ready will facilitate a smoother completion of the Iht411 form.

Form Submission Methods (Online / Mail / In-Person)

The Iht411 form can be submitted through various methods, depending on the preferences of the executor or administrator. Options include:

- Online submission via the HMRC website, which offers a streamlined process.

- Mailing a paper copy of the completed form to HMRC.

- In-person submission at designated HMRC offices, if required.

Choosing the appropriate method can depend on the complexity of the estate and the executor's comfort with digital tools.

Quick guide on how to complete iht411

Complete Iht411 effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow offers you all the tools you need to create, modify, and electronically sign your documents swiftly without hassle. Manage Iht411 on any device using airSlate SignNow's Android or iOS applications and streamline any document-focused procedure today.

The simplest method to adjust and electronically sign Iht411 with ease

- Obtain Iht411 and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Adjust and electronically sign Iht411 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iht411

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is iht411 and how can it benefit my business?

The iht411 is a powerful document management tool provided by airSlate SignNow that allows businesses to streamline their eSigning processes. By leveraging iht411, you can reduce the time spent on document approvals and enhance collaboration among team members. This solution is especially useful for businesses looking to improve efficiency and reduce operational costs.

-

How much does it cost to use iht411?

Pricing for the iht411 varies based on the features your business needs. airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose a plan that suits your budget while gaining access to the essential features of iht411.

-

What features are included with iht411?

With iht411, users benefit from robust features such as customizable templates, document tracking, and advanced security measures. The platform allows for seamless integration with other tools, ensuring a smooth workflow. These features make iht411 a comprehensive solution for managing eSignature needs.

-

Can iht411 integrate with other software tools?

Yes, iht411 is designed to easily integrate with various software applications such as CRM systems, project management tools, and cloud storage services. This ensures that your workflows can remain cohesive and efficient. By using iht411 alongside your existing tools, you can enhance productivity and data management.

-

Is iht411 secure for sensitive documents?

Absolutely, iht411 prioritizes the security of your sensitive documents. With advanced encryption and secure data storage, airSlate SignNow ensures that your documents are fully protected during the signing process. This level of security is crucial for businesses handling confidential information.

-

How do I get started with iht411?

Getting started with iht411 is simple! You can sign up for a free trial to explore its features and functionalities. Once you're comfortable with the platform, you can choose the pricing plan that best fits your business needs and begin enhancing your document workflow.

-

What are the main benefits of using iht411 for eSigning?

The main benefits of using iht411 include increased efficiency, reduced turnaround time, and enhanced compliance for all your eSigning needs. This tool simplifies the signing process, helping you save time and resources. Ultimately, iht411 allows your business to operate more smoothly and effectively.

Get more for Iht411

- Natf form 81 archives

- Tc101 form

- Cell reproduction worksheet answer key form

- Petty cash fund requestchange form

- Newbirthofdom orgresourcesadvancementeagle scout rank application and board of review process form

- 211 hillcrest ave form

- Stalin man of steel video worksheet part one answers form

- Ina gartens best christmas cookie recipes of all timechristmas cookie challengefood network12 employee award ideas inspired by form

Find out other Iht411

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document