Wauseon Income Tax Form

What is the Wauseon Income Tax

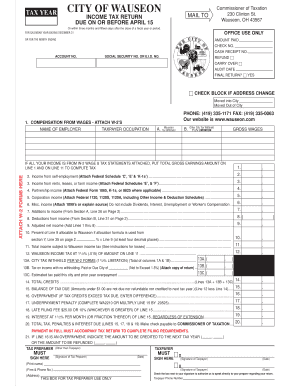

The Wauseon income tax is a municipal tax imposed on individuals and businesses earning income within the city of Wauseon, Ohio. It is designed to generate revenue for local government services, including public safety, infrastructure maintenance, and community programs. The tax applies to wages, salaries, and other forms of compensation, as well as business profits. Understanding the specifics of this tax is essential for residents and business owners to ensure compliance and proper filing.

Steps to complete the Wauseon Income Tax

Completing the Wauseon income tax involves several key steps to ensure accurate and timely submission. Start by gathering all necessary documentation, including W-2 forms, 1099s, and any other income statements. Next, determine your filing status and the applicable tax rate based on your income level. You can then fill out the appropriate forms, which are available online or at local government offices. After completing the forms, review them for accuracy before submitting them either online, by mail, or in person.

Legal use of the Wauseon Income Tax

The legal framework surrounding the Wauseon income tax is governed by local ordinances and state law. To ensure compliance, taxpayers must adhere to established guidelines regarding income reporting and tax payments. Electronic filing methods are recognized as legally binding, provided that they meet specific requirements, such as secure signatures and proper documentation. Utilizing a reliable eSignature platform can enhance the legal validity of your submitted forms.

Filing Deadlines / Important Dates

Filing deadlines for the Wauseon income tax are crucial for avoiding penalties. Typically, individual taxpayers must file their returns by April fifteenth of each year. Business entities may have different deadlines based on their fiscal year. It is important to stay informed about any changes to these dates, as local regulations may adjust them. Mark your calendar to ensure timely submission and compliance with local tax laws.

Required Documents

To successfully complete the Wauseon income tax, several documents are required. Key documents include:

- W-2 forms from employers detailing annual earnings

- 1099 forms for freelance or contract work

- Records of any additional income sources

- Documentation of deductions or credits you wish to claim

Having these documents ready will streamline the filing process and help ensure accuracy in reporting your income.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers in Wauseon have multiple options for submitting their income tax forms. You can file online through the city’s official tax portal, which offers a convenient and efficient way to manage your tax obligations. Alternatively, forms can be mailed to the designated tax office or submitted in person during business hours. Each method has its own advantages, so choose the one that best suits your needs and preferences.

Penalties for Non-Compliance

Failing to comply with the Wauseon income tax regulations can result in significant penalties. Common penalties include late filing fees, interest on unpaid taxes, and potential legal action for persistent non-compliance. It is important to understand these consequences and take proactive steps to meet your tax obligations. Regularly reviewing your tax status and ensuring timely submissions can help avoid these issues.

Quick guide on how to complete wauseon income tax

Complete Wauseon Income Tax effortlessly on any device

Digital document management has gained traction with both businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, amend, and electronically sign your documents rapidly without delays. Manage Wauseon Income Tax on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to edit and eSign Wauseon Income Tax with minimal effort

- Obtain Wauseon Income Tax and then click Get Form to begin.

- Use the features we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and has the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to deliver your form, either by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign Wauseon Income Tax and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wauseon income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Wauseon income tax rate?

The city of Wauseon income tax rate is currently set at 1.5%. It applies to all earned income for individuals who live or work in Wauseon. This rate helps fund local services and infrastructure, making it essential for residents and business owners to understand.

-

How does the city of Wauseon income tax affect businesses?

Businesses operating within Wauseon must comply with the city of Wauseon income tax regulations, which include withholding taxes from employees' paychecks. This ensures that the tax obligations are met, allowing businesses to focus on growth while fulfilling local requirements.

-

What are the benefits of using airSlate SignNow for income tax documents?

airSlate SignNow provides a streamlined process for eSigning income tax documents, making it convenient for residents and businesses in Wauseon. With features such as document tracking and secure storage, users can efficiently manage their tax paperwork while adhering to the requirements of the city of Wauseon income tax.

-

Can airSlate SignNow help with the filing process for the city of Wauseon income tax?

While airSlate SignNow specializes in document management and eSigning, it can simplify the preparation and signature process for tax documents needed for filing the city of Wauseon income tax. By providing a user-friendly platform, it ensures that all necessary forms are efficiently signed and organized.

-

Is there a cost associated with using airSlate SignNow for income tax purposes?

Yes, airSlate SignNow offers various pricing plans tailored to different needs. For individuals or businesses needing to manage city of Wauseon income tax documents, the affordable plans make it a cost-effective choice while providing valuable features for document handling.

-

How can I integrate airSlate SignNow with my existing accounting software for tax documentation?

airSlate SignNow offers integrations with various accounting software that can help manage the complexities of the city of Wauseon income tax documentation process. By connecting your existing tools, you can enhance efficiency and ensure seamless synchronization of your financial information.

-

What security measures does airSlate SignNow provide for sensitive tax documents?

airSlate SignNow employs advanced security measures, including encryption and access controls, to protect sensitive documents related to the city of Wauseon income tax. Users can trust that their information remains confidential and secure throughout the eSigning process.

Get more for Wauseon Income Tax

- Hawaii n 15 rev form

- Technical rmth rmnh documentation modular compact rooftop climacon form

- Provider participation request form coventry health care

- Scholastic scope answer key 435815679 form

- Security administration withdrawal form

- Btf8220d form

- Myzoupu form

- Schedule ca 540 california adjustments residents schedule ca 540 california adjustments residents 771882700 form

Find out other Wauseon Income Tax

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself