Uttarakhand Gramin Bank Atm Card Apply Online Form

What is the Uttarakhand Gramin Bank ATM Card Apply Online

The Uttarakhand Gramin Bank ATM card apply online is a digital process that allows customers to request an ATM card through the bank's online platform. This service is designed to streamline the application process, making it more convenient for users to access banking services from the comfort of their homes. By applying online, customers can avoid the need to visit a physical branch, saving time and effort.

Steps to Complete the Uttarakhand Gramin Bank ATM Card Apply Online

To successfully complete the application for the Uttarakhand Gramin Bank ATM card online, follow these steps:

- Visit the official Uttarakhand Gramin Bank website.

- Navigate to the ATM card application section.

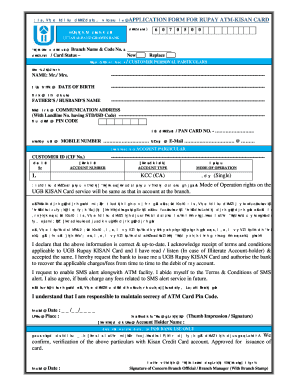

- Fill out the online application form with accurate personal information.

- Upload any required documents, such as identification proof and address verification.

- Review the information provided to ensure accuracy.

- Submit the application form.

After submission, you will receive a confirmation regarding the status of your application.

Required Documents for the ATM Card Application

When applying for the Uttarakhand Gramin Bank ATM card online, several documents are typically required to verify your identity and address. These may include:

- A government-issued photo ID (such as a driver's license or passport).

- Proof of address (utility bill, lease agreement, etc.).

- Recent passport-sized photographs.

Ensure that all documents are clear and legible to avoid delays in processing your application.

Legal Use of the Uttarakhand Gramin Bank ATM Card Apply Online

The online application for the Uttarakhand Gramin Bank ATM card is legally binding when all requirements are met. It is essential to provide accurate information, as any discrepancies can lead to denial of the application. The use of electronic signatures and compliance with eSignature regulations ensures that the application holds legal validity, similar to traditional paper applications.

How to Use the Uttarakhand Gramin Bank ATM Card

Once you receive your Uttarakhand Gramin Bank ATM card, you can use it for various banking transactions. This includes:

- Withdrawing cash from ATMs.

- Making purchases at retail locations.

- Checking your account balance.

- Transferring funds between accounts.

Always ensure that your ATM card is kept secure to prevent unauthorized access to your account.

Eligibility Criteria for the ATM Card Application

To be eligible for the Uttarakhand Gramin Bank ATM card, applicants must meet certain criteria, which typically include:

- Being a customer of Uttarakhand Gramin Bank.

- Maintaining a minimum balance in the account, if applicable.

- Providing valid identification and address proofs.

Meeting these criteria will facilitate a smoother application process and increase the likelihood of approval.

Quick guide on how to complete uttarakhand gramin bank atm card apply online

Prepare Uttarakhand Gramin Bank Atm Card Apply Online effortlessly on any device

Web-based document management has surged in popularity among companies and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed documents and signatures, as one can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with the essential tools to create, alter, and electronically sign your documents swiftly without delays. Manage Uttarakhand Gramin Bank Atm Card Apply Online on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to alter and electronically sign Uttarakhand Gramin Bank Atm Card Apply Online effortlessly

- Locate Uttarakhand Gramin Bank Atm Card Apply Online and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Uttarakhand Gramin Bank Atm Card Apply Online and guarantee outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the uttarakhand gramin bank atm card apply online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the steps to uttarakhand gramin bank atm card apply online?

To apply for the Uttarakhand Gramin Bank ATM card online, visit the official bank website and navigate to the ATM card application section. Fill out the required details and submit the form. After submission, you'll receive confirmation about your application status via email or SMS.

-

What documents are needed to uttarakhand gramin bank atm card apply online?

When applying for the Uttarakhand Gramin Bank ATM card online, you'll typically need to provide identification proof, such as an Aadhar card or passport, along with your bank account details. Additionally, a recent passport-sized photograph may be required. Ensure all documents are uploaded in the specified format.

-

How long does it take to receive the ATM card after uttarakhand gramin bank atm card apply online?

Once you complete your application for the Uttarakhand Gramin Bank ATM card online, it usually takes about 7 to 10 working days to receive your card. Delivery times can vary based on location and processing times at the bank. You can track your application status through the bank’s website.

-

Are there any fees associated with uttarakhand gramin bank atm card apply online?

There may be nominal fees associated with the Uttarakhand Gramin Bank ATM card, such as issuance or annual maintenance charges. These fees vary based on the type of card you apply for. It's advisable to check the official bank site for the most accurate and updated information.

-

What benefits do I gain by opting for uttarakhand gramin bank atm card apply online?

When you choose to apply for the Uttarakhand Gramin Bank ATM card online, you gain the convenience of managing your finances anytime, anywhere. The ATM card allows you to withdraw cash, make purchases, and access various banking services with ease. Online applications also streamline the process, saving you time.

-

Can I track my application status after uttarakhand gramin bank atm card apply online?

Yes, after applying for the Uttarakhand Gramin Bank ATM card online, you can easily track your application status. The bank provides a tracking option on their website where you can enter your application reference number and view the current status. This ensures you stay informed throughout the process.

-

Is it safe to apply for an Uttarakhand Gramin Bank ATM card online?

Applying for the Uttarakhand Gramin Bank ATM card online is safe, provided you use the bank's official website. The bank employs robust security measures to protect your personal information during the application process. Always ensure that you are on the secure website before entering any sensitive details.

Get more for Uttarakhand Gramin Bank Atm Card Apply Online

- Dubois area high s community service time sheet dasd k12 pa form

- Shift availability form

- Ob10colgate form

- Nys barber apprentice application form

- Vehicular property damage claim form 100339033

- Right to remove contingency addendum louisiana form

- California fire protection district 610032805 form

- Transportation contract template form

Find out other Uttarakhand Gramin Bank Atm Card Apply Online

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed