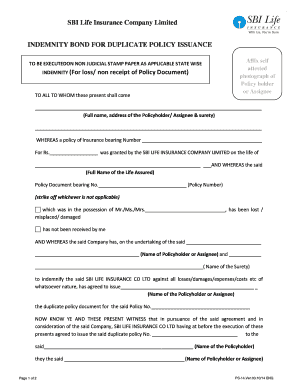

Sbi Life Indemnity Bond Form

What is the SBI Life Indemnity Bond?

The SBI Life Indemnity Bond is a legal document used to safeguard the interests of the State Bank of India (SBI) when a demand draft (DD) is lost or misplaced. This bond acts as a guarantee that the issuer will not seek to claim the funds associated with the lost DD. It is essential for individuals or entities who have lost their demand drafts and wish to ensure that the funds are not misused. The indemnity bond outlines the responsibilities of the person issuing the bond and provides a framework for compensation in case of any claims arising from the lost draft.

Steps to Complete the SBI Life Indemnity Bond

Filling out the SBI Life Indemnity Bond involves several important steps to ensure that the document is legally valid and accepted by the bank. Here is a structured approach:

- Gather necessary information, including details of the lost demand draft, such as the DD number, date of issuance, and amount.

- Obtain the official SBI indemnity bond format for lost demand drafts from a local SBI branch or their website.

- Fill in personal details, including your name, address, and contact information, along with the details of the lost DD.

- Sign the document in the presence of a witness, as required by SBI.

- Submit the completed bond to the nearest SBI branch along with any required identification documents.

Legal Use of the SBI Life Indemnity Bond

The SBI Life Indemnity Bond is legally binding once it is signed and submitted to the bank. It is crucial to ensure that all information is accurate and complete to avoid any legal complications. The bond serves as a protective measure for both the bank and the individual, ensuring that claims related to the lost demand draft are addressed appropriately. Compliance with local laws and regulations is necessary for the bond to be enforceable in a court of law.

Key Elements of the SBI Life Indemnity Bond

Understanding the key elements of the SBI Life Indemnity Bond is vital for its effective use. The bond typically includes:

- Personal Information: Name, address, and contact details of the bond issuer.

- Details of the Lost DD: Information such as the DD number, amount, and date of issuance.

- Indemnification Clause: A statement that the issuer agrees to indemnify SBI against any claims arising from the lost DD.

- Signature and Witness: The bond must be signed by the issuer and witnessed to validate its authenticity.

How to Obtain the SBI Life Indemnity Bond

Obtaining the SBI Life Indemnity Bond is straightforward. Individuals can visit their nearest SBI branch to request the official indemnity bond format. Alternatively, some branches may provide the form online. It is essential to ensure that you have all necessary information and documentation ready before visiting the bank to facilitate a smooth process.

Examples of Using the SBI Life Indemnity Bond

The SBI Life Indemnity Bond is commonly used in various scenarios, such as:

- When an individual loses a demand draft issued for payment of services or goods.

- In situations where a business has misplaced a demand draft intended for vendor payments.

- For individuals seeking to replace a lost demand draft for personal transactions, such as gift payments or donations.

Quick guide on how to complete sbi life indemnity bond

Complete Sbi Life Indemnity Bond effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and safely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents promptly without delays. Manage Sbi Life Indemnity Bond on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest approach to modify and eSign Sbi Life Indemnity Bond without hassle

- Obtain Sbi Life Indemnity Bond and click on Get Form to commence.

- Utilize the tools available to complete your document.

- Emphasize important parts of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Sbi Life Indemnity Bond and guarantee excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sbi life indemnity bond

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the sbi indemnity bond format and how is it used?

The SBI indemnity bond format is a legal document that outlines the terms of indemnification in case of loss or damage. This format is essential for individuals or entities who need to secure funds from the State Bank of India, ensuring that they are protected. Understanding how to use this format correctly can help in expediting banking processes.

-

How can airSlate SignNow help with the sbi indemnity bond format?

With airSlate SignNow, you can easily upload, modify, and eSign the SBI indemnity bond format. The platform’s intuitive interface simplifies the process, allowing users to swiftly complete and send documents. This efficiency not only saves time but also enhances the overall document management experience.

-

Is there a cost associated with using airSlate SignNow for the sbi indemnity bond format?

Yes, there are pricing plans available for using airSlate SignNow, which cater to various business needs. Each plan offers access to features that streamline the processing of documents, including the SBI indemnity bond format. Review our pricing page to find the most suitable option for your organization.

-

What features does airSlate SignNow offer for the sbi indemnity bond format?

AirSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage for the SBI indemnity bond format. You can easily collaborate with others, track document status, and manage multiple signers. These features are designed to enhance efficiency and compliance.

-

Can I integrate airSlate SignNow with other tools for managing the sbi indemnity bond format?

Yes, airSlate SignNow offers integrations with various applications like Google Drive, Salesforce, and more. These integrations allow for seamless management of the SBI indemnity bond format within your existing workflows. This connectivity ensures that your document processes are streamlined across multiple platforms.

-

What are the benefits of using airSlate SignNow for the sbi indemnity bond format?

Using airSlate SignNow for the SBI indemnity bond format provides advantages such as enhanced security, reduced turnaround time, and improved document accuracy. You can sign documents electronically, which increases convenience and facilitates faster transactions. Additionally, the platform ensures compliance with legal standards.

-

Is the sbi indemnity bond format customizable in airSlate SignNow?

Absolutely! AirSlate SignNow allows you to customize the SBI indemnity bond format to meet your specific requirements. You can edit the text, add your logo, and modify fields as needed, ensuring that the document aligns with your business standards.

Get more for Sbi Life Indemnity Bond

- Mobile home quote sheet pdf form

- Upj admission data form

- Form v39a 250841

- Flex max 321e 1ghz line extender amplifer fm321e arris form

- Hindu wedding checklist pdf form

- Opwdd 147 form

- Www ijsr netarchivev8i1international journal of science and research ijsr form

- Service provision agreement template form

Find out other Sbi Life Indemnity Bond

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation