Home Depot W9 Form

What is the Home Depot W-9

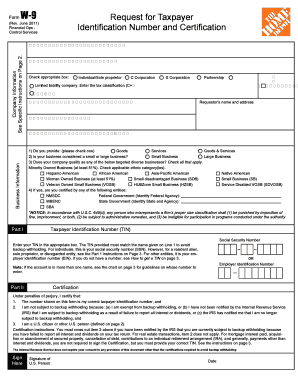

The Home Depot W-9 is a tax form used by the Home Depot to collect information from independent contractors, freelancers, and vendors who provide services to the company. This form is essential for reporting income to the Internal Revenue Service (IRS). The W-9 form requests the individual's name, business name (if applicable), address, taxpayer identification number (TIN), and certification of taxpayer status. It is crucial for ensuring compliance with tax regulations and for the accurate reporting of payments made by Home Depot to these service providers.

How to obtain the Home Depot W-9

To obtain the Home Depot W-9, individuals can visit the official Home Depot website or contact their customer service. The form is typically available for download in PDF format, making it easy to fill out digitally or print for manual completion. If you are an independent contractor or vendor, you may also receive the W-9 form directly from Home Depot when you begin your service engagement. Always ensure that you are using the most current version of the form to comply with IRS requirements.

Steps to complete the Home Depot W-9

Completing the Home Depot W-9 involves several straightforward steps:

- Begin by entering your name as it appears on your tax return.

- If applicable, provide your business name.

- Fill in your address, including city, state, and ZIP code.

- Enter your taxpayer identification number (TIN), which can be your Social Security Number (SSN) or Employer Identification Number (EIN).

- Indicate your tax classification by checking the appropriate box, such as individual, corporation, or partnership.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the Home Depot W-9

The Home Depot W-9 is legally binding when completed accurately and submitted correctly. It serves as a certification of the taxpayer's identification information and is used by Home Depot to report payments to the IRS. It is essential to ensure that all information is truthful and that the form is signed. Failure to provide accurate information may lead to penalties or withholding of taxes. The form must be stored securely, as it contains sensitive personal information.

Key elements of the Home Depot W-9

Key elements of the Home Depot W-9 include:

- Name: The legal name of the individual or business.

- Business Name: If applicable, the name under which the business operates.

- Address: The complete address where the taxpayer can be reached.

- Taxpayer Identification Number (TIN): This can be an SSN or EIN.

- Tax Classification: The appropriate category must be selected to indicate the type of entity.

- Signature: A signature is required to validate the form.

Filing Deadlines / Important Dates

Filing deadlines for the Home Depot W-9 are typically tied to the tax year in which payments are made. While the W-9 itself does not have a specific submission deadline, it is crucial to provide the completed form to Home Depot before any payments are issued. This ensures that the company can accurately report income to the IRS. It's advisable to submit the W-9 as soon as you begin working with Home Depot to avoid any delays in payment processing.

Quick guide on how to complete home depot w9

Complete Home Depot W9 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Home Depot W9 on any device with airSlate SignNow Android or iOS applications and streamline any document-centric process today.

The simplest way to edit and eSign Home Depot W9 with ease

- Locate Home Depot W9 and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or obscure sensitive information using the tools specifically offered by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to secure your modifications.

- Choose your preferred method for submitting your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from any device of your choice. Modify and eSign Home Depot W9 to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the home depot w9

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Home Depot W9 form?

The Home Depot W9 form is a taxpayer identification document required for independent contractors and vendors providing goods or services to Home Depot. It collects essential information, including the contractor's name and tax identification number, ensuring proper tax reporting. If you're doing business with Home Depot, you will need to fill out this form to comply with IRS regulations.

-

How can I obtain a Home Depot W9 form?

You can easily download the Home Depot W9 form from their official website or request it directly from your Home Depot contact. Additionally, airSlate SignNow allows you to upload and eSign the completed form electronically for a more streamlined process. This saves time and ensures that your document is submitted without delay.

-

Why do I need to submit a Home Depot W9?

Submitting a Home Depot W9 is crucial for tax purposes, as it allows Home Depot to accurately report payments made to you during the tax year. If you are an independent contractor, this form helps to ensure that you receive the proper tax documents from Home Depot. Not providing a W9 can result in higher withholding rates on your payments.

-

What information is required on my Home Depot W9 form?

The Home Depot W9 form requires various information, including your legal name, business name (if applicable), address, and taxpayer identification number. It's essential to fill out this information accurately to avoid issues with tax reporting. Ensure that all details are correct before submission to Home Depot to streamline the process.

-

Can I eSign my Home Depot W9 form?

Yes, you can eSign your Home Depot W9 form using airSlate SignNow, which simplifies the signing process. With airSlate SignNow, you can easily upload your completed W9 document and quickly add your signature. This not only saves time but also enhances the efficiency of document handling.

-

How long does it take for Home Depot to process my W9 form?

Typically, once you submit your Home Depot W9 form, it may take a few business days for processing. To expedite the process, ensure that your form is filled out correctly and submitted through an efficient platform like airSlate SignNow. If there are any issues, Home Depot may contact you for clarification.

-

What are the benefits of using airSlate SignNow for my Home Depot W9?

Using airSlate SignNow to manage your Home Depot W9 form offers numerous benefits, including an easy-to-use interface, secure document handling, and the ability to eSign documents remotely. This solution saves you time and ensures that your form is submitted accurately and quickly. Transitioning to airSlate SignNow also allows for better tracking of your document status.

Get more for Home Depot W9

- Banquet checklist form

- How to fill out a renunciation form

- Kern family health care authorization form

- Basketball anschreibebogen pdf form

- Mechanical permit application meridian township form

- Oysarn auth to pay form 4 2015docx

- Real estate and rental and leasing maine u s census bureau census form

- Instructions for form ftb 3522 llc tax voucher

Find out other Home Depot W9

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple