001 Fy Form

What is the 001 FY?

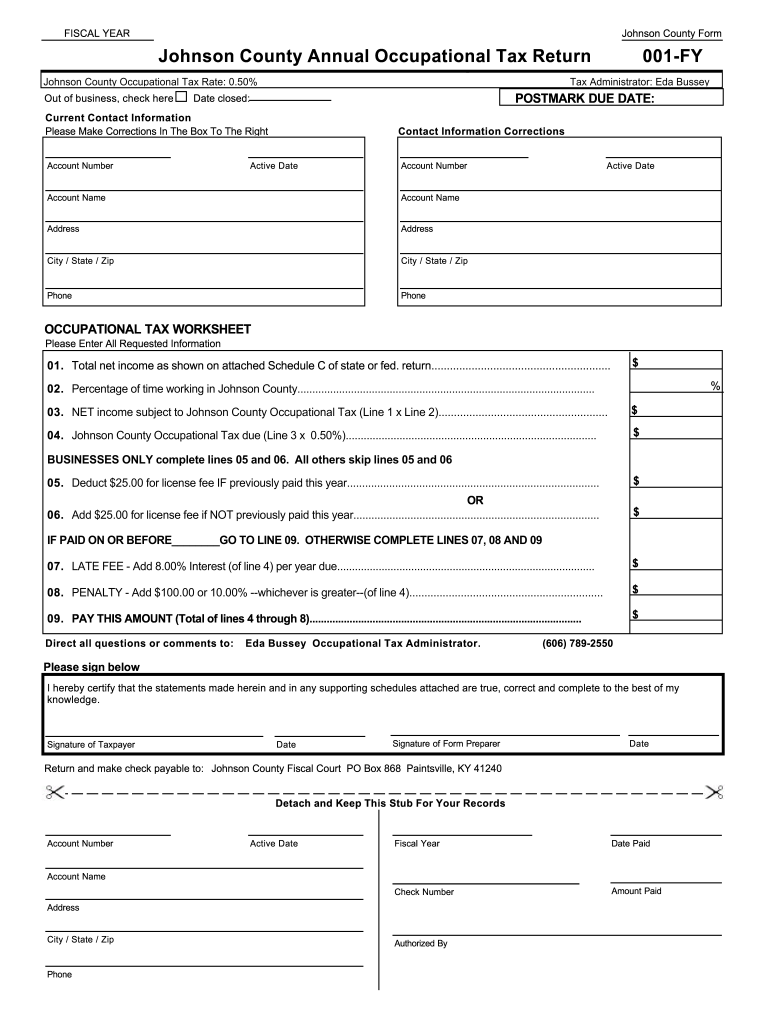

The 001 FY is a specific form used for reporting occupational taxes in Johnson County, Kentucky. This form is essential for individuals and businesses to comply with local tax regulations. It captures various income details and ensures that the correct tax amount is calculated based on the earnings reported. Understanding the purpose and requirements of the 001 FY is crucial for accurate tax filing.

Steps to Complete the 001 FY

Completing the 001 FY involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form by entering your personal information, such as name, address, and Social Security number. Carefully report your income details, ensuring that all figures are accurate. It is also important to review the completed form for any errors before submission. Finally, sign and date the form to validate it.

Required Documents

To successfully complete the 001 FY, certain documents are necessary. These typically include:

- Income statements, such as W-2s or 1099s

- Previous year’s tax returns for reference

- Documentation of any deductions or credits you plan to claim

- Identification documents, such as a driver's license or Social Security card

Having these documents ready will streamline the completion process and help ensure that all required information is accurately reported.

Form Submission Methods

The 001 FY can be submitted through various methods to accommodate different preferences. Options include:

- Online Submission: Many jurisdictions allow for electronic filing through secure portals.

- Mail: You can print the completed form and send it via postal service to the designated tax office.

- In-Person: Submitting the form in person at the local tax office may be an option for those who prefer direct interaction.

Choosing the right method depends on personal convenience and the specific requirements set by the local tax authority.

Penalties for Non-Compliance

Failing to file the 001 FY or submitting inaccurate information can lead to penalties. Common repercussions include:

- Monetary fines based on the amount of tax owed

- Interest on unpaid taxes that accrue over time

- Potential legal action for persistent non-compliance

Understanding these penalties emphasizes the importance of timely and accurate filing to avoid unnecessary financial burdens.

IRS Guidelines

While the 001 FY is a local form, it is essential to be aware of IRS guidelines that may impact your filing. The IRS provides regulations on income reporting, deductions, and eSignature acceptance that may apply to your situation. Familiarizing yourself with these guidelines can help ensure that your local tax filings align with federal requirements, reducing the risk of errors or audits.

Quick guide on how to complete johnson county annual occupational tax return 001 fy

Your assistance manual on how to prepare your 001 Fy

If you’re wondering how to create and submit your 001 Fy, here are a few concise guidelines on how to simplify tax filing.

To get started, you first need to set up your airSlate SignNow account to revolutionize the way you handle documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, create, and complete your income tax forms with ease. With its editor, you can switch between text, checkboxes, and eSignatures and revisit to amend details as necessary. Enhance your tax management with advanced PDF editing, eSigning, and intuitive sharing.

Follow these steps to finalize your 001 Fy in just a few minutes:

- Create your account and begin working on PDFs in a matter of minutes.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Get form to access your 001 Fy in our editor.

- Complete the required fillable fields with your details (text, numbers, checkmarks).

- Use the Sign Tool to add your legally-binding eSignature (if necessary).

- Inspect your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that filing manually can lead to increased return errors and delayed refunds. Furthermore, before e-filing your taxes, consult the IRS website for reporting regulations in your state.

Create this form in 5 minutes or less

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the johnson county annual occupational tax return 001 fy

How to make an eSignature for the Johnson County Annual Occupational Tax Return 001 Fy in the online mode

How to make an electronic signature for the Johnson County Annual Occupational Tax Return 001 Fy in Chrome

How to make an eSignature for signing the Johnson County Annual Occupational Tax Return 001 Fy in Gmail

How to generate an electronic signature for the Johnson County Annual Occupational Tax Return 001 Fy right from your smartphone

How to make an electronic signature for the Johnson County Annual Occupational Tax Return 001 Fy on iOS

How to make an eSignature for the Johnson County Annual Occupational Tax Return 001 Fy on Android

People also ask

-

What is the purpose of the form annual occupational tax?

The form annual occupational tax is required to determine the taxes owed by businesses operating in specific jurisdictions. It ensures that you are compliant with local regulations and helps maintain transparent business practices. Filing this form accurately is essential for avoiding penalties.

-

How can airSlate SignNow assist with the form annual occupational tax?

airSlate SignNow provides an efficient platform for businesses to manage and eSign documents, including the form annual occupational tax. Our solution simplifies the process by allowing users to fill out, sign, and send documents securely online, saving time and reducing errors.

-

What are the pricing options for airSlate SignNow when filing the form annual occupational tax?

airSlate SignNow offers flexible pricing plans tailored to fit various business needs. Whether you are a small business or a large enterprise, our plans include features that allow you to handle your form annual occupational tax efficiently while managing your budget effectively.

-

Does airSlate SignNow integrate with other accounting software for managing the form annual occupational tax?

Yes, airSlate SignNow seamlessly integrates with popular accounting and tax software, making it easier to handle the form annual occupational tax. These integrations enhance your workflow by connecting document signing with your existing platforms, ensuring you can manage taxes accurately and efficiently.

-

Can I track the status of my form annual occupational tax submission using airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your form annual occupational tax submission. This includes notifications when documents are viewed and signed, ensuring you stay informed throughout the process.

-

What security measures does airSlate SignNow have for handling the form annual occupational tax?

airSlate SignNow prioritizes security, utilizing encryption and secure servers to protect your data while handling the form annual occupational tax. We ensure compliance with industry standards, so you can sign and send sensitive documents with peace of mind.

-

Is there a mobile app for filing the form annual occupational tax with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that enables you to manage your documents, including the form annual occupational tax, on the go. This convenience allows you to fill out, sign, and send forms from anywhere, increasing your productivity and efficiency.

Get more for 001 Fy

- Financial statements only in connection with prenuptial premarital agreement washington form

- Wa revocation form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children washington form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497429235 form

- Change residence form

- Washington business incorporation package to incorporate corporation washington form

- Washington corporation template form

- Washington pre incorporation agreement shareholders agreement and confidentiality agreement washington form

Find out other 001 Fy

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe