Temp 2201 Form

What is the Temp 2201

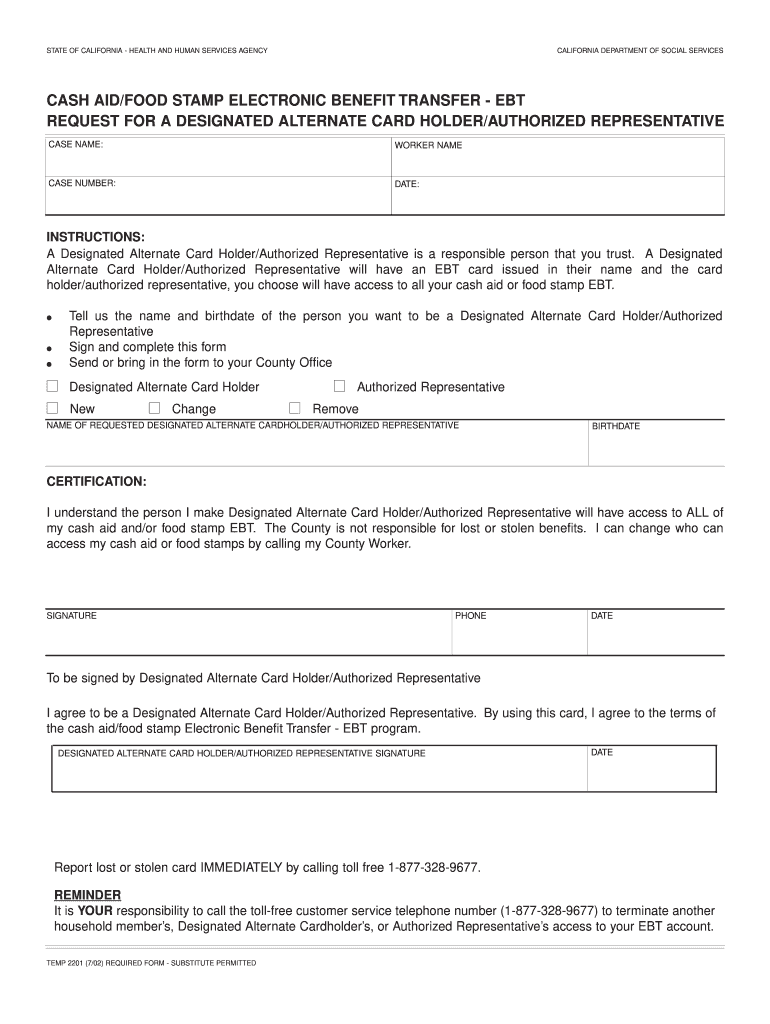

The Temp 2201 is a specific form utilized primarily for tax-related purposes in the United States. This form is essential for individuals and businesses to report certain types of income or claim specific deductions. Understanding its purpose is crucial for ensuring compliance with IRS regulations. The Temp 2201 form can be filled out electronically, making it easier to manage and submit.

How to use the Temp 2201

Using the Temp 2201 involves several straightforward steps. First, gather all necessary information, including personal details and financial records relevant to the form. Next, access the fillable Temp 2201 online, where you can input your information directly. After completing the form, review the entries for accuracy before submitting. This digital approach allows for easier corrections and ensures that you meet all requirements set by the IRS.

Steps to complete the Temp 2201

Completing the Temp 2201 requires a systematic approach to ensure all information is accurately reported. Follow these steps:

- Gather required documents, such as W-2s or 1099s.

- Access the fillable Temp 2201 form online.

- Input your personal information, including your name, address, and Social Security number.

- Enter financial data as required, ensuring all figures are accurate.

- Review the completed form for any errors or omissions.

- Submit the form electronically or print it for mailing, depending on your preference.

Legal use of the Temp 2201

The legal use of the Temp 2201 is governed by IRS regulations. To be considered valid, the form must be filled out completely and accurately. Electronic submissions are legally binding, provided they comply with eSignature laws, ensuring that the document holds up in legal contexts. It is essential to maintain records of the submission for future reference, especially in case of audits.

Filing Deadlines / Important Dates

Filing deadlines for the Temp 2201 can vary based on the specific tax year and the individual's filing status. Generally, forms must be submitted by April 15 of the following tax year. However, extensions may be available under certain circumstances. It is crucial to stay informed about any changes to deadlines to avoid penalties.

Required Documents

To complete the Temp 2201 accurately, several documents are typically required. These may include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income sources.

- Receipts for deductible expenses.

Having these documents ready will streamline the completion process and ensure compliance with IRS requirements.

Quick guide on how to complete temp 2201

Accomplish Temp 2201 effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers a perfect eco-conscious alternative to traditional printed and signed documents, as you can locate the appropriate form and securely archive it online. airSlate SignNow furnishes you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Handle Temp 2201 on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Temp 2201 without any hassle

- Obtain Temp 2201 and click on Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from a device of your choice. Alter and eSign Temp 2201 while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the temp 2201

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is temp 2201 and how does it relate to airSlate SignNow?

Temp 2201 refers to the comprehensive solution provided by airSlate SignNow for electronic signatures and document management. It allows businesses to send, eSign, and manage documents efficiently, streamlining workflows and enhancing productivity.

-

How much does it cost to use airSlate SignNow's temp 2201 features?

The pricing for airSlate SignNow's temp 2201 features varies based on the plan you choose. They offer flexible pricing options designed to accommodate the needs of different businesses, ensuring a cost-effective solution for eSigning and document management.

-

What are the key benefits of using temp 2201 by airSlate SignNow?

Using temp 2201 by airSlate SignNow provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for your documents. It enables users to complete transactions quickly and easily, improving the overall customer experience.

-

Can temp 2201 integrate with other software solutions?

Yes, temp 2201 seamlessly integrates with various software solutions, enhancing its functionality and usability. This feature allows businesses to connect their existing tools for a more streamlined workflow, improving overall productivity.

-

Is temp 2201 suitable for small businesses?

Absolutely, temp 2201 is designed to be scalable and cost-effective, making it suitable for small businesses. It provides the same powerful eSigning and document management capabilities that larger enterprises use, empowering small firms to operate efficiently.

-

What types of documents can be signed using temp 2201?

Temp 2201 allows users to sign a wide range of documents, including contracts, agreements, and forms. With airSlate SignNow, you can easily manage and eSign any document, ensuring compliance and legal validity.

-

How secure is the temp 2201 eSigning process?

The temp 2201 eSigning process is highly secure, utilizing advanced encryption protocols to protect your documents. airSlate SignNow adheres to industry standards and regulations, ensuring that all transactions are secure and compliant with legal requirements.

Get more for Temp 2201

- Utah youth soccer association participant registration form 15162789

- Weight lifting chart form

- Contagious diseaseoutpatient surgery care benefit claim aflac form

- Nits form fillable pdf fordham university fordham

- Kentucky affidavit of incomplete transfer form

- Fillable online driver dismissal form

- Sli stuttering checklist student dob date teacher form

- Egr 103 fundamentals of engineering design rowan college at bcc form

Find out other Temp 2201

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later