St 12tel 2020

What is the St 12tel?

The St 12tel is a specific form used in Wisconsin for reporting sales and use tax. It is designed for businesses that make taxable sales or purchases and need to report their tax liability to the state. This form helps ensure compliance with state tax laws and provides a structured way to calculate and remit the appropriate sales and use taxes. The St 12tel is essential for maintaining accurate tax records and fulfilling legal obligations regarding sales tax collection.

Steps to complete the St 12tel

Completing the St 12tel involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to sales and purchases, including invoices and receipts. Next, calculate the total taxable sales and any exempt sales, as well as the total use tax owed. Fill out the form by entering the required information in the designated fields, ensuring that all calculations are correct. Finally, review the completed form for accuracy before submitting it to the Wisconsin Department of Revenue.

Legal use of the St 12tel

The legal use of the St 12tel is governed by Wisconsin state tax regulations. To be considered valid, the form must be filled out accurately and submitted by the designated deadline. The information provided on the form must reflect actual sales and use transactions, as inaccuracies can lead to penalties or audits. Utilizing the St 12tel properly ensures that businesses remain compliant with state tax laws and avoid potential legal issues.

How to obtain the St 12tel

The St 12tel can be obtained through the Wisconsin Department of Revenue's official website. It is typically available as a downloadable PDF file, which can be printed for completion. Businesses may also request a physical copy of the form by contacting the department directly. Ensuring that you have the most current version of the St 12tel is crucial for accurate reporting.

Form Submission Methods

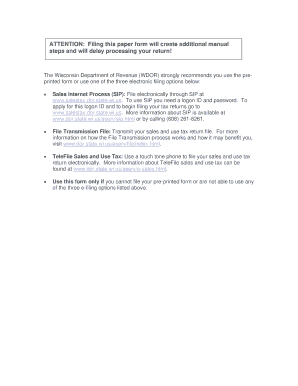

There are several methods available for submitting the St 12tel to the Wisconsin Department of Revenue. Businesses can file the form electronically through the state's online tax filing system, which is often the fastest and most efficient method. Alternatively, the completed form can be mailed to the appropriate address or submitted in person at a local office. It is important to choose the submission method that best fits your business needs while ensuring compliance with filing deadlines.

Key elements of the St 12tel

The St 12tel includes several key elements that are essential for accurate reporting. These elements typically consist of fields for entering total sales, exempt sales, and the amount of use tax owed. Additionally, the form requires information about the business, such as the name, address, and tax identification number. Accurate completion of these elements is vital for ensuring that the form is processed correctly and that the business meets its tax obligations.

Quick guide on how to complete st 12tel

Prepare St 12tel effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage St 12tel on any device using airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign St 12tel with ease

- Find St 12tel and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, time-consuming form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign St 12tel and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st 12tel

Create this form in 5 minutes!

How to create an eSignature for the st 12tel

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ST-12TEL Wisconsin Telefile Sales and Use Worksheet?

The ST-12TEL Wisconsin Telefile Sales and Use Worksheet is a document used by businesses in Wisconsin to report their sales and use tax obligations. This worksheet simplifies the filing process, making it more efficient for users. By utilizing this worksheet, companies ensure compliance with state tax laws while effectively managing their sales tax responsibilities.

-

How can airSlate SignNow help with the ST-12TEL Wisconsin Telefile Sales and Use Worksheet?

airSlate SignNow provides a streamlined solution for electronically signing and sending the ST-12TEL Wisconsin Telefile Sales and Use Worksheet. Its user-friendly interface simplifies the document management process, ensuring that all necessary signatures are collected quickly. By integrating this platform into your workflow, you save time and improve overall efficiency.

-

Is there a cost associated with using airSlate SignNow for the ST-12TEL Wisconsin Telefile Sales and Use Worksheet?

airSlate SignNow offers various pricing plans designed to accommodate different budgets and business sizes. Users can choose a plan that suits their needs for managing the ST-12TEL Wisconsin Telefile Sales and Use Worksheet. The costs are competitive, considering the time and resources saved by using an electronic signature solution.

-

What features are included with airSlate SignNow for managing the ST-12TEL Wisconsin Telefile Sales and Use Worksheet?

AirSlate SignNow includes features such as customizable templates, document tracking, and team collaboration tools when handling the ST-12TEL Wisconsin Telefile Sales and Use Worksheet. These tools enhance productivity and ensure that all required actions are completed on time. This comprehensive suite makes it easier to manage tax documentation efficiently.

-

Can I integrate airSlate SignNow with other software for the ST-12TEL Wisconsin Telefile Sales and Use Worksheet?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing its usability for the ST-12TEL Wisconsin Telefile Sales and Use Worksheet. This allows users to connect their document workflows with existing tools, such as accounting and CRM software. Such integrations improve efficiency and data consistency during tax preparation.

-

What are the benefits of using airSlate SignNow for the ST-12TEL Wisconsin Telefile Sales and Use Worksheet?

Using airSlate SignNow for the ST-12TEL Wisconsin Telefile Sales and Use Worksheet offers numerous benefits, including an easy-to-use interface, rapid document turnaround, and enhanced compliance. It minimizes the risk of errors associated with traditional paper methods while ensuring the security of your sensitive information. Ultimately, this leads to a smoother filing experience.

-

How does airSlate SignNow ensure the security of the ST-12TEL Wisconsin Telefile Sales and Use Worksheet?

airSlate SignNow employs advanced security measures, including end-to-end encryption and secure cloud storage, to protect the ST-12TEL Wisconsin Telefile Sales and Use Worksheet. These features ensure that your documents remain confidential and accessible only to authorized users. Trusting airSlate SignNow means you can focus on your business while knowing your data is secure.

Get more for St 12tel

Find out other St 12tel

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement