ST-12 Wisconsin Sales and Use Tax Return 2020-2026

What is the ST-12 Wisconsin Sales and Use Tax Return

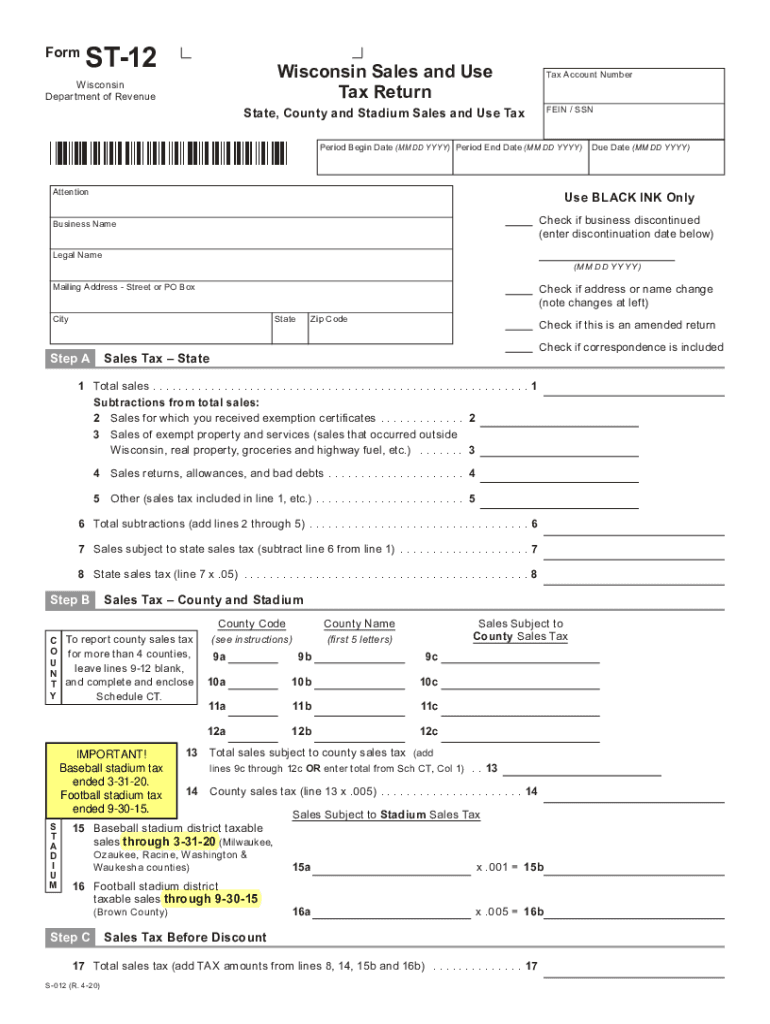

The ST-12 Wisconsin Sales and Use Tax Return is a crucial document for businesses operating in Wisconsin. It is used to report sales and use tax obligations to the Wisconsin Department of Revenue. This form is essential for ensuring compliance with state tax laws and helps businesses accurately calculate the taxes they owe based on their sales activities. The ST-12 form is particularly relevant for retailers and service providers who collect sales tax from customers and must remit it to the state.

Steps to complete the ST-12 Wisconsin Sales and Use Tax Return

Completing the ST-12 form involves several key steps to ensure accuracy and compliance:

- Gather necessary information: Collect sales records, tax-exempt certificates, and any other relevant documentation.

- Calculate total sales: Determine the total sales amount for the reporting period, including taxable and non-taxable sales.

- Determine tax liability: Apply the appropriate sales tax rate to the taxable sales to calculate the total tax owed.

- Complete the form: Fill out the ST-12 form with the calculated figures and any required details.

- Review for accuracy: Double-check all entries to ensure there are no errors before submission.

- Submit the form: File the completed ST-12 form with the Wisconsin Department of Revenue by the specified deadline.

Legal use of the ST-12 Wisconsin Sales and Use Tax Return

The ST-12 form is legally binding when completed accurately and submitted on time. It serves as an official record of a business's sales and use tax obligations. To ensure its legal validity, businesses must adhere to the guidelines set forth by the Wisconsin Department of Revenue, which include maintaining accurate sales records and properly calculating tax liabilities. Failure to comply with these regulations can result in penalties or legal repercussions.

Form Submission Methods

Businesses have several options for submitting the ST-12 Wisconsin Sales and Use Tax Return:

- Online: The preferred method is to file electronically through the Wisconsin Department of Revenue's online portal, which allows for quicker processing.

- Mail: Businesses can also print the completed form and mail it to the appropriate address provided by the Department of Revenue.

- In-Person: Some businesses may choose to submit their forms in person at designated Department of Revenue offices.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the ST-12 form is essential for compliance. Typically, the ST-12 form must be filed quarterly, with specific due dates set by the Wisconsin Department of Revenue. Businesses should be aware of these dates to avoid late fees and penalties. It is advisable to check the Department's official website for the most current deadlines and any changes to the filing schedule.

Required Documents

To successfully complete the ST-12 Wisconsin Sales and Use Tax Return, certain documents are necessary:

- Sales records: Detailed records of all sales transactions during the reporting period.

- Tax-exempt certificates: Any certificates for sales that are exempt from tax must be included.

- Previous tax returns: Reference to past returns may be helpful for ensuring consistency and accuracy in reporting.

Key elements of the ST-12 Wisconsin Sales and Use Tax Return

The ST-12 form includes several key elements that must be accurately completed:

- Business information: Name, address, and tax identification number of the business.

- Sales figures: Total sales, taxable sales, and any exempt sales reported separately.

- Tax calculations: Clearly outlined calculations for the total tax owed based on the reported sales.

- Signature: The form must be signed by an authorized representative of the business to validate the submission.

Quick guide on how to complete april 2020 s 012 st 12 wisconsin sales and use tax return state county and stadium sales and use tax st 12

Complete ST-12 Wisconsin Sales and Use Tax Return effortlessly on any device

Online document handling has become increasingly favored by companies and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage ST-12 Wisconsin Sales and Use Tax Return on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric operation today.

The easiest way to modify and electronically sign ST-12 Wisconsin Sales and Use Tax Return seamlessly

- Find ST-12 Wisconsin Sales and Use Tax Return and click Get Form to start.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign ST-12 Wisconsin Sales and Use Tax Return and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct april 2020 s 012 st 12 wisconsin sales and use tax return state county and stadium sales and use tax st 12

Create this form in 5 minutes!

How to create an eSignature for the april 2020 s 012 st 12 wisconsin sales and use tax return state county and stadium sales and use tax st 12

The best way to make an eSignature for your PDF document in the online mode

The best way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is st 12tel?

St 12tel refers to a reliable and cost-effective platform for sending and eSigning documents. It provides users with a seamless experience to streamline their document management process efficiently.

-

How does st 12tel improve document workflow?

St 12tel enhances document workflow by allowing users to quickly send, sign, and track documents in real-time. This leads to increased productivity and a signNow reduction in turnaround times for important business agreements.

-

What pricing options are available for st 12tel?

St 12tel offers flexible pricing plans designed to fit various business needs. Depending on the size of your organization and usage requirements, you can choose from multiple tiers that provide great value without compromising on features.

-

What features does st 12tel offer?

St 12tel includes robust features such as customizable templates, advanced eSigning capabilities, and document tracking. These features empower users to manage their documents more efficiently and effectively.

-

Can st 12tel integrate with other software?

Yes, st 12tel seamlessly integrates with a variety of business applications, including CRM and project management tools. This ensures that you can work within your existing ecosystem without disruption.

-

What are the benefits of using st 12tel for businesses?

Using st 12tel can signNowly reduce the time and resources spent on document management. Clients benefit from a straightforward interface, enhanced security features, and the ability to track their documents throughout the signing process.

-

Is st 12tel secure for sensitive documents?

Absolutely, st 12tel prioritizes security by encrypting your documents and ensuring compliance with industry-standard regulations. This provides peace of mind when handling sensitive information.

Get more for ST-12 Wisconsin Sales and Use Tax Return

- Legal last will and testament for married person with minor children from prior marriage vermont form

- Vt civil union form

- Legal last will and testament form for married person with adult children from prior marriage vermont

- Legal last will and testament form for divorced person not remarried with adult children vermont

- Vt civil union 497429143 form

- Legal last will and testament form for divorced person not remarried with no children vermont

- Legal last will and testament form for divorced person not remarried with minor children vermont

- Legal last will and testament form for divorced person not remarried with adult and minor children vermont

Find out other ST-12 Wisconsin Sales and Use Tax Return

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple