1040x Fillable Forms

What is the 1040x Fillable Form?

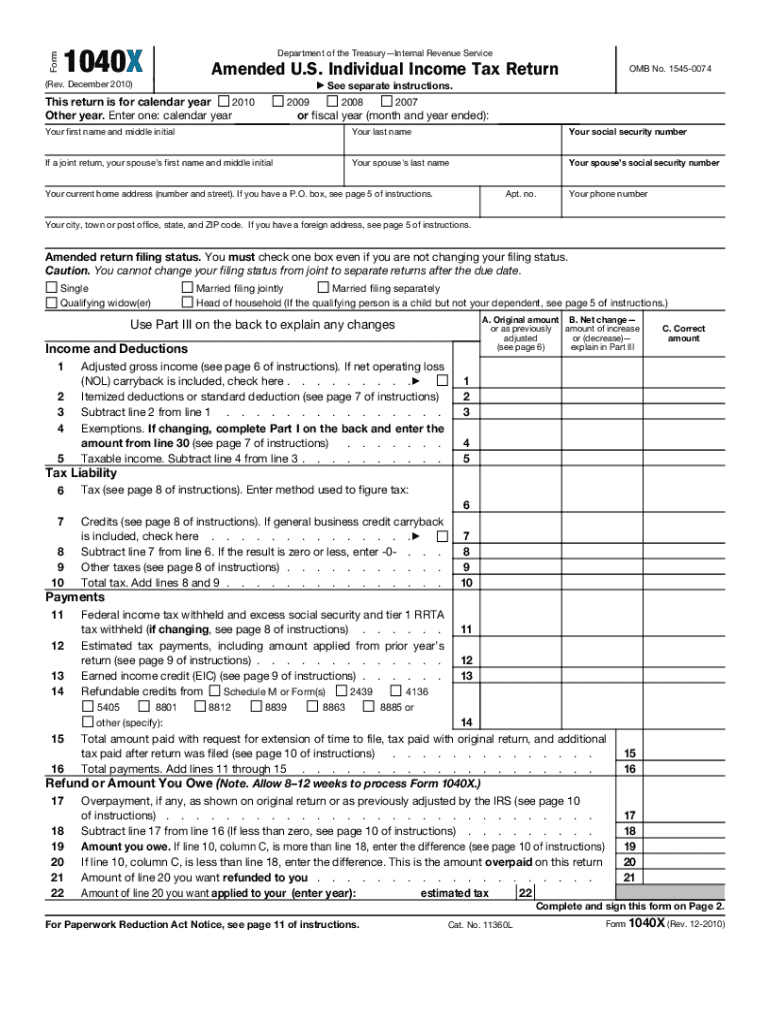

The 1040x fillable form is an amended tax return form used by U.S. taxpayers to correct errors or make changes to their previously filed Form 1040, 1040A, or 1040EZ. This form allows individuals to adjust their income, deductions, or credits, ensuring that their tax return accurately reflects their financial situation. It is essential for taxpayers who discover mistakes after filing their original return or need to claim additional deductions or credits.

How to Use the 1040x Fillable Form

To effectively use the 1040x fillable form, begin by downloading the form from the IRS website or using a reliable digital platform that offers fillable forms. Once you have the form, carefully enter the necessary information, including your personal details and the specific changes you wish to make. It is crucial to follow the instructions provided on the form and ensure that all adjustments are clearly documented. After completing the form, review it for accuracy before submission.

Steps to Complete the 1040x Fillable Form

Completing the 1040x fillable form involves several key steps:

- Download the form from a trusted source.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax year you are amending and provide the original amounts as well as the corrected amounts.

- Explain the reason for the amendment in the designated section.

- Sign and date the form to certify its accuracy.

After completing these steps, you can submit the form electronically or by mail, depending on your preference and the submission guidelines.

Legal Use of the 1040x Fillable Form

The 1040x fillable form is legally recognized for amending tax returns in the United States. To ensure its validity, it must be completed accurately and submitted within the designated time frames set by the IRS. When using this form, it is important to comply with all IRS regulations and guidelines, as failure to do so may result in penalties or delays in processing your amended return.

Filing Deadlines / Important Dates

When filing a 1040x fillable form, it is crucial to be aware of the deadlines. Generally, taxpayers have three years from the original filing deadline to submit an amended return. This means if you filed your 2020 taxes by April 15, 2021, you have until April 15, 2024, to file your 1040x. Additionally, if you are claiming a refund, it is advisable to file as soon as possible to avoid missing the deadline.

Form Submission Methods

The 1040x fillable form can be submitted through various methods. Taxpayers have the option to file electronically using approved e-filing software or submit a paper form by mail. If filing by mail, it is important to send the form to the correct address specified by the IRS for amended returns. Ensure that you retain a copy of the submitted form for your records.

Quick guide on how to complete 1040x fillable forms

Prepare 1040x Fillable Forms effortlessly on any device

Digital document management has gained signNow traction among companies and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed materials, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to craft, modify, and electronically sign your documents swiftly and without complications. Manage 1040x Fillable Forms on any device using airSlate SignNow Android or iOS applications and enhance any document-driven task today.

How to modify and electronically sign 1040x Fillable Forms with ease

- Locate 1040x Fillable Forms and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with the tools offered by airSlate SignNow specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes moments and holds the same legal significance as a traditional handwritten signature.

- Verify the details and click the Done button to save your changes.

- Choose your preferred method for submitting your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or mistakes that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign 1040x Fillable Forms while ensuring outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1040x fillable forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are 1040x fillable forms and why are they important?

1040x fillable forms are IRS tax forms used to amend previously filed tax returns. They allow taxpayers to correct errors or make changes to their original filing, ensuring compliance and potentially increasing refunds. Using these fillable forms simplifies the amendment process and helps avoid penalties.

-

How can airSlate SignNow help with 1040x fillable forms?

airSlate SignNow provides an intuitive platform to easily fill out and sign 1040x fillable forms. With our user-friendly interface, you can seamlessly prepare documents, gather signatures, and manage your tax amendments efficiently. Our solution ensures that you stay on track with your tax obligations.

-

Are 1040x fillable forms available for free on airSlate SignNow?

While airSlate SignNow offers a variety of features, access to 1040x fillable forms may come with a subscription based on your needs. Our pricing plans are designed to provide cost-effective solutions for businesses of all sizes. Check our website to explore the best plan for using 1040x fillable forms.

-

Can I customize 1040x fillable forms using airSlate SignNow?

Yes, airSlate SignNow allows you to customize 1040x fillable forms to suit your specific requirements. You can add fields, modify layouts, and integrate other necessary information into your forms. This flexibility ensures that your amendment process is tailored to your needs.

-

Do 1040x fillable forms integrate with other business tools?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and platforms, enhancing your workflow. Whether you need to sync with accounting software or document management systems, our integration capabilities make it easy to manage your 1040x fillable forms efficiently.

-

What security measures are in place for 1040x fillable forms?

At airSlate SignNow, security is our top priority, especially when handling sensitive documents like 1040x fillable forms. Our platform utilizes advanced encryption and secure authentication methods to ensure that your data remains protected. Trust us to safeguard your personal and financial information.

-

Can I track the progress of my 1040x fillable forms?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your 1040x fillable forms. You can receive real-time notifications when documents are opened, reviewed, or signed, keeping you informed throughout the amendment process. This feature enhances accountability and ensures timely completion.

Get more for 1040x Fillable Forms

- Con fid ent ia l hea lt h in fo rmat io n confidential health information

- Catamaran mail order forms

- Oberweis uniform

- Beta club information form students already in rcms beta

- Cenpatico psychological testing authorization request form

- The offer maker form amazon s3

- Summons for appointment of guardian of minor will county illinois form

- Vendor contract template form

Find out other 1040x Fillable Forms

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online