Crummey Letter Sample 2016-2026

What is the Crummey Letter Sample

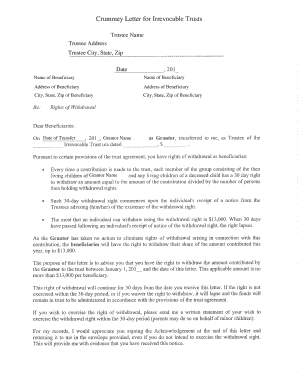

A Crummey letter sample is a legal document used to provide beneficiaries with the right to withdraw funds from a trust, thereby qualifying contributions to that trust for the annual gift tax exclusion. This letter is named after the 1968 court case Crummey v. Commissioner, which established that beneficiaries must have a meaningful opportunity to access the funds to ensure that the contributions are not subject to gift tax. The Crummey letter outlines the amount of the gift, the time frame in which beneficiaries can withdraw the funds, and the conditions under which the withdrawal can occur.

Key Elements of the Crummey Letter Sample

When drafting a Crummey letter, it is essential to include specific elements to ensure its effectiveness and compliance with tax regulations. Key elements include:

- Identification of the Trust: Clearly state the name of the trust and the date it was established.

- Beneficiary Information: Include the names of the beneficiaries who are entitled to withdraw funds.

- Gift Amount: Specify the amount of the gift being made to the trust for that year.

- Withdrawal Period: Define the time frame during which beneficiaries can exercise their right to withdraw funds.

- Instructions for Withdrawal: Provide clear instructions on how beneficiaries can withdraw their funds, including any necessary steps they must take.

Steps to Complete the Crummey Letter Sample

Completing a Crummey letter sample involves several steps to ensure that it meets legal requirements and effectively communicates the necessary information to beneficiaries. The steps include:

- Gather Trust Information: Collect all relevant details about the trust, including its name, date of creation, and the trustee's information.

- Determine Gift Amount: Decide on the annual gift amount that will be contributed to the trust.

- Draft the Letter: Use the key elements to draft the letter, ensuring clarity and compliance with IRS guidelines.

- Distribute the Letter: Send the completed letter to all beneficiaries, ensuring they understand their rights regarding the withdrawal.

- Maintain Records: Keep copies of the letter and any correspondence related to the withdrawals for tax records.

Legal Use of the Crummey Letter Sample

The legal use of a Crummey letter sample is crucial for ensuring that contributions to a trust qualify for the annual gift tax exclusion under IRS regulations. By providing beneficiaries with the right to withdraw funds, the letter helps establish that the gift is complete and not subject to gift tax. It is important to ensure that the letter is properly executed and delivered to beneficiaries, as failure to do so may result in the IRS disallowing the gift tax exclusion.

Examples of Using the Crummey Letter Sample

Crummey letters can be used in various scenarios involving trusts. For instance:

- A parent establishes a trust for their children and wishes to contribute a gift each year while maintaining the tax benefits.

- A grandparent sets up a trust for grandchildren, using a Crummey letter to allow them to withdraw a portion of the funds annually.

- A family trust is created to manage assets, and Crummey letters are issued to ensure compliance with tax regulations while providing beneficiaries access to funds.

IRS Guidelines for Crummey Letters

The IRS has specific guidelines regarding the use of Crummey letters to ensure that contributions to a trust qualify for the annual gift tax exclusion. These guidelines include:

- Beneficiaries must be given a reasonable period to withdraw the gifted amount, typically at least 30 days.

- The letter must clearly communicate the amount of the gift and the withdrawal rights of the beneficiaries.

- Documentation must be maintained to demonstrate compliance with IRS requirements, including copies of the Crummey letters sent to beneficiaries.

Quick guide on how to complete crummey letter sample 403148305

Effortlessly Prepare Crummey Letter Sample on Any Device

Online document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed forms, as you can easily locate the necessary document and save it securely online. airSlate SignNow equips you with all the resources required to swiftly create, modify, and electronically sign your documents without any delays. Handle Crummey Letter Sample on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

How to Alter and Electronically Sign Crummey Letter Sample with Ease

- Locate Crummey Letter Sample and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of the files or obscure sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose how you wish to send your document, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Crummey Letter Sample to ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the crummey letter sample 403148305

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Crummey letter sample?

A Crummey letter sample is a document that notifies beneficiaries about their right to withdraw contributions made to a trust within a specific time frame. This type of letter is essential for creating Crummey trusts that allow annual exclusions from gift taxes. Understanding a Crummey letter sample can help ensure compliance with IRS regulations.

-

How can airSlate SignNow help with creating a Crummey letter sample?

AirSlate SignNow provides users with customizable templates that can be easily modified to align with specific needs, including a Crummey letter sample. Our intuitive interface allows you to draft and eSign documents swiftly, ensuring your trust documents are legally compliant and securely stored. Start using airSlate SignNow to streamline your document management.

-

Is there a cost associated with using airSlate SignNow for a Crummey letter sample?

Yes, airSlate SignNow offers various pricing plans that cater to different business sizes and needs. Each plan provides access to our eSignature services, including the ability to create and send a Crummey letter sample. You can check our website for detailed pricing information and choose the plan that fits your requirements best.

-

What features does airSlate SignNow offer for eSigning a Crummey letter sample?

AirSlate SignNow offers features like customizable templates, in-person signing, and mobile access for eSigning documents like a Crummey letter sample. Additionally, it provides real-time tracking and notifications, ensuring you stay updated on the signing progress. These features enhance efficiency and security for all your document transactions.

-

Can I save a Crummey letter sample in airSlate SignNow?

Absolutely! With airSlate SignNow, you can create, eSign, and securely store your Crummey letter sample in the cloud. Our platform offers easy access and document management, allowing you to retrieve your important documents whenever needed. This convenience ensures your trust-related documents are always available.

-

Does airSlate SignNow integrate with other applications for managing a Crummey letter sample?

Yes, airSlate SignNow offers integrations with numerous popular applications, enhancing your ability to manage a Crummey letter sample seamlessly. You can connect with tools like Google Drive, Dropbox, and CRM systems for streamlined document storage and sharing. These integrations simplify your workflow and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for a Crummey letter sample?

Using airSlate SignNow for your Crummey letter sample simplifies the document management process, making it faster and more secure. Our platform ensures compliance with legal standards while offering an intuitive user experience. Additionally, the cost-effective nature of our solution helps businesses save time and resources on administrative tasks.

Get more for Crummey Letter Sample

- Union bank of india deposit slip in excel format

- Pa 33 nh department of revenue administration revenue nh form

- Coaguchek order form

- Ca 24 04 annual inspection notification for non certified aircraft 230910 caa co form

- Inventory of radioactive sealed sources amp devices form

- Dllr unpaid wages form

- Slides pdf university of washington cs washington form

- Understanding credit worthiness of customers form

Find out other Crummey Letter Sample

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT