Tax New York 2023

What is the Tax New York

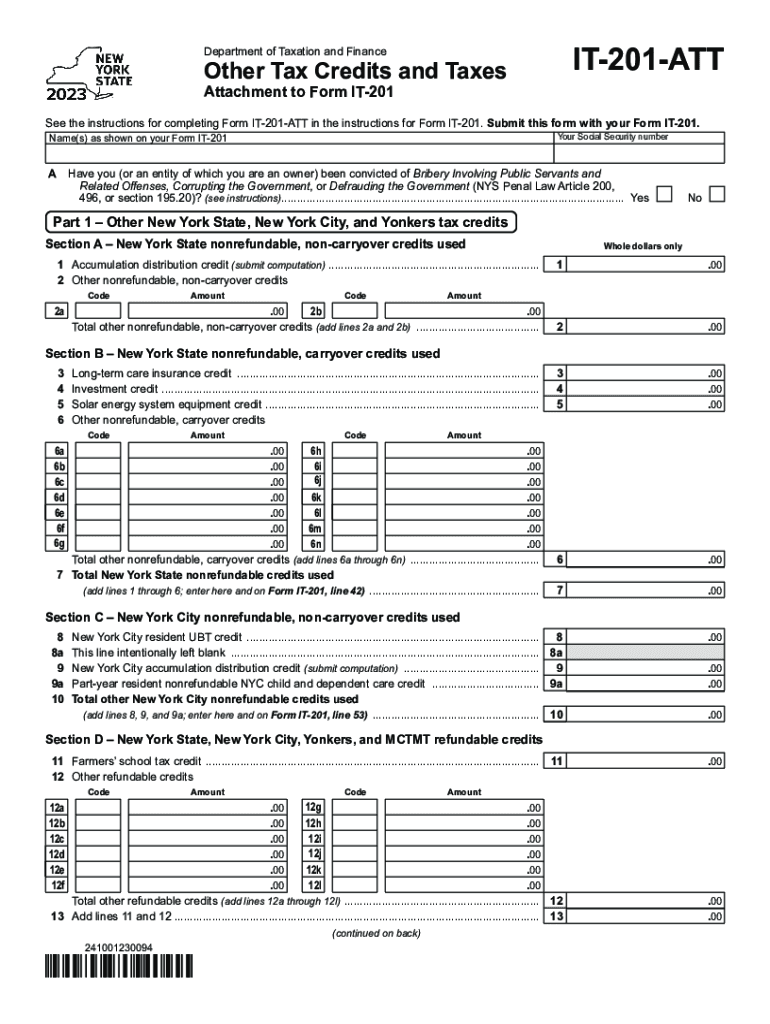

The Tax New York, specifically the IT-201-ATT form, is an essential document for taxpayers in New York State. It serves as an attachment to the IT-201 form, allowing individuals to claim various credits and adjustments to their taxable income. This form is particularly relevant for residents who need to report additional information regarding their tax situation, such as credits for household credit, child and dependent care expenses, and other specific deductions that can lower their overall tax liability.

Steps to complete the Tax New York

Completing the IT-201-ATT form involves several key steps:

- Gather all necessary documents, including income statements, previous tax returns, and any relevant receipts for deductions or credits.

- Begin by filling out your personal information, ensuring that your name, address, and Social Security number are accurate.

- Follow the instructions on the form to report your income and any adjustments. Be sure to include all applicable credits, such as the Empire State child credit.

- Double-check your calculations to ensure accuracy, as errors can lead to delays or penalties.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

For the Tax New York, the filing deadline typically aligns with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to stay informed about any changes to deadlines, especially in light of potential extensions or changes in tax law.

Required Documents

To accurately complete the IT-201-ATT form, you will need to gather several documents:

- W-2 forms from employers, which report your annual income.

- 1099 forms for any additional income sources, such as freelance work or interest income.

- Documentation for any credits or deductions you plan to claim, including receipts for childcare expenses or proof of education credits.

- Previous year’s tax return for reference and to ensure consistency in reporting.

Who Issues the Form

The IT-201-ATT form is issued by the New York State Department of Taxation and Finance. This agency is responsible for managing tax collection and ensuring compliance with state tax laws. They provide resources and guidance on how to properly complete and submit the form, as well as information on any updates or changes to tax regulations.

Penalties for Non-Compliance

Failing to file the IT-201-ATT form or submitting it inaccurately can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action in severe cases. It is important to file on time and ensure that all information is correct to avoid these consequences. Taxpayers should also be aware that the state may audit returns, leading to further scrutiny of submitted forms.

Quick guide on how to complete tax new york

Complete Tax New York effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can access the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents swiftly without delays. Manage Tax New York on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to change and eSign Tax New York with ease

- Find Tax New York and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which requires seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and hit the Done button to secure your changes.

- Select your preferred method of sending your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or errors that necessitate printing additional copies. airSlate SignNow meets all your document management needs in just a few clicks from your device of choice. Modify and eSign Tax New York and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax new york

Create this form in 5 minutes!

How to create an eSignature for the tax new york

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the cost of using airSlate SignNow for the 2021 it 201 att?

The pricing for airSlate SignNow for 2021 it 201 att is structured to be cost-effective for businesses of all sizes. We offer various plans, suitable for teams looking to streamline their document processes. Detailed pricing information can be found on our website, ensuring you can choose the plan that meets your needs.

-

What features are included in the airSlate SignNow platform for users in 2021 it 201 att?

In 2021 it 201 att, airSlate SignNow includes a range of features designed to enhance document management. Users can enjoy electronic signatures, customizable templates, and real-time tracking of documents. These features are aimed at simplifying the entire signing process and improving overall efficiency.

-

How does airSlate SignNow benefit businesses utilizing the 2021 it 201 att?

For businesses focusing on the 2021 it 201 att, airSlate SignNow delivers signNow benefits by reducing turnaround time for documents. The platform enhances workflow efficiency by allowing secure and fast electronic signatures. This boosts productivity and improves customer satisfaction through quick document processing.

-

Can I integrate airSlate SignNow with other software for managing 2021 it 201 att?

Yes, airSlate SignNow can be seamlessly integrated with various software applications to manage your 2021 it 201 att effectively. Our platform supports integrations with CRMs, cloud storage services, and productivity tools. This flexibility allows businesses to create a streamlined document workflows tailored to their needs.

-

Is airSlate SignNow secure for managing documents related to 2021 it 201 att?

Absolutely. airSlate SignNow prioritizes security, making it an ideal choice for managing sensitive documents in the 2021 it 201 att category. The platform complies with industry-standard security protocols, ensuring that your data is protected through encryption and secure access controls.

-

What is the user experience like on airSlate SignNow for 2021 it 201 att users?

Users of airSlate SignNow in the 2021 it 201 att market find the platform remarkably user-friendly. Its intuitive interface allows for quick navigation through document processes, making the eSigning experience smooth and efficient. Businesses can easily train their staff to utilize the platform with minimal disruption.

-

Can I perform bulk sending of documents using airSlate SignNow for 2021 it 201 att?

Yes, airSlate SignNow allows users to send documents in bulk, which is particularly useful for managing multiple contracts or agreements under the 2021 it 201 att. This feature saves time and minimizes errors that can occur during manual sending. You can efficiently manage high volumes of documents in one go.

Get more for Tax New York

- Abandoned personal property form

- Maryland dom rel 55 affidavit of service private process form

- Maryland lease renewal form

- Maine letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration form

- Minnesota letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by form

- Cosigner agreement form 481373400

- Missouri residential or rental lease extension agreement form

- Mo notice form

Find out other Tax New York

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF