Va760cg Form

What is the va760cg?

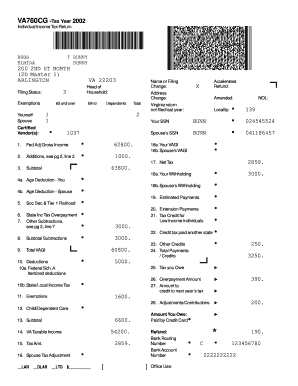

The va760cg, also known as the Virginia 760CG form, is a state tax return document used by residents of Virginia to report their income and calculate their state tax obligations. This form is specifically designed for individuals who are claiming certain deductions and credits that may apply to their situation. It is essential for ensuring compliance with Virginia state tax regulations and for accurately determining the amount of tax owed or refund due.

How to use the va760cg

Using the va760cg involves several steps to ensure accurate completion. First, gather all necessary financial documents, including W-2 forms, 1099 forms, and any records of deductions you plan to claim. Next, fill out the form by entering your personal information, income details, and any applicable deductions. Once completed, review the form for accuracy before submitting it to the Virginia Department of Taxation. It is important to keep a copy of the submitted form for your records.

Steps to complete the va760cg

Completing the va760cg requires careful attention to detail. Follow these steps:

- Gather all relevant tax documents, such as W-2s and 1099s.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources on the form.

- Claim any deductions or credits you are eligible for, ensuring you have the proper documentation.

- Calculate your total tax owed or refund due.

- Review the completed form for any errors or omissions.

- Submit the form either electronically or by mail, as per your preference.

Key elements of the va760cg

Several key elements are vital to the va760cg form. These include:

- Personal Information: Accurate details about the taxpayer, including name, address, and Social Security number.

- Income Reporting: A comprehensive summary of all income sources, including wages, interest, and dividends.

- Deductions and Credits: Sections dedicated to claiming various deductions and tax credits available to Virginia residents.

- Tax Calculation: A clear method for calculating the total tax liability or refund.

Legal use of the va760cg

The legal use of the va760cg is governed by Virginia state tax laws. When completed accurately and submitted on time, this form serves as a legally binding document that fulfills your tax obligations. It is essential to ensure that all information provided is truthful and substantiated by appropriate documentation to avoid penalties or legal issues. Compliance with state tax regulations is crucial for maintaining good standing with the Virginia Department of Taxation.

Filing Deadlines / Important Dates

Filing deadlines for the va760cg are critical to ensure timely submission and avoid penalties. Typically, the deadline for filing the Virginia state tax return is May 1st of the year following the tax year. If May 1st falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to deadlines each tax year to ensure compliance.

Quick guide on how to complete va760cg

Prepare Va760cg effortlessly on any device

Online document management has gained traction with businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Va760cg on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The most efficient way to modify and eSign Va760cg with ease

- Locate Va760cg and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant parts of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Va760cg while ensuring excellent communication at every step of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the va760cg

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is va760cg and how does it work with airSlate SignNow?

The va760cg is a feature within airSlate SignNow that allows users to streamline their document signing process. By leveraging va760cg, businesses can efficiently send, track, and manage eSignatures all in one platform, enhancing productivity and reducing turnaround time.

-

How much does airSlate SignNow cost for using the va760cg feature?

Pricing for airSlate SignNow varies depending on the plan you choose, but utilizing the va760cg feature is included in all plans. This ensures that businesses of all sizes can access sophisticated eSigning capabilities without breaking the bank.

-

What are the key features of va760cg in airSlate SignNow?

The key features of va760cg in airSlate SignNow include customizable templates, real-time tracking, and secure cloud storage. These features enable users to manage their documents easily, ensuring a smooth signing process that is both efficient and secure.

-

Can I integrate va760cg with other applications?

Yes, va760cg within airSlate SignNow offers seamless integrations with numerous applications such as Google Drive, Salesforce, and more. This ability to integrate allows businesses to create a unified workflow, making document management quicker and more efficient.

-

Is va760cg suitable for small businesses?

Absolutely! The va760cg feature in airSlate SignNow is designed with small businesses in mind, offering a cost-effective solution that simplifies document signing. It helps small business owners save time and focus on what truly matters: growing their business.

-

What benefits does using the va760cg feature provide?

Utilizing the va760cg feature in airSlate SignNow offers numerous benefits, including increased efficiency and enhanced security for document handling. Users can expect faster turnaround times for signatures, which accelerates business processes and improves overall productivity.

-

How does the security of va760cg ensure safe document signing?

The va760cg feature in airSlate SignNow ensures high-level security by implementing encryption and secure access controls. This means that your sensitive documents are protected during the signing process, giving users peace of mind while managing important contracts and agreements.

Get more for Va760cg

Find out other Va760cg

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document