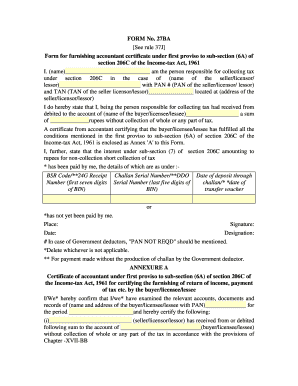

Form 27ba Word Format

What is the Form 27ba Word Format

The Form 27ba is a specific document used primarily for income tax purposes in the United States. It serves as a means for taxpayers to report certain types of income or deductions. The word format of this form allows users to fill it out digitally, making it easier to manage and submit. The electronic version maintains the same legal validity as its paper counterpart, provided it meets the necessary requirements for eSignatures and compliance with relevant regulations.

How to use the Form 27ba Word Format

Using the Form 27ba in word format involves several straightforward steps. First, download the form from a reliable source. Once downloaded, open the document in a compatible word processing application. Fill in the required fields with accurate information, ensuring that all entries comply with IRS guidelines. After completing the form, save it securely. If you need to submit it electronically, use a trusted eSignature solution to sign the document, ensuring it is legally binding.

Steps to complete the Form 27ba Word Format

Completing the Form 27ba involves a series of organized steps:

- Download the form in word format from a trusted source.

- Open the document using a word processor that supports the format.

- Carefully read the instructions provided on the form.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details regarding your income or deductions as required.

- Review the completed form for accuracy and completeness.

- Save the document securely and prepare for submission.

Legal use of the Form 27ba Word Format

The legal use of the Form 27ba in word format is contingent upon meeting specific criteria. For an electronic version to be considered legally binding, it must comply with the ESIGN and UETA acts, which govern electronic signatures in the United States. Utilizing a reliable eSignature platform ensures that the form is executed correctly, providing a digital certificate that verifies the signature and the time of signing. This compliance helps protect both the signer and the recipient in case of disputes.

Filing Deadlines / Important Dates

Filing deadlines for the Form 27ba can vary depending on individual circumstances. Generally, taxpayers should submit their forms by the annual tax deadline, which is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes to tax filing dates and to ensure that all forms are submitted on time to avoid penalties.

Examples of using the Form 27ba Word Format

The Form 27ba can be utilized in various scenarios. For instance, self-employed individuals may use it to report income from freelance work. Similarly, small business owners might employ the form to detail business expenses and deductions. Each example illustrates the form's versatility in accommodating different taxpayer situations while ensuring compliance with IRS regulations.

Quick guide on how to complete form 27ba word format

Effortlessly Prepare Form 27ba Word Format on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the proper form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents swiftly and without holdups. Manage Form 27ba Word Format across any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Edit and eSign Form 27ba Word Format with Ease

- Locate Form 27ba Word Format and select Get Form to begin.

- Utilize the resources we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically offered by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information thoroughly and click the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or by downloading it to your computer.

No more worries about lost or misplaced documents, tedious form searches, or mistakes that require printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 27ba Word Format to ensure excellent communication throughout all stages of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 27ba word format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 27ba and how does it work with airSlate SignNow?

Form 27ba is a specific document used for various governmental and administrative processes. With airSlate SignNow, users can easily fill out, sign, and send the form 27ba electronically, streamlining documentation workflows and enhancing efficiency.

-

Is there a cost associated with using airSlate SignNow for form 27ba?

Yes, airSlate SignNow offers different pricing plans suitable for various business needs. Each plan provides access to essential features for managing form 27ba and other documents at a competitive price, ensuring a cost-effective solution.

-

What features does airSlate SignNow offer for managing form 27ba?

airSlate SignNow includes features such as electronic signatures, document templates, and real-time tracking. These features allow users to manage form 27ba efficiently, ensuring a smooth and quick signing process.

-

Can I integrate airSlate SignNow with other applications for form 27ba management?

Absolutely! airSlate SignNow supports integrations with a variety of third-party applications. This capability allows users to automate workflows involving form 27ba and enhance overall productivity.

-

How secure is my data when using airSlate SignNow for form 27ba?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption protocols to protect your data, including form 27ba, ensuring that your documents remain confidential and secure during transmission and storage.

-

What are the benefits of using airSlate SignNow for form 27ba?

Using airSlate SignNow for form 27ba brings numerous benefits such as faster processing times, reduced paperwork, and improved collaboration among team members. This allows businesses to focus on core operations while maintaining compliance.

-

How do I get started with airSlate SignNow for form 27ba?

Getting started is easy! Simply sign up for an airSlate SignNow account, choose a suitable plan, and begin creating or uploading your form 27ba. The user-friendly interface guides you through the eSigning process step by step.

Get more for Form 27ba Word Format

- Form g see rule 10 form of consent for invasive techniques i wifedaughter of

- Of form 612 usaid

- Getting paid reinforcement worksheet answers form

- Netherlands visa information thailand home vfs global

- I 360 form

- Outpatient physical therapy prescription form

- Lifter 1 mail in rebate oampamp39reilly auto parts form

- Verdict form

Find out other Form 27ba Word Format

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form