MO CFC 2023

What is the MO CFC

The MO CFC, or Missouri Corporate Franchise Tax, is a tax imposed on corporations operating within the state of Missouri. This tax applies to both domestic and foreign corporations that conduct business in Missouri. The MO CFC is calculated based on the corporation's net income, and it is designed to generate revenue for state services and infrastructure. Understanding the MO CFC is essential for businesses to ensure compliance with state tax obligations and to avoid potential penalties.

How to use the MO CFC

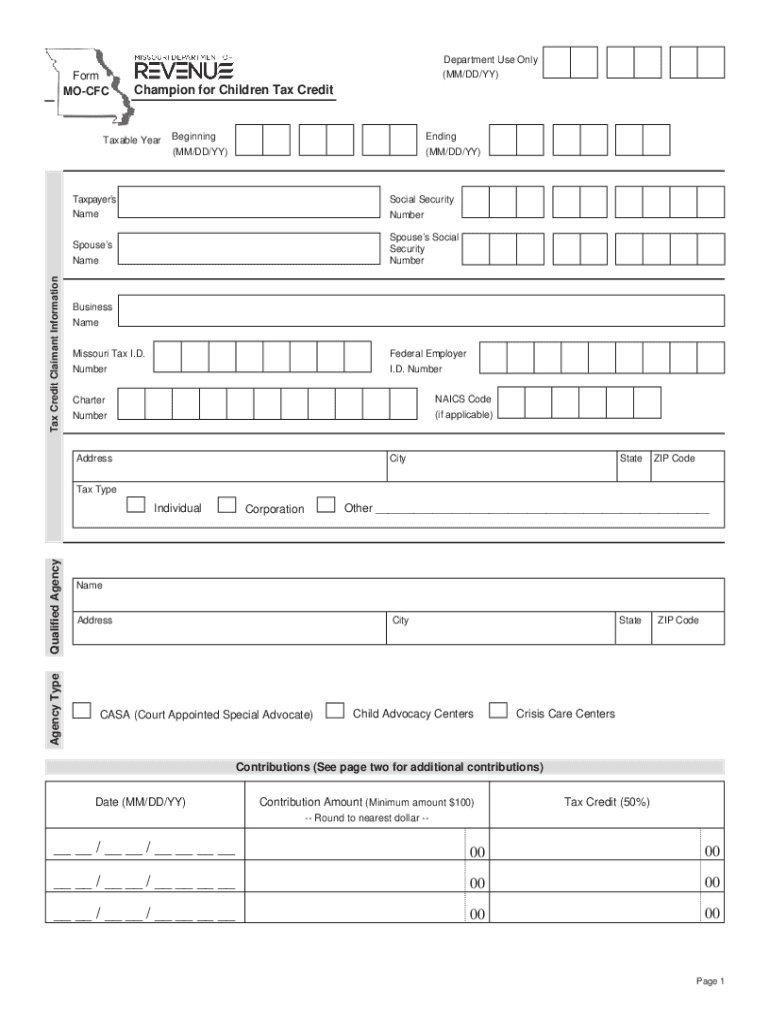

Using the MO CFC involves understanding your corporation's tax obligations and accurately completing the necessary forms. Corporations must first determine their eligibility for the tax and calculate their net income based on state guidelines. Once the calculations are complete, businesses can fill out the MO CFC form, ensuring all required information is included. After completing the form, corporations must submit it to the Missouri Department of Revenue by the designated filing deadline.

Steps to complete the MO CFC

To complete the MO CFC, follow these steps:

- Gather financial records, including income statements and balance sheets.

- Calculate your corporation's net income according to Missouri tax regulations.

- Obtain the latest version of the MO CFC form from the Missouri Department of Revenue.

- Fill out the form, ensuring all sections are accurately completed.

- Review the form for any errors or omissions.

- Submit the completed form by mail or electronically, as per the instructions provided.

Legal use of the MO CFC

The legal use of the MO CFC is governed by Missouri state tax laws. Corporations must comply with these regulations to avoid penalties. Filing the MO CFC is mandatory for all qualifying corporations, and failure to do so may result in fines or other legal repercussions. It is important for businesses to stay informed about any changes in tax law that may affect their obligations regarding the MO CFC.

Filing Deadlines / Important Dates

Filing deadlines for the MO CFC are typically aligned with the corporate tax year. Corporations must file their MO CFC by the 15th day of the fourth month following the end of their fiscal year. For those operating on a calendar year, the deadline is April 15. It is crucial for businesses to mark these dates on their calendars to ensure timely submission and avoid late fees.

Required Documents

When completing the MO CFC, corporations need to gather several key documents, including:

- Financial statements, such as income statements and balance sheets.

- Records of any deductions or credits claimed.

- Prior year tax returns, if applicable.

- Any additional documentation required by the Missouri Department of Revenue.

Penalties for Non-Compliance

Failure to comply with MO CFC filing requirements can result in various penalties. These may include late fees, interest on unpaid taxes, and potential legal action. Corporations that do not file the MO CFC on time or provide inaccurate information may face increased scrutiny from the Missouri Department of Revenue. It is essential for businesses to prioritize compliance to avoid these repercussions.

Quick guide on how to complete mo cfc

Effortlessly Prepare MO CFC on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as a great eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly without any holdups. Manage MO CFC on any device using the airSlate SignNow apps for Android or iOS and streamline your document-related processes today.

Steps to Edit and Electronically Sign MO CFC with Ease

- Obtain MO CFC and then select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive details using the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to finalize your changes.

- Select how you would like to send your form, whether by email, text message (SMS), or an invitation link, or download it to your PC.

Say goodbye to lost or misplaced files, the hassle of searching for forms, or mistakes that necessitate reprinting documents. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign MO CFC while ensuring outstanding communication throughout the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mo cfc

Create this form in 5 minutes!

How to create an eSignature for the mo cfc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is MO CFC and how does it relate to airSlate SignNow?

MO CFC stands for Missouri Corporate Franchise Certificate. airSlate SignNow provides a seamless way to eSign and manage documents related to MO CFC, ensuring compliance and efficiency in your business operations.

-

How much does airSlate SignNow cost for MO CFC document management?

airSlate SignNow offers competitive pricing plans tailored for businesses handling MO CFC documents. Our plans are designed to be cost-effective, providing you with the tools you need without breaking the bank.

-

What features does airSlate SignNow offer for MO CFC processing?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for MO CFC. These features streamline the process, making it easier to manage your corporate documents efficiently.

-

Can I integrate airSlate SignNow with other tools for MO CFC management?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your MO CFC management. Whether you use CRM systems or cloud storage solutions, our integrations help you maintain a smooth workflow.

-

What are the benefits of using airSlate SignNow for MO CFC documents?

Using airSlate SignNow for MO CFC documents offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. Our platform ensures that your documents are handled with care and compliance.

-

Is airSlate SignNow secure for handling MO CFC documents?

Absolutely! airSlate SignNow employs advanced security measures to protect your MO CFC documents. With encryption and secure access controls, you can trust that your sensitive information is safe.

-

How can airSlate SignNow help with compliance for MO CFC?

airSlate SignNow helps ensure compliance with MO CFC regulations by providing legally binding eSignatures and audit trails. This transparency is crucial for businesses looking to maintain compliance in their documentation processes.

Get more for MO CFC

Find out other MO CFC

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy