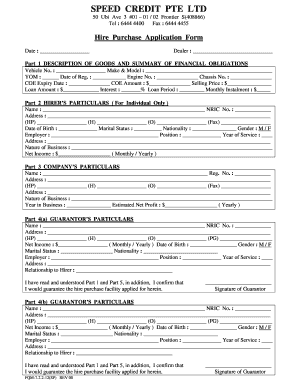

Speed Credit Pte Ltd Form

What is the Coe Renewal Loan

The Coe Renewal Loan is a financial product designed to assist individuals in renewing their Certificate of Eligibility (COE) for various benefits. This loan is particularly relevant for veterans and active-duty service members seeking to maintain their eligibility for VA loans and other related services. By obtaining a Coe Renewal Loan, applicants can ensure that they remain compliant with the necessary requirements to access these benefits.

Eligibility Criteria

To qualify for a Coe Renewal Loan, applicants must meet specific eligibility criteria. Generally, these criteria include:

- Active-duty service members or veterans of the U.S. Armed Forces.

- Proof of service, such as a DD Form 214 or other military documentation.

- Meeting the minimum credit score requirements set by the lending institution.

- Demonstrating the ability to repay the loan through income verification.

It is essential for applicants to review these criteria carefully to ensure they meet all necessary qualifications before applying.

Steps to Complete the Coe Renewal Loan

Completing the Coe Renewal Loan application involves several key steps:

- Gather necessary documentation, including proof of service and financial information.

- Complete the loan application form accurately, ensuring all information is current.

- Submit the application along with the required documents to the lender.

- Await approval and respond to any additional requests for information from the lender.

- Once approved, review the loan terms carefully before signing the agreement.

Following these steps can help streamline the application process and increase the likelihood of a successful loan approval.

Required Documents

Applicants must provide specific documents when applying for a Coe Renewal Loan. These typically include:

- Proof of military service (e.g., DD Form 214).

- Identification documents, such as a driver's license or state ID.

- Financial documents, including recent pay stubs, tax returns, and bank statements.

- Any existing loan agreements or documentation relevant to the current COE.

Having these documents prepared in advance can expedite the application process and help ensure that all requirements are met.

Legal Use of the Coe Renewal Loan

The Coe Renewal Loan must be used in accordance with legal guidelines established by the Department of Veterans Affairs and other regulatory bodies. This includes ensuring that the funds are utilized for their intended purpose, such as maintaining eligibility for VA benefits. Misuse of the loan can lead to penalties, including the loss of benefits or legal repercussions.

Form Submission Methods

Applicants can submit their Coe Renewal Loan application through various methods, including:

- Online submission via the lender's secure portal.

- Mailing a physical copy of the application to the lender's address.

- In-person submission at designated lending offices.

Each submission method has its advantages, and applicants should choose the one that best fits their needs and circumstances.

Quick guide on how to complete speed credit pte ltd

Complete Speed Credit Pte Ltd seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, edit, and eSign your documents quickly without delays. Manage Speed Credit Pte Ltd on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Speed Credit Pte Ltd with ease

- Find Speed Credit Pte Ltd and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate concerns about missing or lost files, tedious form searching, and mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Speed Credit Pte Ltd and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the speed credit pte ltd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a COE renewal loan?

A COE renewal loan refers to a process where individuals can renew their Certificate of Eligibility for VA loans, making it easier to access financing options. Utilizing this renewal can be beneficial for veterans looking to secure favorable loan terms for their homes or properties.

-

How does airSlate SignNow assist with COE renewal loans?

airSlate SignNow streamlines the document signing process for COE renewal loans, allowing users to easily send, eSign, and manage necessary documents online. This not only saves time but ensures that all paperwork is completed efficiently and securely.

-

What are the pricing options for using airSlate SignNow for COE renewal loans?

airSlate SignNow offers flexible pricing plans suitable for businesses and individuals looking to manage COE renewal loans. Our plans are designed to be cost-effective while providing robust features for document management and eSignatures.

-

Can airSlate SignNow integrate with other financial software for COE renewal loans?

Yes, airSlate SignNow can seamlessly integrate with various financial software solutions, enhancing the management of COE renewal loans. This integration helps ensure that users have access to all necessary tools for a smooth application and renewal process.

-

What are the key benefits of using airSlate SignNow for COE renewal loans?

Using airSlate SignNow for COE renewal loans offers multiple benefits, including increased efficiency, enhanced security, and improved collaboration. Users can quickly complete transactions, which is vital for keeping the loan process on track.

-

Is airSlate SignNow compliant with regulations for COE renewal loans?

Absolutely, airSlate SignNow complies with all necessary regulations and industry standards for COE renewal loans. Our platform ensures that all transactions are secure and meet legal requirements, giving users peace of mind.

-

How can I get started with airSlate SignNow for my COE renewal loan?

Getting started with airSlate SignNow for your COE renewal loan is simple. You can sign up for an account online, choose the pricing plan that fits your needs, and begin sending documents for eSignature immediately.

Get more for Speed Credit Pte Ltd

- Maryland notice lien 497310125 form

- Quitclaim deed from individual to husband and wife maryland form

- Warranty deed from individual to husband and wife maryland form

- Maryland sale form

- Quitclaim deed from corporation to husband and wife maryland form

- Warranty deed from corporation to husband and wife maryland form

- Quitclaim deed from corporation to individual maryland form

- Md corporation 497310132 form

Find out other Speed Credit Pte Ltd

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application