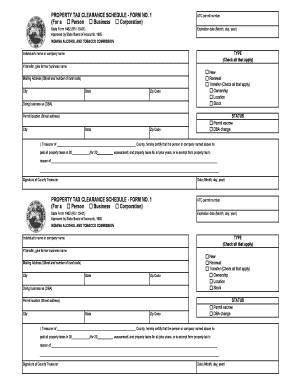

Indiana State Form 1462 2001-2026

What is the IRS Notice 1462?

The IRS Notice 1462 is a communication issued by the Internal Revenue Service to inform taxpayers about the status of their tax return or refund. This notice typically indicates that the IRS has identified an issue that requires the taxpayer's attention. Understanding the meaning of this notice is crucial for ensuring compliance with tax obligations and addressing any potential discrepancies in a timely manner.

How to Use the IRS Notice 1462

Using the IRS Notice 1462 involves carefully reviewing the information provided within the notice. Taxpayers should follow these steps:

- Read the notice thoroughly to understand the specific issue raised by the IRS.

- Gather any necessary documentation that may be required to resolve the issue.

- Respond to the notice within the timeframe specified to avoid further penalties.

- If needed, consult a tax professional for assistance in addressing the matter.

Steps to Complete the IRS Notice 1462

Completing the IRS Notice 1462 involves several key steps:

- Identify the specific issue mentioned in the notice.

- Collect relevant documents, such as tax returns or supporting evidence.

- Fill out any required forms or provide additional information as requested.

- Submit your response to the IRS using the method outlined in the notice.

Legal Use of the IRS Notice 1462

The IRS Notice 1462 serves a legal purpose by formally notifying taxpayers of issues related to their tax filings. It is essential for taxpayers to respond appropriately to maintain compliance with federal tax laws. Failure to address the notice can result in penalties, interest, or further action by the IRS.

Filing Deadlines / Important Dates

When dealing with the IRS Notice 1462, it is important to pay attention to any deadlines specified in the notice. Generally, taxpayers are given a specific timeframe to respond, which may vary depending on the nature of the issue. Missing these deadlines can lead to complications, including delayed refunds or additional penalties.

Required Documents

To effectively respond to the IRS Notice 1462, taxpayers may need to provide various documents, such as:

- Copies of previously filed tax returns.

- W-2 forms or 1099 statements.

- Any correspondence received from the IRS.

- Additional documentation that supports your claims or clarifies the issue.

Who Issues the IRS Notice 1462

The IRS Notice 1462 is issued by the Internal Revenue Service, which is the federal agency responsible for tax administration in the United States. The notice is part of the IRS's efforts to communicate with taxpayers regarding their tax obligations and ensure compliance with tax laws.

Quick guide on how to complete indiana state form 1462

Effortlessly Prepare Indiana State Form 1462 on Any Gadget

The management of documents online has surged in popularity among businesses and individuals alike. It offers a fantastic eco-friendly substitute for conventional printed and signed papers, as you can locate the right template and securely save it on the web. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without any holdups. Manage Indiana State Form 1462 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to modify and electronically sign Indiana State Form 1462 without hassle

- Locate Indiana State Form 1462 and then click Retrieve Form to commence.

- Utilize the tools we provide to fill out your form.

- Highlight key sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional handwritten signature.

- Review all the information and then click on the Complete button to save your modifications.

- Choose how you wish to share your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form hunts, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs within a few clicks from any gadget you prefer. Alter and electronically sign Indiana State Form 1462 and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indiana state form 1462

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Notice 1462?

IRS Notice 1462 is a notice sent by the IRS regarding your tax return and the status of your refund. It typically provides important information about potential issues with your return and steps you need to take. If you've received IRS Notice 1462, it's crucial to understand its implications for your tax filings.

-

How can airSlate SignNow help me respond to IRS Notice 1462?

With airSlate SignNow, you can easily prepare and eSign documents needed to respond to IRS Notice 1462. Our platform streamlines the document management process, allowing you to send and sign forms securely. This ensures you can provide timely responses to the IRS while maintaining compliance.

-

Is there a cost for using airSlate SignNow in relation to IRS Notice 1462?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, including those needing to handle IRS Notice 1462. By using our cost-effective solution, you can manage your documents efficiently without incurring excessive costs. Contact us for detailed pricing tailored to your needs.

-

What features does airSlate SignNow provide that relate to IRS Notice 1462?

airSlate SignNow offers robust features like document templates, real-time collaboration, and secure eSigning, which are beneficial when dealing with IRS Notice 1462. These features simplify the process of preparing and submitting required documentation to the IRS. Additionally, you can track the status of your documents easily through our platform.

-

Can I integrate airSlate SignNow with other tools to manage IRS Notice 1462?

Yes, airSlate SignNow integrates seamlessly with various business applications that can help manage IRS Notice 1462. Our platform can connect with customer relationship management tools, cloud storage solutions, and accounting software to streamline document workflows. This integration enhances your ability to keep track of your tax-related documents.

-

What are the benefits of using airSlate SignNow for IRS Notice 1462?

Using airSlate SignNow to handle IRS Notice 1462 provides several benefits, including increased efficiency, enhanced security, and improved compliance. Our user-friendly platform ensures that you can resolve issues quickly while keeping your documents secure. You'll also save time, allowing you to focus more on growing your business.

-

How do I get started with airSlate SignNow for IRS Notice 1462?

Getting started with airSlate SignNow is simple and user-friendly. You can sign up for a free trial, explore our features, and see how our solutions can help address IRS Notice 1462 efficiently. Our onboarding process includes tutorials and customer support to ensure you maximize the platform’s capabilities.

Get more for Indiana State Form 1462

Find out other Indiana State Form 1462

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple