Us Bank Short Sale Form

What is the Us Bank Short Sale

A short sale with US Bank occurs when a homeowner sells their property for less than the amount owed on their mortgage. This process typically requires the bank's approval, as they must agree to accept a reduced payoff to release the mortgage lien. Short sales are often pursued by homeowners facing financial hardship, allowing them to avoid foreclosure while minimizing losses for the lender. The US Bank short sale process involves several steps, including submitting a request for a short sale and providing necessary documentation to demonstrate financial distress.

Steps to complete the Us Bank Short Sale

Completing a US Bank short sale involves a series of steps that must be followed carefully to ensure a successful transaction. Here are the key steps:

- Contact US Bank’s short sale department to express your intent to initiate the process.

- Gather necessary documentation, including financial statements, hardship letters, and the US Bank short sale authorization form.

- Submit the short sale package, which includes the completed authorization form and supporting documents, to US Bank for review.

- Work with your real estate agent to list the property and market it effectively.

- Once an offer is received, submit it to US Bank for approval.

- After receiving approval, complete the sale and ensure all paperwork is finalized.

Key elements of the Us Bank Short Sale

Understanding the key elements of a US Bank short sale is crucial for homeowners considering this option. Important aspects include:

- Hardship Documentation: Homeowners must provide evidence of their financial difficulties, which can include job loss, medical expenses, or other financial burdens.

- Property Valuation: US Bank will assess the property's current market value to determine if the short sale price is acceptable.

- Approval Process: The bank will review the short sale request, including the offer received, and make a decision based on their guidelines.

- Closing Costs: Homeowners should be aware of who will cover closing costs, as this can affect the net proceeds from the sale.

Legal use of the Us Bank Short Sale

The legal validity of a US Bank short sale hinges on compliance with federal and state regulations. It's essential to ensure that all documentation is accurately completed and submitted. The eSignature laws, such as ESIGN and UETA, apply to electronic submissions, making it vital to use a reliable digital platform for signing and submitting forms. Homeowners should also consult legal professionals to understand their rights and obligations throughout the process.

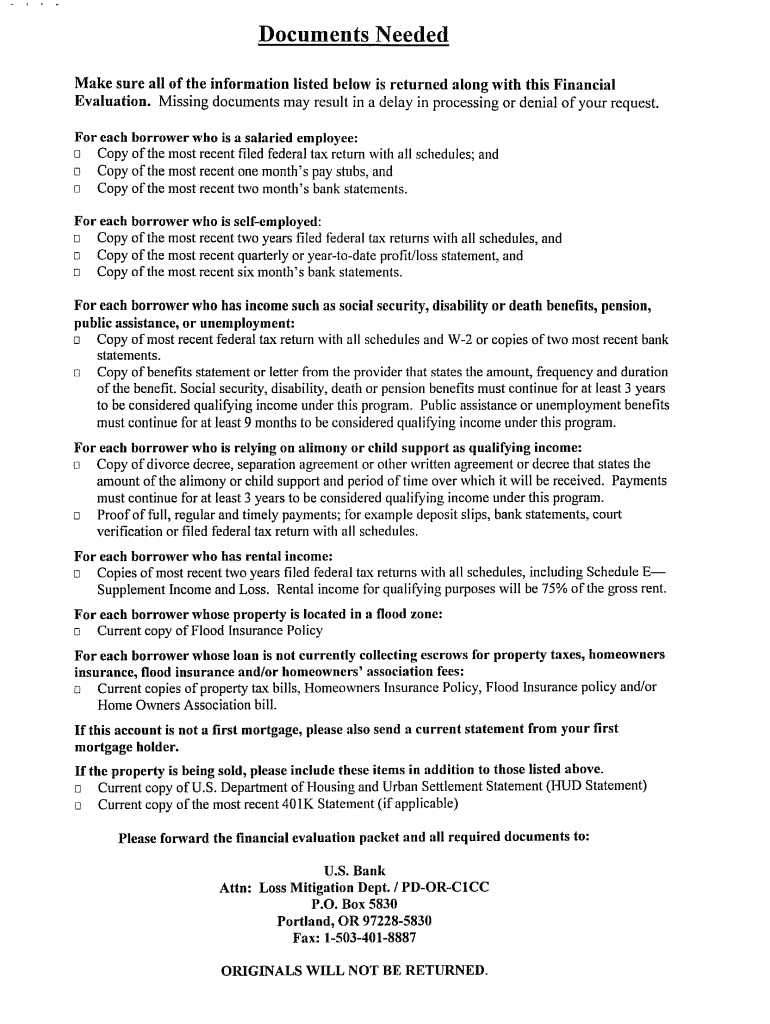

Required Documents

To successfully initiate a US Bank short sale, homeowners must prepare and submit several key documents. These typically include:

- The US Bank short sale authorization form, which grants permission for the bank to discuss the account with third parties.

- A hardship letter explaining the financial situation and reasons for the short sale.

- Financial statements detailing income, expenses, and assets.

- Recent pay stubs, tax returns, and bank statements to support the financial claims.

Eligibility Criteria

Eligibility for a US Bank short sale is determined by various factors. Homeowners must demonstrate financial hardship, which can include job loss, reduced income, or other significant financial challenges. Additionally, the property must be the homeowner's primary residence, and the mortgage must be delinquent or at risk of default. Meeting these criteria is essential for the bank to consider a short sale request.

Quick guide on how to complete us bank short sale

Complete Us Bank Short Sale effortlessly on any device

Online file management has become increasingly favored by businesses and individuals alike. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage Us Bank Short Sale on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

The easiest way to modify and eSign Us Bank Short Sale without hassle

- Locate Us Bank Short Sale and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, either via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Us Bank Short Sale and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the us bank short sale

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a US Bank short sale?

A US Bank short sale is a real estate transaction where the bank agrees to accept less than the amount owed on the mortgage. This option often benefits homeowners facing financial difficulties, allowing them to avoid foreclosure. With airSlate SignNow, you can streamline the document signing process involved in short sales.

-

How can airSlate SignNow help with US Bank short sales?

airSlate SignNow simplifies the documentation required for US Bank short sales by allowing electronic signatures on various forms. This saves time and reduces the hassle of printing and mailing documents. Our platform also ensures that all documents are securely stored and easily accessible.

-

Are there any costs associated with using airSlate SignNow for a US Bank short sale?

Yes, while airSlate SignNow offers flexible pricing plans, using our platform for a US Bank short sale is often more cost-effective than traditional document signing methods. We provide various subscription options tailored to meet different business needs, making it easier to integrate into your short sale process.

-

What features does airSlate SignNow offer for US Bank short sales?

airSlate SignNow provides features like customizable templates, bulk sending, and automated reminders, specifically designed for US Bank short sales. These tools help ensure that all parties involved can complete and sign documents efficiently. Additionally, our user-friendly interface makes the process straightforward for everyone.

-

Can I integrate airSlate SignNow with other tools for managing US Bank short sales?

Absolutely! airSlate SignNow easily integrates with various CRM and document management systems, enhancing your workflow for US Bank short sales. This integration allows you to automate parts of the short sale process, ensuring all documents are properly signed and stored.

-

What are the benefits of using airSlate SignNow for US Bank short sales?

Using airSlate SignNow for US Bank short sales can signNowly reduce turnaround time and increase efficiency. Our solution eliminates the paperwork hassle and enhances the overall experience for buyers, sellers, and lenders. Additionally, you can track the status of documents in real-time, ensuring nothing falls through the cracks.

-

Is airSlate SignNow secure for handling US Bank short sales documentation?

Yes, security is a top priority at airSlate SignNow. We employ advanced encryption and security measures to protect all documents related to US Bank short sales. This ensures that sensitive information remains confidential throughout the signing process.

Get more for Us Bank Short Sale

- Fixed deposit application form individual the director

- Nbha form

- Pdffiller volunteer services agreement for natural resources agencies form

- Proof of loss other than fire interim ibc claim form no ciaa adjusters

- Transmittals in construction form

- Md single payer proposal would cost 117000 heartland institute heartland form

- Canada plans to stop u s drug importation heartland institute heartland form

- Massage therapist independent contractor agreement template form

Find out other Us Bank Short Sale

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation