Stark County Conveyance Form

What is the Stark County Conveyance Form

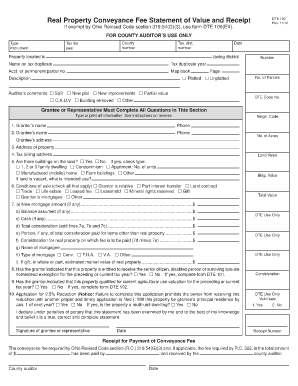

The Stark County Conveyance Form is a legal document used for the transfer of real estate ownership within Stark County, Ohio. This form is essential for recording the sale or transfer of property, ensuring that the transaction is recognized by local authorities. It typically includes details such as the names of the buyer and seller, the property description, and the sale price. Proper completion of this form is crucial for the legal validity of the property transfer.

How to use the Stark County Conveyance Form

Using the Stark County Conveyance Form involves several steps to ensure accuracy and compliance with local regulations. First, obtain the form from the appropriate county office or online resource. Next, fill out the required fields, including the property details and the parties involved in the transaction. After completing the form, both the buyer and seller must sign it, and it may require notarization. Finally, submit the completed form to the county recorder's office to finalize the property transfer.

Steps to complete the Stark County Conveyance Form

Completing the Stark County Conveyance Form involves a systematic approach to ensure all necessary information is accurately provided. Follow these steps:

- Obtain the form from the Stark County recorder’s office or an authorized website.

- Fill in the names and addresses of both the buyer and seller.

- Provide a detailed description of the property, including its address and parcel number.

- Indicate the sale price of the property.

- Sign the form in the presence of a notary public, if required.

- Submit the completed form to the county recorder’s office along with any applicable fees.

Key elements of the Stark County Conveyance Form

The Stark County Conveyance Form contains several key elements that must be accurately completed for the document to be valid. Important components include:

- Buyer and Seller Information: Full names and addresses of both parties.

- Property Description: A clear description of the property being transferred, including the legal description and parcel number.

- Sale Price: The agreed-upon price for the property.

- Signatures: Required signatures of both the buyer and seller, often needing notarization.

Legal use of the Stark County Conveyance Form

The legal use of the Stark County Conveyance Form is critical for ensuring that property transfers are recognized by law. This form serves as a public record of the transaction, which protects the rights of both the buyer and seller. It is essential to ensure that the form is filled out correctly and submitted to the appropriate authorities to avoid any legal disputes or complications regarding property ownership.

Form Submission Methods

The Stark County Conveyance Form can be submitted through various methods to accommodate the preferences of the parties involved. These methods include:

- In-Person: Submit the completed form directly to the Stark County recorder’s office.

- By Mail: Send the form along with any required fees to the recorder’s office via postal service.

- Online: Check if the county offers an online submission option for convenience.

Quick guide on how to complete stark county conveyance form

Complete Stark County Conveyance Form effortlessly on any device

The management of online documents has become increasingly common among businesses and individuals. It offers an ideal eco-friendly option to traditional printed and signed paperwork, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Stark County Conveyance Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related operation today.

How to alter and eSign Stark County Conveyance Form with ease

- Find Stark County Conveyance Form and click on Get Form to begin.

- Use the tools offered to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Stark County Conveyance Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the stark county conveyance form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Stark County conveyance form?

The Stark County conveyance form is a legal document used to transfer ownership of real estate within Stark County. This form is crucial for ensuring that property transactions are recorded accurately and in compliance with local laws. Properly filling out this form helps to prevent disputes and facilitates a smooth transfer process.

-

How can airSlate SignNow help with the Stark County conveyance form?

airSlate SignNow allows users to easily create, send, and eSign the Stark County conveyance form online. Our platform simplifies document management by providing a user-friendly interface and tools that ensure your conveyance form is completed accurately. With SignNow, you can complete the process from anywhere, streamlining your real estate transactions.

-

What are the costs associated with using airSlate SignNow for the Stark County conveyance form?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including options for individual users and teams. You can start with a free trial to explore its features, and when ready, choose a plan that best fits your requirements for managing the Stark County conveyance form. This cost-effective solution ensures you get value for your investment.

-

Are there any specific features for handling the Stark County conveyance form in airSlate SignNow?

Yes, airSlate SignNow offers specialized features tailored for the Stark County conveyance form, such as customizable templates and easy eSigning capabilities. These features allow users to fill out the form quickly and ensure all necessary parties can sign electronically. Additionally, you can track the status of document submissions in real-time.

-

Can I integrate airSlate SignNow with other software for managing the Stark County conveyance form?

Absolutely! airSlate SignNow supports seamless integration with various software applications, allowing users to connect their preferred tools to manage the Stark County conveyance form more effectively. Whether it's CRM systems, cloud storage solutions, or accounting software, integration options enhance your workflow and document handling efficiency.

-

Is the Stark County conveyance form legally binding when eSigned through airSlate SignNow?

Yes, the Stark County conveyance form is legally binding when it is eSigned through airSlate SignNow, as the platform complies with all necessary electronic signature laws. This ensures that your transactions are not only efficient but also legitimate and enforceable. Using airSlate SignNow adds an extra layer of security and compliance to your real estate documents.

-

How does using airSlate SignNow improve the process of filing the Stark County conveyance form?

Using airSlate SignNow signNowly improves the filing process for the Stark County conveyance form by making it fast, easy, and secure. The platform eliminates the need for physical signatures, reducing the time spent on coordinating in-person meetings. This efficiency helps streamline transactions and enhances the overall user experience.

Get more for Stark County Conveyance Form

- Brigance cibs r inventory form

- Preliminary trainee application form 494787054

- Bfa entrance exam question paper pdf form

- Disclosure statement for volunteers keep kids safe form

- Dma410 eb tpl icn georgia department of community form

- Uniform needlestick and sharp object injury report west

- Ny dtf ct 34 i fill out tax template online form

- Form gw 2 the virginia department of environmental quality deq virginia

Find out other Stark County Conveyance Form

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template