Schedule 2 8849 Form

What is the Schedule 2 8849 Form

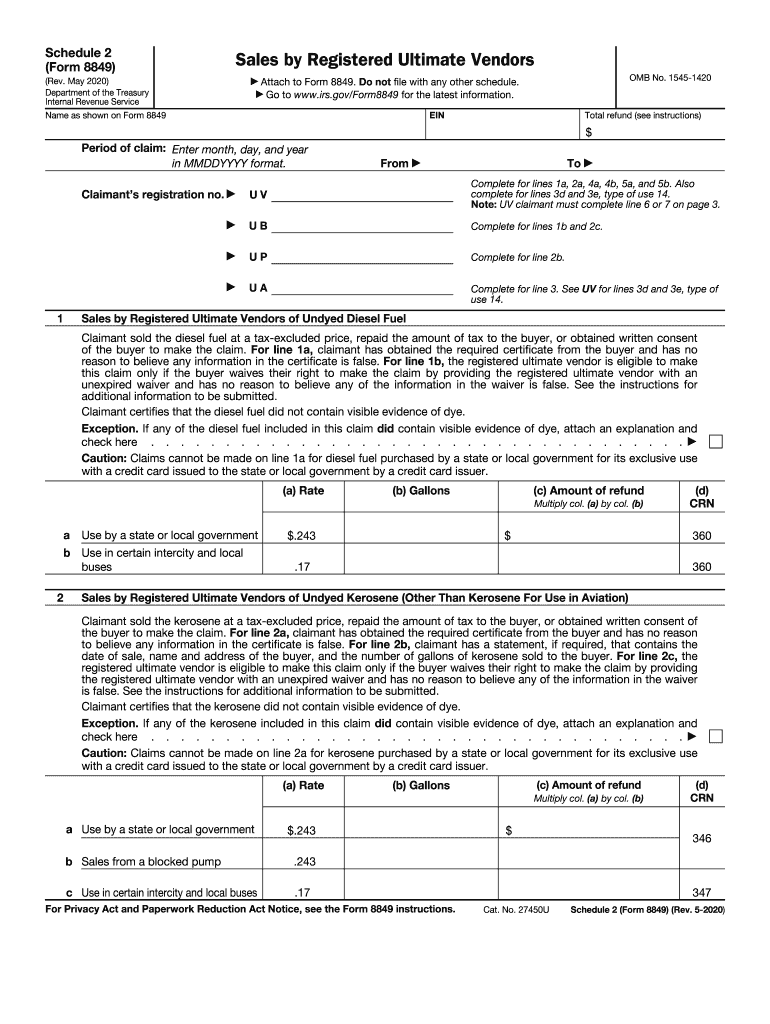

The Schedule 2 form 8849 is a tax form used by businesses and individuals to claim refunds for certain excise taxes. This form is specifically designed for reporting the overpayment of excise taxes on fuel and other products. It is a part of the IRS Form 8849 series, which allows taxpayers to request refunds for various excise taxes they have paid. Understanding the purpose of this form is crucial for ensuring compliance with IRS regulations and for maximizing potential refunds.

How to use the Schedule 2 8849 Form

Using the Schedule 2 form 8849 involves several steps to ensure accurate completion and submission. Taxpayers must first gather all relevant information regarding the excise taxes paid. This includes details about the types of fuel or products for which refunds are being claimed. Once the necessary information is collected, the taxpayer can fill out the form, ensuring that all sections are completed accurately. After completing the form, it should be submitted to the IRS according to the specified guidelines, either electronically or via mail.

Steps to complete the Schedule 2 8849 Form

Completing the Schedule 2 form 8849 requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary documentation, including receipts and records of excise taxes paid.

- Fill out the taxpayer information section, including name, address, and taxpayer identification number.

- Complete the specific sections related to the excise taxes being claimed, ensuring that all amounts are accurate.

- Sign and date the form to certify that the information provided is correct.

- Submit the completed form to the IRS, either electronically through an authorized e-file provider or by mailing it to the appropriate address.

Legal use of the Schedule 2 8849 Form

The Schedule 2 form 8849 is legally binding when completed correctly and submitted according to IRS regulations. To ensure its legal validity, it is essential to provide accurate information and adhere to all filing requirements. The form must be signed by the taxpayer or an authorized representative, as this signature certifies the truthfulness of the claims made. Failure to comply with these legal standards may result in penalties or denial of the refund claim.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule 2 form 8849 are crucial for taxpayers seeking refunds. Generally, claims for refund must be filed within three years from the date the tax was paid or within two years from the date the tax was reported on the return. It is important to stay informed about any updates to these deadlines, as they can change based on IRS regulations or specific tax situations. Missing these deadlines may result in the inability to claim a refund.

Form Submission Methods (Online / Mail / In-Person)

The Schedule 2 form 8849 can be submitted through various methods, providing flexibility for taxpayers. The form can be filed electronically through an authorized e-file provider, which is often the fastest method. Alternatively, taxpayers can print the completed form and mail it to the appropriate IRS address. In-person submissions are typically not available for this form, making electronic and mail options the primary methods for filing.

Quick guide on how to complete schedule 2 8849 form

Effortlessly Complete Schedule 2 8849 Form on Any Device

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed files, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle Schedule 2 8849 Form on any platform using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The Easiest Way to Modify and Electronically Sign Schedule 2 8849 Form

- Find Schedule 2 8849 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact private information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to deliver your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or inaccuracies that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Schedule 2 8849 Form while ensuring outstanding communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule 2 8849 form

How to generate an electronic signature for a PDF document online

How to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is a schedule 2 form 8849 and why is it important?

The schedule 2 form 8849 is a tax form used by businesses to claim a refund for certain excise taxes. Understanding this form is crucial as it helps minimize tax liabilities and ensures compliance with IRS regulations. Proper filing of the schedule 2 form 8849 can save businesses signNow amounts of money and time.

-

How can airSlate SignNow help with completing the schedule 2 form 8849?

airSlate SignNow provides an intuitive platform to fill out and manage the schedule 2 form 8849 efficiently. Our user-friendly interface allows for easy electronic signing and submission, streamlining your filing process. By using airSlate SignNow, you can ensure accurate and timely submission of your schedule 2 form 8849.

-

Is there a cost associated with using airSlate SignNow for the schedule 2 form 8849?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Our cost-effective solutions provide access to essential features for completing the schedule 2 form 8849 efficiently. You can choose a plan that best suits your business requirements and budget.

-

What integrations does airSlate SignNow offer for handling the schedule 2 form 8849?

airSlate SignNow integrates seamlessly with various business tools and applications to enhance your workflow when handling the schedule 2 form 8849. Our platform connects with leading software like Google Drive, Salesforce, and more. This makes it easier to manage your documents and collaborate with your team.

-

Can I track the status of my schedule 2 form 8849 submission with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your schedule 2 form 8849 submissions in real-time. You will receive notifications when your documents are viewed, signed, or completed. This transparency ensures that you are always informed about the progression of your filings.

-

What security measures does airSlate SignNow implement for my schedule 2 form 8849?

Security is a top priority at airSlate SignNow. We implement advanced encryption protocols and secure storage measures to protect your sensitive information, including the schedule 2 form 8849. You can trust that your data is safe while managing your documents with us.

-

Is it easy to collaborate on the schedule 2 form 8849 using airSlate SignNow?

Absolutely! airSlate SignNow offers collaborative features that make it simple to work on the schedule 2 form 8849 with team members or clients. You can invite others to review and sign the document, facilitating efficient teamwork and ensuring everyone is on the same page.

Get more for Schedule 2 8849 Form

Find out other Schedule 2 8849 Form

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer