1 DEPARTMENT of the TREASURY Internal Revenue Service Form

Understanding the IRS and Its Role

The Internal Revenue Service (IRS) is a vital part of the U.S. Department of the Treasury, responsible for administering and enforcing federal tax laws. The IRS handles the collection of taxes, processes tax returns, and manages various tax-related programs. Understanding the IRS's function is crucial for individuals and businesses to ensure compliance with tax regulations and to take advantage of available benefits.

Steps to Complete the IRS Form

Completing the IRS form requires careful attention to detail. Begin by gathering all necessary documentation, including income statements and previous tax returns. Next, fill out the form accurately, ensuring that all information is current and correct. After completing the form, review it for any errors before submission. Finally, submit the form electronically or via mail, depending on your preference and the specific requirements of the form.

Required Documents for IRS Forms

When preparing to fill out an IRS form, it's essential to have the appropriate documents on hand. Commonly required documents include:

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Previous year’s tax return

- Social Security numbers for dependents

Having these documents ready will facilitate a smoother completion process and help ensure accuracy.

Eligibility Criteria for IRS Programs

Eligibility for various IRS programs often depends on specific criteria, including income level, filing status, and residency. For example, certain tax credits and deductions may only be available to individuals within specific income brackets or those who meet particular conditions, such as having dependents. Understanding these criteria is essential for maximizing potential tax benefits.

Penalties for Non-Compliance with IRS Regulations

Failing to comply with IRS regulations can lead to significant penalties. Common penalties include:

- Failure to file on time, resulting in fines

- Underpayment penalties if not enough tax is paid

- Interest on unpaid taxes

Being aware of these penalties can motivate timely and accurate filing, helping to avoid unnecessary financial burdens.

Form Submission Methods

IRS forms can be submitted through various methods. Options include:

- Electronic filing via authorized e-file providers

- Mailing paper forms to designated IRS addresses

- In-person submission at local IRS offices

Choosing the right submission method can depend on personal preference, the specific form being filed, and any applicable deadlines.

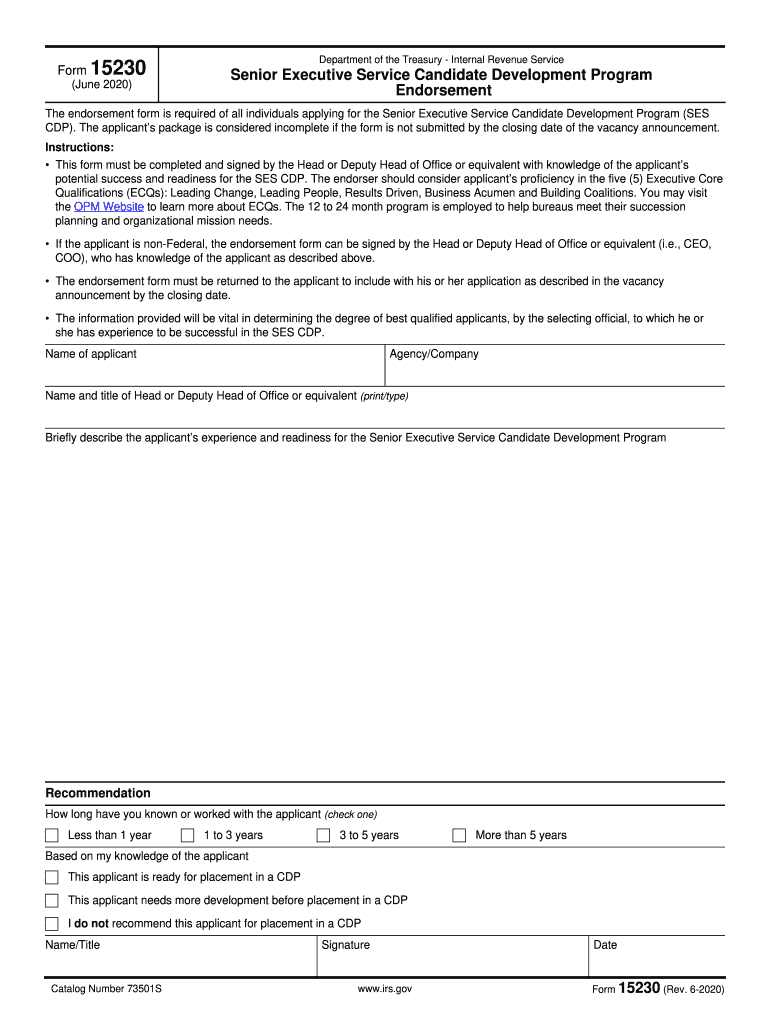

Quick guide on how to complete 1 department of the treasury internal revenue service

Complete 1 DEPARTMENT OF THE TREASURY Internal Revenue Service effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the features required to create, edit, and electronically sign your documents promptly without interruptions. Handle 1 DEPARTMENT OF THE TREASURY Internal Revenue Service on any device with the airSlate SignNow apps for Android or iOS, and enhance any document-centric process today.

How to modify and eSign 1 DEPARTMENT OF THE TREASURY Internal Revenue Service with ease

- Locate 1 DEPARTMENT OF THE TREASURY Internal Revenue Service and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and select the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or mislaid documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Alter and eSign 1 DEPARTMENT OF THE TREASURY Internal Revenue Service and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1 department of the treasury internal revenue service

How to generate an electronic signature for a PDF file in the online mode

How to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

What is the senior executive service and how does it relate to document signing?

The senior executive service (SES) is a framework for managing the government’s senior executives. airSlate SignNow enhances the efficiency of the SES by providing a streamlined platform for electronic document signing, ensuring compliance and security for sensitive documents.

-

How can airSlate SignNow benefit senior executive service professionals?

Senior executive service professionals benefit from airSlate SignNow by gaining access to a user-friendly, cost-effective solution for digital signatures. This enhances workflow efficiency, reduces turnaround time on important documents, and supports remote signing capabilities.

-

What pricing options are available for senior executive service teams using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored for teams, including those in the senior executive service. This ensures that organizations can choose a plan that fits their budget while accessing essential features for secure eSigning and document management.

-

What features does airSlate SignNow offer for senior executive service document management?

Key features of airSlate SignNow include easy-to-use eSigning tools, secure cloud storage, and customizable templates. These features streamline document workflows for senior executive service teams, ensuring a faster and more efficient signing process.

-

Is airSlate SignNow compliant with regulations relevant to the senior executive service?

Yes, airSlate SignNow is designed with compliance in mind, adhering to regulations such as eSign Act and HIPAA. This makes it a safe choice for the senior executive service, where compliance with legal standards is crucial for document handling.

-

Can airSlate SignNow integrate with other software used by senior executive service teams?

Absolutely, airSlate SignNow offers seamless integrations with popular software platforms that senior executive service teams often use. This enhances productivity by allowing for a smooth workflow between document signing and other applications.

-

How does airSlate SignNow enhance collaboration for senior executive service teams?

AirSlate SignNow enhances collaboration by enabling real-time document sharing and signing among senior executive service teams. This collaborative approach ensures that all stakeholders can engage effectively, regardless of their location.

Get more for 1 DEPARTMENT OF THE TREASURY Internal Revenue Service

- Sales tax exemption form

- Ucc1ad form

- Application for security refund for teachers form

- Writable scdhhs wkr001 form

- 6058043 submittal register form

- Form 8879sp rev january irs e file signature authorization spanish version

- 18 05 20 assr 539 rev form

- 576 d los angeles county assessor assessor lacounty form

Find out other 1 DEPARTMENT OF THE TREASURY Internal Revenue Service

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself