D 40 Fillable Form

What is the D 40 Fillable Form

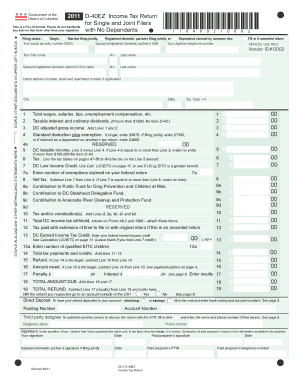

The D 40 fillable form is a tax document used by residents of Washington, D.C., to report their income and calculate their tax liability. This form is essential for individuals who need to file their annual income tax returns. The D 40 form captures various sources of income, deductions, and credits, allowing taxpayers to determine the amount of tax owed or any refund due. It is designed to be user-friendly, with sections that guide filers through the necessary information required by the District of Columbia's Office of Tax and Revenue.

Steps to Complete the D 40 Fillable Form

Completing the D 40 fillable form involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Access the D 40 fillable form online and open it in a compatible PDF reader.

- Enter personal information, such as your name, address, and Social Security number.

- Report all sources of income in the designated sections, ensuring accuracy.

- Apply any deductions or credits that you qualify for, as outlined in the form instructions.

- Review your entries for completeness and accuracy before finalizing the form.

- Save your completed form for submission.

How to Obtain the D 40 Fillable Form

The D 40 fillable form can be easily obtained online through the District of Columbia's Office of Tax and Revenue website. It is available as a downloadable PDF that can be filled out electronically. Additionally, taxpayers can request a physical copy by contacting the tax office directly or visiting their local office. Ensuring access to the most current version of the form is crucial, especially as tax laws and requirements may change annually.

Legal Use of the D 40 Fillable Form

The D 40 fillable form is legally recognized for tax filing purposes in Washington, D.C. To ensure its validity, taxpayers must adhere to the guidelines set forth by the Office of Tax and Revenue. This includes submitting the form by the designated filing deadlines and providing accurate information. Electronic submissions are accepted, provided they comply with the eSignature regulations and maintain the integrity of the data. Using a trusted platform for e-signatures can enhance the legal standing of the completed form.

Form Submission Methods

Taxpayers have several options for submitting the D 40 fillable form:

- Online Submission: The form can be submitted electronically through the District of Columbia's tax portal, which is designed for secure online filing.

- Mail: Completed forms can be printed and mailed to the appropriate tax office address. It is advisable to use certified mail for tracking purposes.

- In-Person: Taxpayers may also choose to deliver the form in person at designated tax office locations, ensuring immediate confirmation of receipt.

Filing Deadlines / Important Dates

Filing deadlines for the D 40 fillable form are critical for compliance. Typically, individual income tax returns are due on April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, as well as deadlines for estimated tax payments throughout the year. Staying informed about these dates helps avoid penalties and ensures timely filing.

Quick guide on how to complete d 40 fillable form

Complete D 40 Fillable Form seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage D 40 Fillable Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign D 40 Fillable Form effortlessly

- Obtain D 40 Fillable Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal validity as a standard wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign D 40 Fillable Form and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the d 40 fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a D40 tax form?

The D40 tax form is used by residents of the District of Columbia to report their personal income and file their annual income tax returns. It includes various sections for detailing income, deductions, and credits. Understanding what is a D40 tax form is essential for ensuring compliance with local tax laws.

-

Who needs to file a D40 tax form?

Individuals who reside in the District of Columbia and earn income are required to file a D40 tax form. This includes residents who receive wages, business income, or other taxable income. Knowing who needs to file is crucial for timely and accurate tax reporting.

-

What information is required on the D40 tax form?

The D40 tax form requires personal information such as your name, address, and Social Security number, along with details about your income and deductions. Taxpayers should also report any credits they are eligible for. Familiarity with what is a D40 tax form can simplify the filing process considerably.

-

What are the deadlines for submitting a D40 tax form?

The deadline for submitting a D40 tax form typically aligns with the federal tax filing deadline, which is usually April 15. Any changes to the deadlines will be communicated by the local tax authority. Being aware of these deadlines is part of understanding what is a D40 tax form.

-

What are the penalties for not filing a D40 tax form?

Failing to file a D40 tax form on time can result in penalties, including interest on unpaid taxes and additional late fees. It’s vital to file by the deadline to avoid these consequences. Knowing what is a D40 tax form helps you stay compliant and avoid penalties.

-

Can I file a D40 tax form electronically?

Yes, residents can file the D40 tax form electronically through authorized online platforms. Electronic filing is generally faster and can expedite the processing of your return. Understanding what is a D40 tax form also includes knowing about modern filing options.

-

What documents do I need to file a D40 tax form?

To file a D40 tax form, you'll need W-2s, 1099 forms, records of other income, and documentation for any deductions you plan to claim. It's important to gather these documents before you start the filing process to ensure accuracy. Recognizing what is a D40 tax form involves knowing the required documentation.

Get more for D 40 Fillable Form

Find out other D 40 Fillable Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors