Education Checkoff Chart Template Form

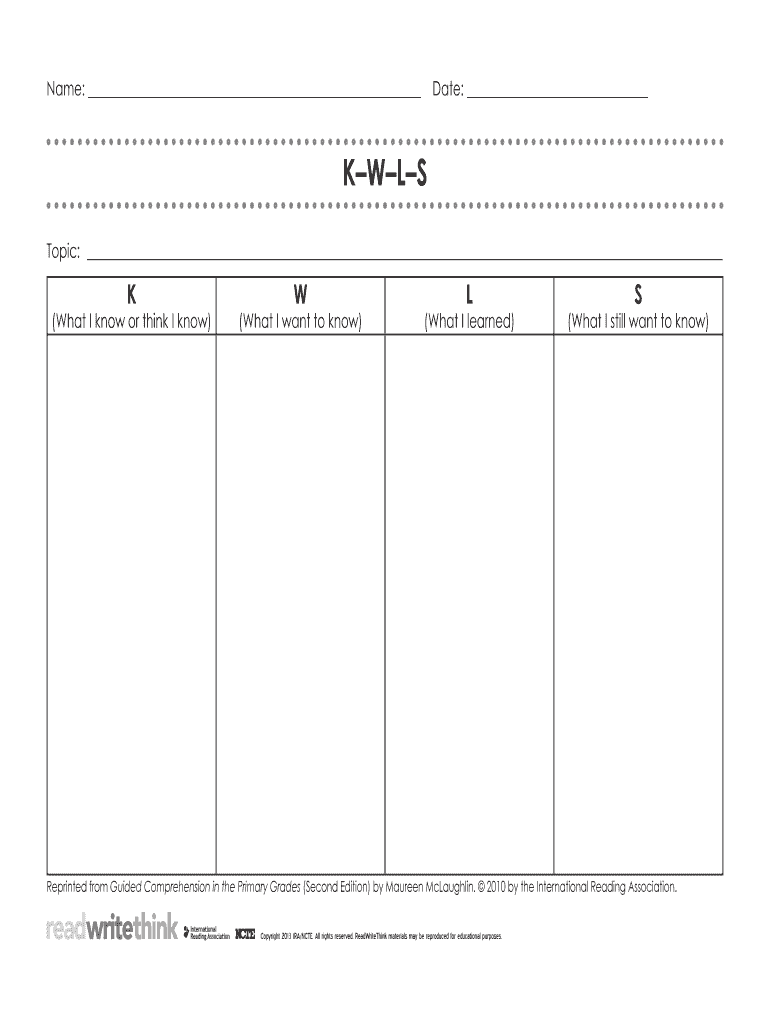

What is the KWL Chart Template?

The KWL chart template is an educational tool designed to help learners organize their thoughts and track their learning progress. KWL stands for "Know," "Want to know," and "Learned." This structured format allows users to identify what they already know about a topic, what they wish to learn, and what they have discovered after completing their research. The KWL chart is widely used in classrooms and educational settings to enhance comprehension and retention of information.

How to Use the KWL Chart Template

Using the KWL chart template is a straightforward process. Begin by filling out the "Know" column with any existing knowledge about the topic. Next, move to the "Want to know" section, where you can list questions or areas of interest related to the subject. Finally, after conducting research or completing a lesson, fill in the "Learned" column with new insights or information gathered. This method not only promotes active engagement but also helps in reflecting on the learning journey.

Steps to Complete the KWL Chart Template

Completing the KWL chart template involves a few simple steps:

- Step 1: Identify the topic you want to explore.

- Step 2: In the "Know" section, write down everything you already understand about the topic.

- Step 3: In the "Want to know" section, list questions or specific areas you are curious about.

- Step 4: After learning, fill in the "Learned" section with new information or insights gained.

Legal Use of the KWL Chart Template

The KWL chart template can be utilized in various educational contexts without legal restrictions. It is a versatile tool that supports learning across different subjects and age groups. However, it is important to respect copyright laws when using or distributing any specific versions of the KWL chart template that may be published by educational institutions or organizations.

Key Elements of the KWL Chart Template

Key elements of the KWL chart template include three distinct sections: "Know," "Want to know," and "Learned." Each section serves a unique purpose:

- Know: Captures pre-existing knowledge and sets a foundation for learning.

- Want to know: Encourages curiosity and goal-setting for the learning process.

- Learned: Documents new information acquired, reinforcing knowledge retention.

Examples of Using the KWL Chart Template

The KWL chart template can be applied in various educational scenarios. For instance, a teacher may use it for a science lesson on ecosystems, where students list what they know about plants and animals, what they want to learn about their interactions, and what they have learned after the lesson. Similarly, it can be used in history classes to explore significant events, encouraging students to engage deeply with the material.

Quick guide on how to complete k w l s chart readwritethink

Discover how to effortlessly navigate the Education Checkoff Chart Template execution with this straightforward guide

eFiling and electronically signNowing documents is becoming increasingly favored and is the preferred option for numerous clients. It presents many benefits over traditional printed documents, such as convenience, time savings, enhanced accuracy, and security.

With tools like airSlate SignNow, you can locate, edit, sign, optimize, and dispatch your Education Checkoff Chart Template without getting caught up in endless printing and scanning. Adhere to this concise guide to begin and complete your form.

Follow these instructions to obtain and complete Education Checkoff Chart Template

- Commence by clicking the Get Form button to access your form in our editor.

- Pay attention to the green label on the left highlighting the required fields so you don’t miss any.

- Utilize our advanced features to annotate, edit, sign, secure, and enhance your form.

- Protect your document or convert it into a fillable form using the appropriate tab tools.

- Thoroughly review the form and inspect it for mistakes or inconsistencies.

- Select DONE to complete your editing.

- Rename your document or keep it as is.

- Choose the storage option you wish to use for saving your form, send it via USPS, or click the Download Now button to save your document.

If Education Checkoff Chart Template isn’t what you were seeking, you can explore our comprehensive selection of pre-imported forms that you can finish with minimal effort. Visit our platform today!

Create this form in 5 minutes or less

FAQs

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

I am retired and living in the Czech Republic. My social security check is transferred to a local bank. They asked me to fill out a form W-9. I am not working, not having business or any kind of additional income. Do l need to file it?

Under FATCA, the Czech government has signed a treaty with the U.S. government where they agree to have financial institutions document whether or not U.S. citizens are account holders (and therefore, they pretty much have to document all account holders). So, if you do not fill out the W-9, the bank will have to close your account as you will not have provided sufficient evidence to document whether or not you are a U.S. citizen. Countries have been signing the treaties and starting to implement over the last couple of years - portions of the Czech treaty become effective in 2014.

-

I recently opened a Fidelity Roth IRA and it says my account is closed and I need to submit a W-9 form. Can anyone explain how this form relates to an IRA and why I need to fill it out?

Financial institutions are required to obtain tax ID numbers when opening an account, and the fact that it's an IRA doesn't exempt them from that requirement. They shouldn't have opened it without the W-9 in the first place, but apparently they did. So now they had to close it until they get the required documentation.

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

-

How is a single-member LLC owned by a nonresident alien taxed? Should I fill out a W-8 or am I deemed not to have U.S. activities?

Based on the facts as you have presented them:You are selling a product, as I see it, and not a service - although there's something of a gray area here, this is more like an intangible asset than it is providing a personal service for compensation. That product is being offered to US-based customers who are using it in the US - your focus is building up your market in the US, and you are doing that under the auspices of an LLC which is US-based. Looking at all of the facts and circumstances surrounding the conduct of your business, as you have presented them and as the IRS will look at them if asked, I conclude that you are conducting a business in the US and your income from US sources is effectively connected with the conduct of that business in the US, which means that you are subject to US taxes on that income.With that conclusion, Form W-8ECI is the proper form to provide to your US sources if you wish to prevent withholding on the income from your business.I want to add one point, since this seems to be coming up frequently - while an LLC is a disregarded entity for tax purposes, it is still a legal entity in the US - and the fact that you, as a nonresident alien, choose to operate a business under the auspices of a US-based LLC is a piece of evidence that can, under the appropriate set of facts and circumstances, be used by the IRS to support an argument that you are conducting business in the US and that your income from that business that comes from US sources should be taxable in the U.S. You should not assume that as a nonresident alien you have carte blanche to create a US LLC, operate a business under its auspices, and then at tax time argue that the income should not be taxable in the US because the LLC is a disregarded entity. The IRS will look at all of the facts and circumstances surrounding your business, including your choice of a US-based entity as the face of your business, and while that decision alone won't be dispositive, it will certainly be considered.

Create this form in 5 minutes!

How to create an eSignature for the k w l s chart readwritethink

How to generate an eSignature for your K W L S Chart Readwritethink in the online mode

How to generate an eSignature for your K W L S Chart Readwritethink in Google Chrome

How to generate an electronic signature for signing the K W L S Chart Readwritethink in Gmail

How to create an electronic signature for the K W L S Chart Readwritethink from your mobile device

How to create an electronic signature for the K W L S Chart Readwritethink on iOS devices

How to create an eSignature for the K W L S Chart Readwritethink on Android

People also ask

-

What is an Education Checkoff Chart Template?

An Education Checkoff Chart Template is a customizable tool designed to help educators track student progress and learning outcomes efficiently. It allows for easy documentation of skills mastered and areas needing improvement. With airSlate SignNow, you can easily create and modify these templates to suit your educational needs.

-

How can I use the Education Checkoff Chart Template in my classroom?

You can use the Education Checkoff Chart Template to monitor student achievements and ensure that all learning objectives are met. By integrating it into your lesson plans, you can facilitate personalized feedback for students. This template enhances your classroom management and supports a structured learning environment.

-

Is the Education Checkoff Chart Template easy to customize?

Yes, the Education Checkoff Chart Template is highly customizable to fit any educational setting. With airSlate SignNow, you can easily modify the template fields to align with your specific curriculum and assessment criteria. This flexibility ensures that your checkoff chart meets your unique requirements.

-

What are the benefits of using an Education Checkoff Chart Template?

Using an Education Checkoff Chart Template streamlines the tracking of student progress, saving you time and effort. It allows for better communication with students and parents about academic performance. Moreover, it supports data-driven decision-making in improving teaching strategies and learning outcomes.

-

Can I integrate the Education Checkoff Chart Template with other tools?

Absolutely! The Education Checkoff Chart Template can be integrated with various educational tools and software through airSlate SignNow's robust API. This integration enhances functionality, allowing you to sync data across platforms and maintain comprehensive records of student performance.

-

What is the pricing structure for the Education Checkoff Chart Template?

The Education Checkoff Chart Template is part of airSlate SignNow's subscription plans, which are designed to be cost-effective for educational institutions. Pricing may vary based on the features and number of users, ensuring that you get the best value for your needs. Check our website for the latest pricing details.

-

Is the Education Checkoff Chart Template secure for student information?

Yes, the Education Checkoff Chart Template ensures the security of student information through advanced encryption and compliance with data protection regulations. With airSlate SignNow, you can trust that your sensitive data is handled securely, providing peace of mind for educators and parents alike.

Get more for Education Checkoff Chart Template

- Notice of application filed seeking release or other relief form

- Parentage and child support branchdistrict of columbia form

- Official transcript new logo form

- Form 11 30 day notice to vacate for illegal act performed

- Instructions for florida supreme court approved fa form

- City of york accommodations tax reporting form tax

- R1029i 722sales tax return general instructions form

- Application for property tax relief av 9 web 7 22 form

Find out other Education Checkoff Chart Template

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word