Ontario Insurance Premium Tax Guide Form

What is the Ontario Insurance Premium Tax Guide

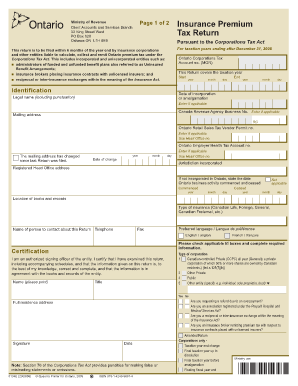

The Ontario Insurance Premium Tax Guide serves as a comprehensive resource for understanding the tax implications associated with insurance premiums in Ontario. This guide outlines the rules, regulations, and procedures necessary for accurately calculating and reporting the insurance premium tax. It is essential for insurance providers and policyholders to familiarize themselves with this guide to ensure compliance with local tax laws.

How to use the Ontario Insurance Premium Tax Guide

Using the Ontario Insurance Premium Tax Guide involves several steps. First, individuals and businesses should review the guide to understand the specific tax rates applicable to different types of insurance premiums. Next, they should gather all necessary documentation related to their insurance policies. This includes policy details, premium amounts, and any relevant correspondence. Finally, users must complete the required tax forms as outlined in the guide and submit them to the appropriate tax authority.

Steps to complete the Ontario Insurance Premium Tax Guide

Completing the Ontario Insurance Premium Tax Guide requires a systematic approach. Start by collecting all relevant documents, including your insurance policy and premium payment records. Next, refer to the guide to determine the applicable tax rate based on your insurance type. Calculate the total premium tax owed by applying the tax rate to your total premiums. After completing the calculations, fill out the necessary forms accurately, ensuring all information is correct. Finally, submit the forms by the specified deadline to avoid penalties.

Legal use of the Ontario Insurance Premium Tax Guide

The legal use of the Ontario Insurance Premium Tax Guide is crucial for ensuring compliance with tax regulations. This guide provides the legal framework for calculating and reporting insurance premium taxes. It is important for users to adhere to the guidelines set forth in the document to avoid legal repercussions. Utilizing the guide correctly helps in establishing that all tax obligations are met, thereby protecting individuals and businesses from potential audits or penalties.

Filing Deadlines / Important Dates

Understanding filing deadlines and important dates is essential when using the Ontario Insurance Premium Tax Guide. Typically, insurance premium taxes must be filed on a quarterly or annual basis, depending on the specific requirements outlined in the guide. Users should mark these deadlines on their calendars to ensure timely submissions. Missing a deadline can result in late fees or penalties, making it crucial to stay informed about these important dates.

Required Documents

To complete the Ontario Insurance Premium Tax Guide, several documents are required. Users must provide proof of insurance coverage, including policy numbers and premium amounts. Additionally, any previous tax filings related to insurance premiums should be included. Having these documents readily available will facilitate a smoother process when filling out the necessary forms and ensure accuracy in reporting.

Penalties for Non-Compliance

Failing to comply with the regulations outlined in the Ontario Insurance Premium Tax Guide can result in significant penalties. Non-compliance may lead to fines, interest on unpaid taxes, or even legal action in severe cases. It is important for individuals and businesses to understand the potential consequences of failing to adhere to the guidelines to avoid these penalties. Regularly reviewing the guide and staying informed about compliance requirements can help mitigate these risks.

Quick guide on how to complete ontario insurance premium tax guide

Effortlessly Prepare Ontario Insurance Premium Tax Guide on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents quickly and without interruptions. Manage Ontario Insurance Premium Tax Guide on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and Electronically Sign Ontario Insurance Premium Tax Guide Effortlessly

- Find Ontario Insurance Premium Tax Guide and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using the tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors requiring you to print new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Ontario Insurance Premium Tax Guide and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ontario insurance premium tax guide

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ontario insurance premium tax guide?

The Ontario insurance premium tax guide provides essential information about the taxes applicable to insurance premiums in Ontario. This guide helps insurance agents and policyholders understand their tax obligations, ensuring compliance with local regulations. It's an invaluable resource for anyone involved in the insurance industry in Ontario.

-

How can the Ontario insurance premium tax guide help my business?

Utilizing the Ontario insurance premium tax guide can streamline your business operations by clarifying tax obligations. It helps businesses accurately calculate tax amounts, reducing the risk of errors and penalties. Additionally, using the guide can improve your financial planning and reporting.

-

Are there any costs associated with accessing the Ontario insurance premium tax guide?

The Ontario insurance premium tax guide may be available for free or at a nominal cost, depending on the source. It's essential to verify the pricing with authorized providers. This resource offers signNow savings by helping you avoid costly mistakes in tax filings.

-

How often is the Ontario insurance premium tax guide updated?

The Ontario insurance premium tax guide is typically updated annually or whenever there are changes in tax laws. Staying up-to-date with the latest version ensures that you are compliant with current regulations. Regular updates help prevent outdated information from affecting your tax calculations.

-

Can I integrate the Ontario insurance premium tax guide with other tools?

Yes, many providers offer integrations with accounting and tax software for the Ontario insurance premium tax guide. This integration simplifies the management and calculation of insurance premium taxes within your existing workflow. It enhances efficiency and accuracy in your tax reporting processes.

-

What are the benefits of using the Ontario insurance premium tax guide?

Using the Ontario insurance premium tax guide helps ensure compliance with tax regulations, reducing the risk of audits and penalties. It provides clarity on tax calculations and fosters better financial planning. Access to this guide also enhances confidence when making business decisions related to insurance.

-

Who should use the Ontario insurance premium tax guide?

The Ontario insurance premium tax guide is essential for insurance agents, brokers, business owners, and financial professionals operating in Ontario. Anyone involved in the insurance sector will benefit from understanding the tax implications of their policies. This guide is a key resource for anyone needing to manage insurance taxes more effectively.

Get more for Ontario Insurance Premium Tax Guide

Find out other Ontario Insurance Premium Tax Guide

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors