Tpt Form

What is the Tpt Form

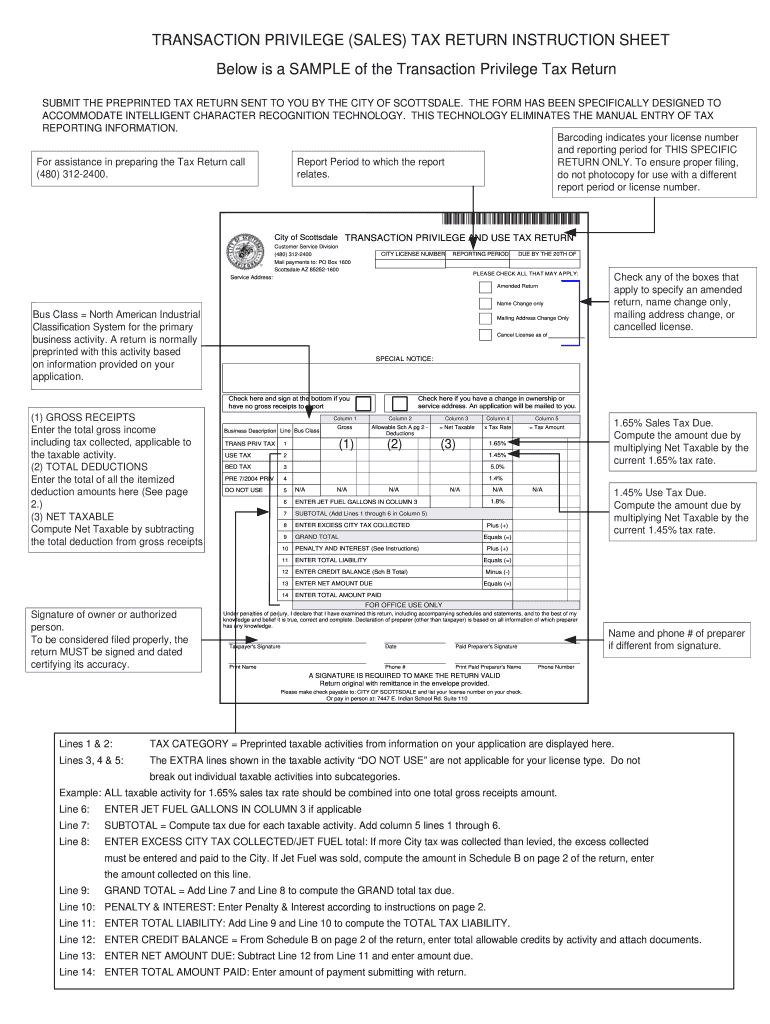

The Tpt form, often referred to as the Tpt tax form, is a specific document used for tax reporting purposes. It is primarily utilized by businesses and individuals to report certain types of transactions or income to the relevant tax authorities. Understanding the Tpt form is crucial for ensuring compliance with federal and state tax regulations, as it helps to accurately reflect financial activities within a designated tax year.

How to Use the Tpt Form

Using the Tpt form involves several key steps that ensure accurate completion and submission. First, gather all necessary financial documents and information related to the transactions or income you need to report. Next, carefully fill out the form, ensuring that all required fields are completed accurately. It is essential to double-check your entries for any errors or omissions before submission. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements set by the tax authority.

Steps to Complete the Tpt Form

Completing the Tpt form requires attention to detail. Follow these steps for a successful submission:

- Gather necessary documentation, including income statements and transaction records.

- Access the Tpt form through the appropriate tax authority's website or obtain a physical copy.

- Fill in your personal or business information accurately at the top of the form.

- Report all relevant income and transactions in the designated sections.

- Review the form for accuracy, ensuring all calculations are correct.

- Submit the form electronically or by mail, following the instructions provided.

Legal Use of the Tpt Form

The legal use of the Tpt form is governed by specific tax laws and regulations. It is essential to ensure that the form is filled out truthfully and accurately, as any discrepancies can lead to penalties or legal issues. The Tpt form must be submitted by the designated deadline to avoid late fees or additional scrutiny from tax authorities. By adhering to legal guidelines, individuals and businesses can maintain compliance and avoid potential legal ramifications.

Filing Deadlines / Important Dates

Filing deadlines for the Tpt form vary based on the type of taxpayer and the specific tax year. Generally, it is advisable to submit the form by the annual deadline set by the Internal Revenue Service (IRS) or state tax authorities. Mark important dates on your calendar, including any extensions that may apply. Staying informed about these deadlines helps ensure timely compliance and avoids unnecessary penalties.

Required Documents

To complete the Tpt form accurately, certain documents are required. These typically include:

- Income statements, such as W-2s or 1099s.

- Records of any relevant transactions or deductions.

- Previous tax returns for reference, if applicable.

Having these documents ready will facilitate a smoother completion process and help ensure that all necessary information is reported accurately.

Quick guide on how to complete tpt form 100094545

Complete Tpt Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents with ease. Manage Tpt Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and electronically sign Tpt Form without hassle

- Find Tpt Form and click on Get Form to begin.

- Use the features we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that require reprinting of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign Tpt Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tpt form 100094545

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a TPT form and how is it used in airSlate SignNow?

A TPT form, or Third-Party Transfer form, is commonly used for document transfers in business processes. With airSlate SignNow, you can create, send, and eSign TPT forms easily, streamlining your workflow and ensuring compliance. The platform simplifies the handling of TPT forms by providing a user-friendly interface.

-

How does airSlate SignNow pricing work for TPT form usage?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those requiring TPT form functionalities. Pricing is based on the number of users and features selected, allowing you to manage costs effectively while maximizing your use of TPT forms. Specific discounts may be available for annual subscriptions.

-

What features does airSlate SignNow provide for TPT form management?

AirSlate SignNow includes several features for efficient TPT form management, such as customizable templates, automated workflows, and real-time tracking. Users can easily create and modify TPT forms, ensuring they meet regulatory compliance. The ability to integrate with other applications enhances the utility of TPT forms within your existing processes.

-

What are the benefits of using airSlate SignNow for TPT forms?

Using airSlate SignNow for TPT forms offers signNow benefits, including enhanced efficiency and reduced errors in document handling. The platform ensures quick turnaround times for document signing, which can lead to faster decision-making processes. Additionally, eSigning provides an added layer of security and traceability for your TPT forms.

-

Can I integrate airSlate SignNow with other software for TPT form management?

Yes, airSlate SignNow offers integrations with various software applications that can help in managing TPT forms more effectively. Integrations with CRM systems, document storage services, and other productivity tools can streamline your workflow. This interconnected approach enhances the versatility of TPT forms in your operations.

-

Is it possible to track the status of a TPT form sent through airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all TPT forms sent through the platform. This feature allows you to see when a document is opened, signed, and completed, giving you complete visibility over your TPT form processes. Notifications can also be set up to alert you of any updates.

-

How can I ensure my TPT form is secure when using airSlate SignNow?

Security is a top priority for airSlate SignNow, especially when handling TPT forms. The platform employs encryption and secure access protocols to protect your documents. Additionally, features like authentication options for signers add an extra layer of safety for your TPT forms.

Get more for Tpt Form

- Petition for involuntary admission for treatment virginia form

- Disability questionnaire 35106849 form

- Skd kanker doc form

- Southern california region a nonprofit corporation eoc 18 kaiser permanente traditional plan evidence of coverage for county of form

- Ap world history must know dates answer key nov 24 form

- Notice of intended delivery excel sterigenics form

- Modified duty form

- Firefighter medical clearance form bozrah bozrahfire

Find out other Tpt Form

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document