State Form 48845

What is the State Form 48845

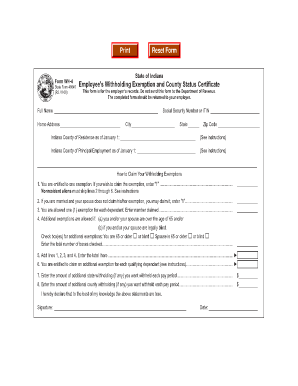

The State Form 48845, commonly known as the Indiana WH-4 form, is a crucial document used by employees in Indiana to determine their state income tax withholding. This form allows employees to specify the number of allowances they wish to claim, which directly affects the amount of state income tax withheld from their paychecks. Understanding this form is essential for ensuring that the correct amount of taxes is withheld, helping to avoid underpayment or overpayment of taxes throughout the year.

Steps to complete the State Form 48845

Completing the Indiana WH-4 form involves several straightforward steps:

- Begin by providing your personal information, including your name, address, and Social Security number.

- Indicate your filing status, which can be single, married, or head of household.

- Determine the number of allowances you wish to claim. This number can affect your withholding amount; generally, more allowances mean less tax withheld.

- If applicable, indicate any additional amount you want withheld from your paycheck.

- Sign and date the form to certify that the information provided is accurate.

How to obtain the State Form 48845

The Indiana WH-4 form can be easily obtained through various channels. It is available online through the Indiana Department of Revenue's official website, where you can download and print the form. Additionally, employers may provide the form to their employees during onboarding or upon request. It is important to ensure you are using the most current version of the form to comply with state regulations.

Legal use of the State Form 48845

The Indiana WH-4 form is legally binding once completed and submitted to your employer. It is essential for ensuring compliance with Indiana state tax laws. Employers are required to use the information provided on the form to calculate the appropriate amount of state income tax to withhold from employees' wages. Failure to submit a completed form may result in the employer withholding the maximum amount of state tax, which could lead to over-withholding for the employee.

Key elements of the State Form 48845

Several key elements are critical when filling out the Indiana WH-4 form:

- Personal Information: Accurate personal details are necessary for proper identification.

- Filing Status: This determines the tax rate applied to your income.

- Allowances: The number of allowances claimed directly influences the withholding amount.

- Additional Withholding: If you anticipate owing more taxes, you can specify an additional amount to be withheld.

Form Submission Methods (Online / Mail / In-Person)

Once the Indiana WH-4 form is completed, it must be submitted to your employer. This can typically be done in several ways:

- In-Person: Handing the form directly to your employer or payroll department.

- Mail: Sending the completed form via postal service if your employer accepts submissions this way.

- Online: Some employers may allow electronic submission of the form through their payroll systems.

Quick guide on how to complete state form 48845

Complete State Form 48845 effortlessly on any gadget

Digital document handling has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the correct format and securely store it online. airSlate SignNow provides you with all the tools required to generate, modify, and electronically sign your documents promptly without interruptions. Manage State Form 48845 on any gadget with airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The simplest method to modify and electronically sign State Form 48845 with ease

- Find State Form 48845 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere moments and holds the same legal significance as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Alter and electronically sign State Form 48845 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state form 48845

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is WH 4 Indiana in relation to eSignature solutions?

WH 4 Indiana refers to the specific tax form used by employees in Indiana. Understanding how to manage this form while utilizing eSignature solutions like airSlate SignNow can streamline your document processing, ensuring compliance and efficiency in managing employee records.

-

How can airSlate SignNow assist with completing the WH 4 Indiana form?

airSlate SignNow allows you to easily create, send, and eSign the WH 4 Indiana form. With our platform, you can ensure that all necessary fields are filled out correctly and securely get signatures from your employees, simplifying the filing process.

-

What are the pricing options for airSlate SignNow when handling forms like WH 4 Indiana?

airSlate SignNow offers flexible pricing plans, making it accessible for businesses of all sizes to manage important documents like the WH 4 Indiana form. Each plan provides robust features that cater to your eSignature needs while maintaining budget efficiency.

-

What features make airSlate SignNow ideal for managing tax forms such as WH 4 Indiana?

airSlate SignNow includes features like easy document creation, automated workflows, and real-time tracking, specifically beneficial for tax forms like WH 4 Indiana. These tools help businesses ensure compliance and reduce administrative burden.

-

Can I integrate airSlate SignNow with other software for managing WH 4 Indiana forms?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your ability to manage tax forms like WH 4 Indiana. This allows for seamless document flow between systems, promoting efficiency and ease of access to crucial information.

-

What benefits does airSlate SignNow provide for businesses in relation to the WH 4 Indiana form?

Using airSlate SignNow for the WH 4 Indiana form can drastically reduce turnaround time for document processing and improve accuracy. Additionally, our solution ensures that all documents are secure, tamper-proof, and easily retrievable, adding a layer of protection to sensitive information.

-

Is customer support available for assistance with WH 4 Indiana through airSlate SignNow?

Absolutely! Our dedicated customer support team is available to help you navigate any issues related to the WH 4 Indiana form within airSlate SignNow. Whether you have questions about features or need assistance with document setup, we're here to help.

Get more for State Form 48845

- Ads cancellation request form 10 15 final

- Small claims settlement agreement template form

- Blanket field trip permission form polk county school district polk fl

- Judgment of dissolution of marriage with children form

- Vesting form

- Letter to beneficiary notification form

- Intake form aclu of san diego amp imperial counties aclusandiego

- Employee invoice contract template form

Find out other State Form 48845

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later