620 F Street NW, Suite 700, Washington DC 20004 1627 2019-2026

Understanding the IPF Pension Fund

The IPF pension fund is a retirement savings plan designed to provide financial security for individuals during their retirement years. It pools contributions from members and invests them to generate returns over time. Understanding how the fund operates is essential for participants to make informed decisions about their retirement planning.

Benefits of the IPF pension fund include tax advantages, potential employer contributions, and a structured approach to saving for retirement. Participants can often choose from various investment options based on their risk tolerance and financial goals.

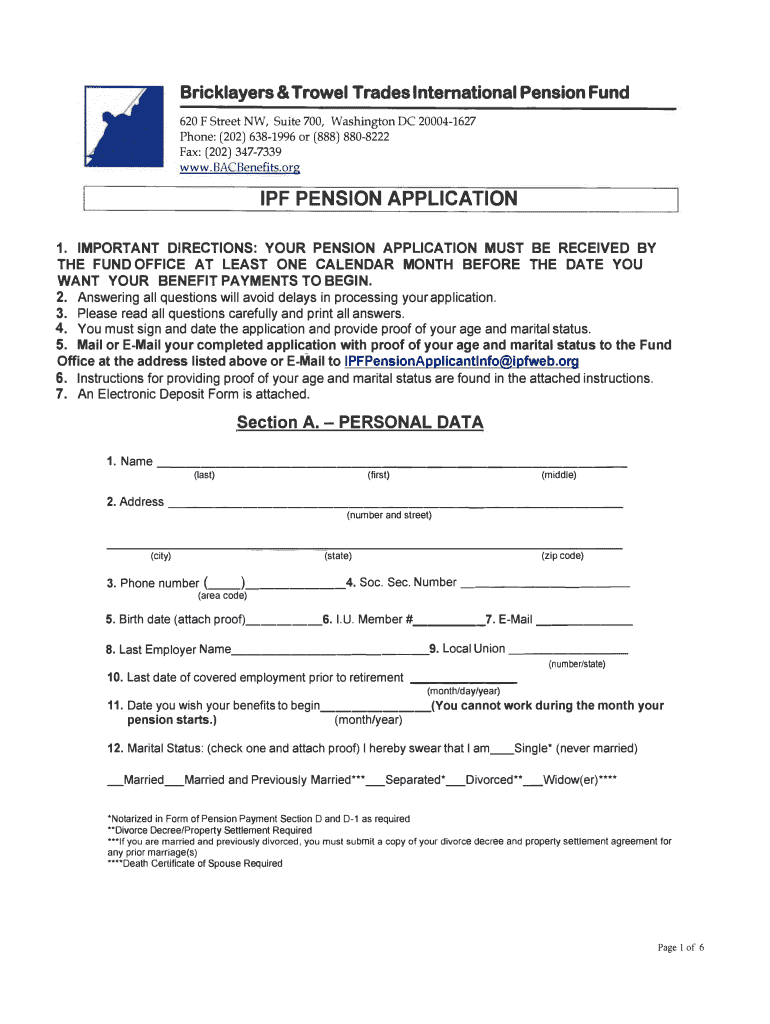

Eligibility Criteria for the IPF Pension Application

To apply for the IPF pension fund, individuals must meet specific eligibility criteria. Generally, these criteria include being a member of a participating organization and reaching a minimum age requirement. Some funds may also require a certain length of service or contributions to qualify for benefits.

It is important to review the specific eligibility requirements associated with the IPF pension fund to ensure compliance and maximize benefits.

Steps to Complete the IPF Application Form

Completing the IPF application form involves several straightforward steps. First, gather all necessary personal information, including identification, employment history, and financial details. Next, fill out the application form accurately, ensuring that all sections are completed.

Once the form is filled out, review it for accuracy before submitting it. Digital submission options may be available, allowing for a quicker and more efficient process. Ensure that you keep a copy of the submitted application for your records.

Required Documents for the IPF Pension Application

When applying for the IPF pension fund, specific documents are typically required. Commonly requested documents include proof of identity, such as a driver's license or passport, and employment verification, which may include pay stubs or tax returns.

Additionally, you may need to provide documentation of previous pension contributions or other retirement accounts to support your application. Having these documents ready can streamline the application process.

Form Submission Methods for the IPF Pension Fund

The submission of the IPF pension application can often be done through various methods. Many organizations now offer online submission, which allows for a faster and more convenient process. Alternatively, applicants may have the option to submit their forms via mail or in-person at designated locations.

Choosing the right submission method depends on personal preference and the specific requirements of the pension fund. It is advisable to verify the submission guidelines to ensure compliance.

Legal Use of the IPF Pension Fund

The legal framework surrounding the IPF pension fund is essential for protecting the rights of participants. Understanding the laws that govern pension funds, including the Employee Retirement Income Security Act (ERISA), can help individuals navigate their rights and responsibilities.

Compliance with these laws ensures that the fund operates fairly and transparently, providing participants with the benefits they are entitled to. It is important for applicants to be aware of their legal rights when engaging with the IPF pension fund.

Quick guide on how to complete 620 f street nw suite 700 washington dc 20004 1627

Complete 620 F Street NW, Suite 700, Washington DC 20004 1627 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage 620 F Street NW, Suite 700, Washington DC 20004 1627 on any platform using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to modify and eSign 620 F Street NW, Suite 700, Washington DC 20004 1627 with ease

- Obtain 620 F Street NW, Suite 700, Washington DC 20004 1627 and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or conceal sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, the hassle of searching through forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 620 F Street NW, Suite 700, Washington DC 20004 1627 and guarantee effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 620 f street nw suite 700 washington dc 20004 1627

Create this form in 5 minutes!

How to create an eSignature for the 620 f street nw suite 700 washington dc 20004 1627

The way to create an eSignature for your PDF document online

The way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What is the ipf pension fund?

The ipf pension fund is a retirement savings plan designed to provide employees with financial security in their retirement years. It offers various investment options and aims to maximize returns over time. Participants can benefit from professional management and strategic asset allocation for a secure financial future.

-

How does the ipf pension fund work?

The ipf pension fund operates by pooling contributions from employers and employees, which are then invested to grow over time. Participants can select from different investment strategies based on their retirement goals. This accumulation of investment growth leads to a larger pension payout upon retirement.

-

What are the benefits of joining the ipf pension fund?

Joining the ipf pension fund provides numerous advantages, including tax efficiency and the potential for higher returns through diversified investments. Additionally, members gain access to expert financial management. The fund also offers peace of mind knowing you are financially preparing for your retirement.

-

What fees are associated with the ipf pension fund?

The ipf pension fund typically charges management fees, which can vary based on the investment strategy chosen. It's important to review these fees, as they can impact your overall returns. Transparency is a priority, and all costs will be clearly outlined during the enrollment process.

-

Can I customize my investment options within the ipf pension fund?

Yes, the ipf pension fund allows participants to customize their investment options based on personal risk tolerance and retirement timelines. This flexibility enables you to align your investments with your financial goals and market conditions. Regular reviews and adjustments can help optimize your portfolio.

-

What kind of support does the ipf pension fund offer its members?

Members of the ipf pension fund have access to customer service representatives who can assist with any questions or concerns. Furthermore, educational resources are provided to help members understand their investment strategies and retirement planning. Ongoing support ensures that participants feel informed and secure.

-

Is the ipf pension fund compatible with other retirement plans?

Yes, the ipf pension fund is designed to complement other retirement plans you may have. It can be integrated with employer-sponsored plans or individual retirement accounts, enhancing your overall retirement savings strategy. This compatibility allows for a more comprehensive approach to financial planning.

Get more for 620 F Street NW, Suite 700, Washington DC 20004 1627

Find out other 620 F Street NW, Suite 700, Washington DC 20004 1627

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice