Lic Jeevan Amar Proposal Form 512

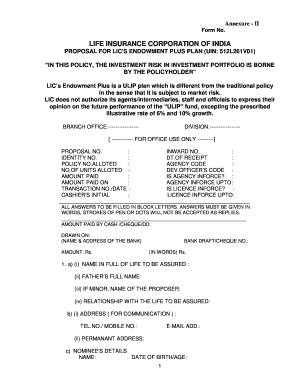

What is the LIC Pension Plus Proposal Form?

The LIC Pension Plus Proposal Form is a crucial document used to apply for the LIC Pension Plus plan, which offers a combination of life insurance and pension benefits. This form collects essential information about the applicant, including personal details, nominee information, and the desired sum assured. Understanding the purpose of this form is vital for anyone looking to secure their financial future through this plan.

Steps to Complete the LIC Pension Plus Proposal Form

Completing the LIC Pension Plus Proposal Form requires careful attention to detail. Here are the key steps to follow:

- Begin by filling in your personal information, including your name, address, and contact details.

- Provide information about your nominee, ensuring to include their relationship to you.

- Specify the sum assured and the premium payment frequency that suits your financial situation.

- Review the declaration section, confirming that all information provided is accurate and complete.

- Sign and date the form to validate your application.

How to Obtain the LIC Pension Plus Proposal Form

The LIC Pension Plus Proposal Form can be obtained through various channels. You can download the form in PDF format from the official LIC website or visit your nearest LIC branch to collect a physical copy. Ensure that you have the latest version of the form to avoid any issues during the application process.

Legal Use of the LIC Pension Plus Proposal Form

Using the LIC Pension Plus Proposal Form legally involves adhering to specific regulations. The form must be filled out accurately, as any discrepancies can lead to complications in the application process. It is essential to ensure that the information provided is truthful and complete to avoid any legal repercussions or denial of benefits.

Key Elements of the LIC Pension Plus Proposal Form

The LIC Pension Plus Proposal Form contains several key elements that are critical for processing your application. These include:

- Personal Information: Details about the applicant, including identification and contact information.

- Nominee Details: Information about the individual who will receive benefits in case of the applicant's demise.

- Plan Selection: Options for the type of pension plan and sum assured.

- Payment Details: Information on premium payment frequency and method.

Form Submission Methods

The completed LIC Pension Plus Proposal Form can be submitted through various methods. You can choose to submit it online via the LIC portal or deliver it in person at a local LIC office. Some applicants may prefer to send the form via postal mail, ensuring it reaches the appropriate department. Each method has its advantages, so choose the one that best fits your needs.

Quick guide on how to complete lic jeevan amar proposal form 512

Effortlessly Prepare Lic Jeevan Amar Proposal Form 512 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Lic Jeevan Amar Proposal Form 512 on any platform with the airSlate SignNow mobile applications for Android or iOS and enhance any document-related process today.

How to Edit and Electronically Sign Lic Jeevan Amar Proposal Form 512 with Ease

- Find Lic Jeevan Amar Proposal Form 512 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred delivery method for the form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Lic Jeevan Amar Proposal Form 512 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lic jeevan amar proposal form 512

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How to fill LIC maturity form online?

How Can I Claim LIC Maturity Online? Step 1: Visit the official website of LIC. Step 2: Click on the “Customer Services” tab and select the “Claim Forms” option. Step 3: Choose the Maturity claim form based on the policy type. Step 4: Fill in the form with the required details and attach the necessary documents.

-

What is the grace period for Jeevan Amar?

A grace period of 30 days shall be allowed for payment of yearly or half yearly premiums from the date of First unpaid premium. If the premium is not paid before the expiry of the days of grace, the Policy lapses.

-

What documents are required for LIC Jeevan Amar policy?

To buy the LIC Jeevan Amar Plan policy, one has to provide: Identity proof - Aadhar card, voter's card, and passport. Address proof- Aadhar card, driving license, electricity bill, ration card, voter's card, and/or passport. Income proof - such as Income tax returns or salary slips.

-

What is the LIC Jeevan Amar plan?

LIC's New Jeevan Amar is a Non-Linked, Non-participating, Individual, Pure Risk Premium Life Insurance Plan, which provides financial protection to the insured's family in case of his/her unfortunate death during the policy term.

-

What is the survival benefit of LIC maturity?

Survival Benefit: On the Life Assured surviving the policy anniversary coinciding with or immediately following the completion of ages 18 years, 20 years and 22 years, 20% of the Basic Sum Assured on each occasion shall be payable, provided the policy is in full force.

-

How to fill a proposal form?

Components of a Proposal Form Personal Information: This includes the applicant's name, age, gender, occupation, and contact details. Policy Details The applicant specifies the type of insurance policy they are applying for, the term of the policy, and the sum assured or coverage amount.

-

What is the benefit of the Jeevan Amar policy?

Benefits of LIC Jeevan Amar Plan The benefit paid for regular and limited premium payment plans will be the highest of: 7 times the annualized premiums paid or. 105% of the premiums paid till death or. the absolute sum assured to be paid on death.

-

What is the premium amount for Jeevan Amar?

Option I (Level Sum Assured) Premium Chart AgePolicy TermAnnual Premium for Limited Premium Paying Term of (Policy Term minus 5) years 20 20 Rs. 6,873 30 20 Rs. 9,091 40 20 Rs. 18,067

Get more for Lic Jeevan Amar Proposal Form 512

- Solved adobe reader 8 or higher 10987122 form

- New jersey surrogate court by countytrust ampamp will form

- Hmsb navy form

- Take flight over travis travis air force base af mil form

- Refractive surgery center naval hospital bremerton med navy form

- Certification certify form

- Nppsc 1160 1 571954859 form

- Bupersinst 1730 11a form

Find out other Lic Jeevan Amar Proposal Form 512

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer