Transfer Property Title Form

What is the Transfer Property Title

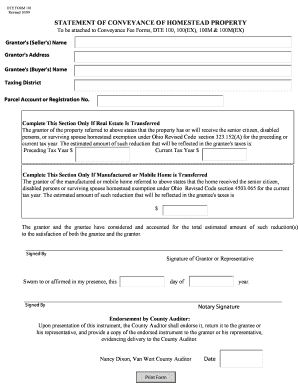

The Transfer Property Title is a legal document used to transfer ownership of real estate from one party to another. In Ohio, this document is often referred to in conjunction with the Cuyahoga County DTE Form 101. It serves as a formal acknowledgment of the transfer and is essential for updating public records. The title includes information about the property, such as its legal description, the names of the parties involved, and the terms of the transfer.

Steps to Complete the Transfer Property Title

Completing the Transfer Property Title involves several key steps to ensure accuracy and compliance with local regulations. First, gather all necessary information, including the property’s legal description and the names of the buyer and seller. Next, fill out the Cuyahoga County DTE Form 101 carefully, ensuring that all fields are completed accurately. After filling out the form, both parties should review it for correctness before signing. Finally, submit the completed form to the appropriate county office for recording.

Legal Use of the Transfer Property Title

The Transfer Property Title is legally binding once it has been signed by the involved parties and recorded with the county. This document is crucial for establishing ownership rights and protecting against future claims on the property. In Ohio, compliance with state laws and local regulations is essential for the validity of the transfer. Ensuring that the form is correctly filled out and submitted helps to avoid potential legal disputes regarding property ownership.

Required Documents

To complete the Transfer Property Title, several documents may be required. These typically include proof of identity for both the buyer and seller, the original deed, and any previous transfer documents. Additionally, if applicable, a tax statement or other financial documents may be needed to verify the status of the property. Having these documents ready will facilitate a smoother transfer process.

Form Submission Methods

The Cuyahoga County DTE Form 101 can be submitted through various methods, including online, by mail, or in person. For online submissions, ensure that the digital format complies with local requirements. If submitting by mail, it is advisable to use a trackable service to confirm receipt. In-person submissions allow for immediate confirmation but may require an appointment depending on the county office's policies.

Who Issues the Form

The Cuyahoga County DTE Form 101 is issued by the Cuyahoga County Fiscal Officer’s office. This office is responsible for maintaining public records related to property ownership and transfers. It is important to ensure that the form is obtained from the official office to guarantee that it meets all necessary legal standards.

Quick guide on how to complete transfer property title

Prepare Transfer Property Title effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Transfer Property Title on any device using the airSlate SignNow apps for Android or iOS and enhance any document-based process today.

How to adjust and eSign Transfer Property Title with ease

- Locate Transfer Property Title and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred delivery method for your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Update and eSign Transfer Property Title while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the transfer property title

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Cuyahoga County DTE Form 101?

The Cuyahoga County DTE Form 101 is a crucial document used for property tax exemption in Cuyahoga County, Ohio. It allows property owners to apply for a reduction in property taxes based on specific eligibility criteria. Understanding and correctly filling out this form can greatly benefit property owners.

-

How can airSlate SignNow help with the Cuyahoga County DTE Form 101?

airSlate SignNow provides a seamless way to complete and eSign the Cuyahoga County DTE Form 101. With our platform, you can easily manage the document lifecycle, ensuring that all necessary signatures are acquired in a timely manner. This helps streamline your application process for tax exemptions.

-

Is there a cost associated with using airSlate SignNow for the Cuyahoga County DTE Form 101?

Using airSlate SignNow for the Cuyahoga County DTE Form 101 is cost-effective, with flexible pricing plans tailored to fit different business needs. Our plans offer competitive rates that provide excellent value for the services we deliver. You can choose the pricing structure that aligns with your volume of document processing.

-

What are the benefits of using airSlate SignNow for completing the Cuyahoga County DTE Form 101?

The primary benefits of using airSlate SignNow for the Cuyahoga County DTE Form 101 include increased efficiency and reduced paperwork. Our user-friendly platform simplifies the signing process, allowing you to track the status of your form in real-time. Additionally, it ensures compliance and security, so you can submit your form with confidence.

-

Can I integrate airSlate SignNow with other tools for the Cuyahoga County DTE Form 101?

Yes, airSlate SignNow offers several integration options for various business tools. This makes it easy to incorporate your existing workflows when handling the Cuyahoga County DTE Form 101. By integrating with popular applications, you can enhance productivity and streamline your document management processes.

-

What features does airSlate SignNow offer that are beneficial for the Cuyahoga County DTE Form 101?

airSlate SignNow provides essential features such as customizable templates, secure cloud storage, and automated reminders specifically for handling the Cuyahoga County DTE Form 101. These features ensure that you can create, manage, and track your document submissions effortlessly and securely. They simplify the signing process and help meet deadlines efficiently.

-

How can I ensure my submission of the Cuyahoga County DTE Form 101 is secure?

With airSlate SignNow, you can rest assured that your submission of the Cuyahoga County DTE Form 101 is secure. We utilize advanced encryption and security protocols to protect your documents throughout the signing process. Additionally, our platform complies with industry standards, ensuring that sensitive information remains confidential.

Get more for Transfer Property Title

- Witness list united states courts flmd uscourts form

- Notice of appeal us court of appeals third circuit paw fd form

- In the court of common pleas of philadelphia county plaintiff vs form

- I affirm that the owners or lessees of leased vehi form

- Fillable online vehicle storage agreement st paul form

- Satchel onelearning platform

- Dl 208 form

- Ol 124 form

Find out other Transfer Property Title

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form