Tomorrow's Scholar Forms 2012

What is the Tomorrow's Scholar Withdrawal?

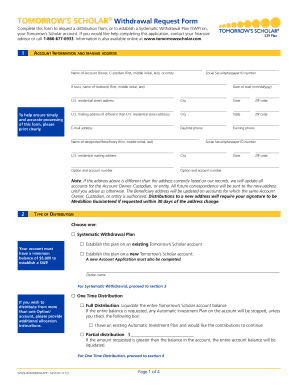

The Tomorrow's Scholar withdrawal refers to the process by which account holders can withdraw funds from their Tomorrow's Scholar 529 plan. This plan is designed to help families save for future education expenses. The withdrawal process is crucial for ensuring that funds are accessed appropriately and used for qualified educational expenses, such as tuition, fees, and other related costs. Understanding the specifics of this withdrawal process can help account holders manage their funds effectively.

Steps to Complete the Tomorrow's Scholar Withdrawal Request Form

Completing the Tomorrow's Scholar withdrawal request form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your account number and the amount you wish to withdraw. Next, fill out the form with your personal details, ensuring that all information is correct. After completing the form, review it for any errors before submitting. Finally, choose your preferred method of receiving the funds, whether through a check or direct deposit.

Legal Use of the Tomorrow's Scholar Withdrawal Form

The Tomorrow's Scholar withdrawal form must be used in accordance with specific legal guidelines to ensure that withdrawals are compliant with state and federal regulations. The funds withdrawn should only be used for qualified educational expenses as defined by the IRS. Failing to comply with these regulations may result in penalties, including taxes on the earnings portion of the withdrawal. It is essential to understand these legal implications when completing the withdrawal process.

Required Documents for Tomorrow's Scholar Withdrawal

When submitting a withdrawal request for the Tomorrow's Scholar plan, specific documents may be required to process your request efficiently. Typically, you will need to provide proof of enrollment or payment for qualified educational expenses, such as tuition bills or receipts. Additionally, having your account information readily available will expedite the process. Ensure that all documentation is accurate and up to date to avoid delays in your withdrawal request.

Form Submission Methods for Tomorrow's Scholar Withdrawal

The Tomorrow's Scholar withdrawal request form can be submitted through various methods, providing flexibility for account holders. Options generally include online submission through the official website, mailing a physical copy of the form, or submitting it in person at designated locations. Each method has its own processing times, so it is advisable to choose the one that best fits your needs and timeline for accessing funds.

Eligibility Criteria for Tomorrow's Scholar Withdrawal

To be eligible for a withdrawal from the Tomorrow's Scholar plan, account holders must meet certain criteria. Primarily, the funds must be used for qualified educational expenses as outlined by the IRS. Additionally, the account must have been open for a specified period, and the withdrawal amount should not exceed the total contributions made to the account. Understanding these eligibility requirements is crucial to ensure that your withdrawal is processed without issues.

Quick guide on how to complete tomorrows scholar forms

Effortlessly Prepare Tomorrow's Scholar Forms on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents rapidly without delays. Manage Tomorrow's Scholar Forms on any platform using the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

How to Edit and eSign Tomorrow's Scholar Forms with Ease

- Find Tomorrow's Scholar Forms and click on Get Form to begin.

- Use the tools provided to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all details and click the Done button to confirm your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Tomorrow's Scholar Forms to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tomorrows scholar forms

Create this form in 5 minutes!

How to create an eSignature for the tomorrows scholar forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tomorrow's scholar withdrawal and how does it work?

Tomorrow's scholar withdrawal refers to the process of easily managing and executing withdrawal requests related to scholarship funds. With airSlate SignNow, you can streamline the document signing necessary for this process, allowing students and administrators to complete withdrawals efficiently.

-

How can airSlate SignNow help with tomorrow's scholar withdrawal?

AirSlate SignNow offers a user-friendly platform that facilitates the quick eSigning of documents related to tomorrow's scholar withdrawal. This ensures that all necessary paperwork is handled seamlessly, saving time and reducing administrative hassles for educational institutions.

-

Are there any costs associated with using airSlate SignNow for tomorrow's scholar withdrawal?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different organizations. You can explore these plans to find one that fits your budget while ensuring you can handle tomorrow's scholar withdrawal processes effectively.

-

What features does airSlate SignNow provide for managing tomorrow's scholar withdrawal?

AirSlate SignNow includes features such as customizable templates, secure document storage, and real-time tracking, which all enhance the process for tomorrow's scholar withdrawal. These tools help ensure that every step is accounted for, making the experience smooth for both students and administrators.

-

Are there any integrations available with airSlate SignNow for tomorrow's scholar withdrawal processes?

Absolutely! AirSlate SignNow integrates with a variety of productivity and document management tools, allowing for seamless handling of tomorrow's scholar withdrawal tasks. This means you can incorporate your existing systems and maximize efficiency.

-

What are the benefits of using airSlate SignNow for tomorrow's scholar withdrawal over traditional methods?

Using airSlate SignNow for tomorrow's scholar withdrawal provides faster processing times, reduced paperwork, and enhanced security compared to traditional methods. The electronic signing capability minimizes delays and simplifies the workflow for all parties involved.

-

Can I track the status of tomorrow's scholar withdrawal documents with airSlate SignNow?

Yes, airSlate SignNow allows users to track the status of their documents related to tomorrow's scholar withdrawal. You'll receive notifications and updates, ensuring you are always informed about the signing process without needing to manually follow up.

Get more for Tomorrow's Scholar Forms

- District vi juvenile detention center bannock county idaho form

- Empower form

- Ira beneficiary claim request wells fargo advantage funds form

- Trust account autherazation and agreement form edward jones

- Health savings account transferrollover request form

- Tn permit building application form

- Cbp explorer post 1801 form

- Payment information

Find out other Tomorrow's Scholar Forms

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter