Homestead Act for Clermont County Ohio to Fill Out Online Form

What is the Clermont County Homestead Exemption?

The Clermont County homestead exemption is a property tax reduction program designed to provide financial relief to eligible homeowners. This exemption allows qualifying individuals, typically seniors or disabled persons, to reduce the taxable value of their primary residence. By lowering the assessed value, homeowners can benefit from decreased property tax bills, making homeownership more affordable.

Eligibility Criteria for the Clermont County Homestead Exemption

To qualify for the Clermont County homestead exemption, applicants must meet specific criteria. Generally, homeowners must be at least sixty-five years old or permanently and totally disabled. Additionally, the property must be the applicant's primary residence, and there may be income limits that apply. It is essential to check local regulations to ensure compliance with all eligibility requirements.

Steps to Complete the Clermont County Homestead Exemption Online

Filling out the Clermont County homestead exemption form online is a straightforward process. Here are the steps to follow:

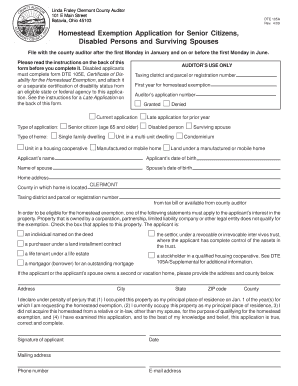

- Visit the official Clermont County website to access the homestead exemption form.

- Fill out the required fields, including personal information and property details.

- Provide documentation that verifies eligibility, such as proof of age or disability.

- Review the completed form for accuracy and completeness.

- Submit the form electronically through the designated online portal.

Required Documents for the Clermont County Homestead Exemption

When applying for the Clermont County homestead exemption, specific documents are necessary to support your application. Commonly required documents include:

- Proof of age or disability, such as a government-issued ID or medical documentation.

- Proof of income, if applicable, to demonstrate eligibility.

- Property deed or tax bill to confirm ownership of the primary residence.

Legal Use of the Clermont County Homestead Exemption

The Clermont County homestead exemption is legally recognized and provides homeowners with a legitimate way to reduce their property tax burden. To ensure compliance, it is crucial to follow all application guidelines and maintain accurate records. Homeowners should also be aware of any changes in eligibility or local laws that may affect their exemption status.

Form Submission Methods for the Clermont County Homestead Exemption

Homeowners in Clermont County have multiple options for submitting their homestead exemption forms. The primary methods include:

- Online submission through the official county website, which is the most efficient method.

- Mailing a printed version of the form to the appropriate county office.

- In-person submission at designated county offices for those who prefer direct interaction.

Quick guide on how to complete homestead act for clermont county ohio to fill out online

Effortlessly Prepare Homestead Act For Clermont County Ohio To Fill Out Online on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It presents an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Homestead Act For Clermont County Ohio To Fill Out Online on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to Modify and eSign Homestead Act For Clermont County Ohio To Fill Out Online Seamlessly

- Obtain Homestead Act For Clermont County Ohio To Fill Out Online and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device of your choice. Edit and eSign Homestead Act For Clermont County Ohio To Fill Out Online to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the homestead act for clermont county ohio to fill out online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Clermont County homestead exemption?

The Clermont County homestead exemption is a property tax reduction program that offers financial relief to eligible homeowners. This exemption assists in lowering the taxable value of your home, making it more affordable for residents. By learning about the Clermont County homestead exemption, homeowners can save signNow amounts on their property taxes over time.

-

Who qualifies for the Clermont County homestead exemption?

To qualify for the Clermont County homestead exemption, homeowners must meet specific criteria, including age, income, and residency status. Generally, the program is available to seniors, disabled individuals, or those with low-incomes. By understanding the eligibility requirements for the Clermont County homestead exemption, homeowners can determine if they can apply for tax savings.

-

How do I apply for the Clermont County homestead exemption?

Homeowners can apply for the Clermont County homestead exemption by completing an application form available at the county auditor’s office or its website. It's essential to gather necessary documentation such as proof of income and residency before applying. The application process can simplify your path to obtaining the Clermont County homestead exemption for tax relief.

-

What are the benefits of the Clermont County homestead exemption?

The Clermont County homestead exemption provides homeowners with a reduction in their taxable property value, leading to lower annual property taxes. This financial benefit helps residents manage their budgets more effectively and maintain their homes without overwhelming costs. By leveraging the Clermont County homestead exemption, homeowners can achieve long-term savings.

-

How much can I save with the Clermont County homestead exemption?

The savings with the Clermont County homestead exemption can vary based on property value and eligibility. Homeowners may receive a signNow reduction in their taxable amount, ultimately decreasing their annual property tax bills. Knowing the potential savings from the Clermont County homestead exemption can encourage homeowners to apply and benefit from the program.

-

Can I combine the Clermont County homestead exemption with other tax exemptions?

Yes, homeowners in Clermont County can often combine the homestead exemption with other tax exemptions, provided they meet the respective eligibility criteria. This combination can lead to even greater savings on property taxes. It’s beneficial to explore the options available alongside the Clermont County homestead exemption to maximize financial relief.

-

What documents do I need for the Clermont County homestead exemption application?

When applying for the Clermont County homestead exemption, homeowners typically need to provide proof of residency, income documentation, and identification. Essential documents can include utility bills, tax returns, and other official paperwork. Being prepared with the required paperwork can streamline your application for the Clermont County homestead exemption.

Get more for Homestead Act For Clermont County Ohio To Fill Out Online

- Transcript request form do not email word doc to students nhia

- Neuroscience for kids drawing contest official entry form faculty washington

- Xavier university of louisiana office of student f form

- Download transcript request form youngstown state university web ysu

- Course planning form for next four semesters name

- Idaho state university office of human resources r form

- Form 3 accounts receivable write off request depa

- Change of major form revised 9 21 10 ww2 nscc

Find out other Homestead Act For Clermont County Ohio To Fill Out Online

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document