Tn Bus 415 Form

What is the Tn Bus 415

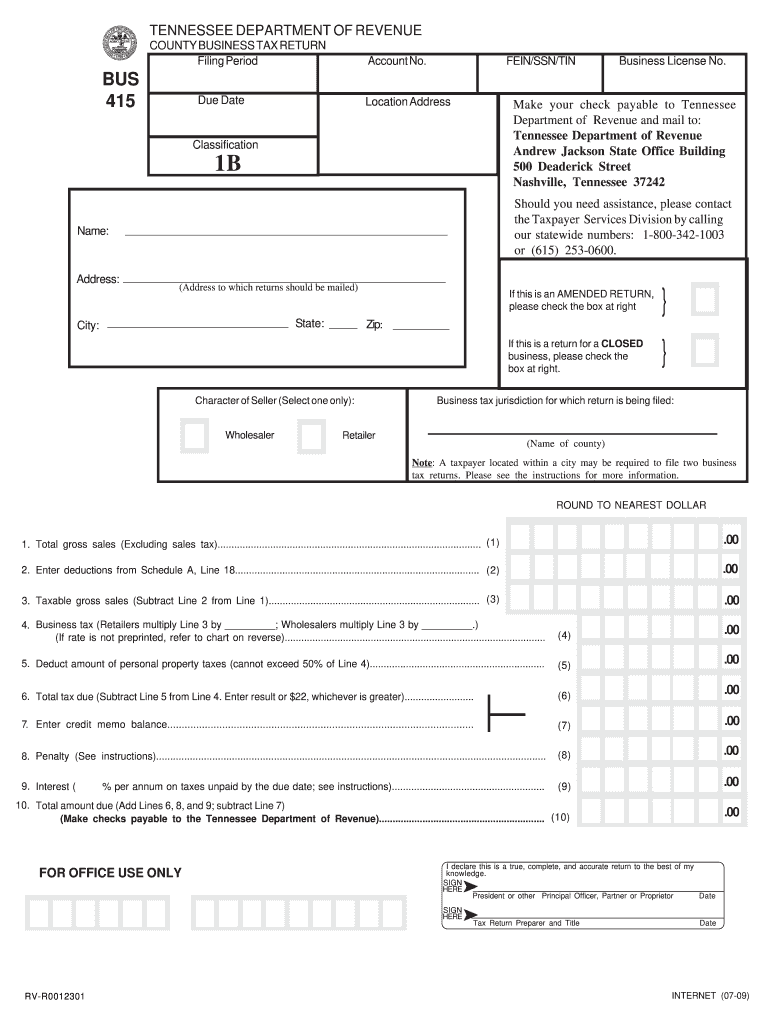

The Tn Bus 415 form is a specific document used primarily for reporting and compliance within the state of Tennessee. It is often required for various business and tax-related purposes, ensuring that organizations adhere to state regulations. Understanding the purpose of this form is crucial for businesses and individuals who need to maintain compliance with local laws.

How to use the Tn Bus 415

Using the Tn Bus 415 form involves several steps to ensure accurate completion and submission. First, gather all necessary information, including business details, financial data, and any other relevant documentation. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once completed, the form can be submitted according to the specified guidelines, either online or through traditional mail, depending on the requirements set forth by the issuing authority.

Steps to complete the Tn Bus 415

Completing the Tn Bus 415 form requires attention to detail. Follow these steps:

- Review the form instructions thoroughly to understand the requirements.

- Collect all necessary documentation, including identification numbers and financial records.

- Fill out the form, ensuring that all information is accurate and complete.

- Double-check for any errors or omissions before finalizing the form.

- Submit the form through the appropriate channels, ensuring it is sent before the deadline.

Legal use of the Tn Bus 415

The Tn Bus 415 form must be used in accordance with state laws and regulations. It is essential to ensure that the information provided is truthful and accurate, as any discrepancies can lead to legal repercussions. Compliance with the legal requirements surrounding this form helps to avoid penalties and ensures that the document is recognized as valid by state authorities.

Who Issues the Form

The Tn Bus 415 form is issued by the Tennessee Department of Revenue. This agency is responsible for overseeing tax compliance and business regulations within the state. Understanding the issuing authority is important for ensuring that the form is completed and submitted correctly, as well as for obtaining any necessary updates or guidance related to the form.

Filing Deadlines / Important Dates

Filing deadlines for the Tn Bus 415 form can vary based on the specific requirements set by the Tennessee Department of Revenue. It is important to stay informed about these deadlines to avoid late submissions, which can result in penalties. Typically, deadlines align with the fiscal year or specific tax periods, so checking the latest updates from the issuing authority is advisable.

Quick guide on how to complete tn bus 415

Effortlessly Prepare Tn Bus 415 on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed paperwork, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle Tn Bus 415 across any platform with the airSlate SignNow apps for Android or iOS, and simplify your document-related tasks today.

How to Modify and Electronically Sign Tn Bus 415 with Ease

- Locate Tn Bus 415 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as an ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Wave goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Tn Bus 415 and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tn bus 415

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Tn Bus 415 and how does it benefit businesses?

Tn Bus 415 is a comprehensive document management service provided by airSlate SignNow that allows businesses to streamline their eSignature processes. By utilizing Tn Bus 415, organizations can efficiently send and eSign important documents, saving time and improving productivity.

-

How much does Tn Bus 415 cost for businesses?

The pricing for Tn Bus 415 varies based on the features and the number of users. airSlate SignNow offers flexible pricing plans that cater to both small businesses and larger enterprises, ensuring that you find a solution that fits your budget while leveraging the powerful capabilities of Tn Bus 415.

-

What features are included in Tn Bus 415?

Tn Bus 415 includes a range of features such as customizable templates, automated workflows, and real-time tracking of document status. These features help enhance efficiency and make the document signing process seamless, providing a robust solution for businesses.

-

Can Tn Bus 415 integrate with other software tools?

Yes, Tn Bus 415 offers integrations with various third-party applications such as Google Workspace, Salesforce, and Microsoft Office. This compatibility allows businesses to incorporate airSlate SignNow's eSigning capabilities into their existing workflows, enhancing productivity and maintaining consistency.

-

Is Tn Bus 415 user-friendly for newcomers?

Absolutely! Tn Bus 415 is designed with user-friendliness in mind. Its intuitive interface allows even those who are not tech-savvy to navigate easily, making it simple for businesses to adopt and implement into their everyday operations.

-

What benefits can businesses expect from using Tn Bus 415?

Businesses can expect increased efficiency, reduced document turnaround times, and improved security when using Tn Bus 415. By streamlining the eSignature process, organizations can focus more on their core activities and less on paperwork.

-

How secure is Tn Bus 415 for handling sensitive documents?

Tn Bus 415 prioritizes security with features like advanced encryption and compliance with industry standards. This ensures that all documents signed through airSlate SignNow are secure, giving businesses peace of mind when handling sensitive information.

Get more for Tn Bus 415

- Detailed questionnaire for the aquatic animal production industry water epa form

- Proof of investment form securities and exchange commission sec

- Application antenna structure registration form

- Open public records act request form

- Please note pickup for items in valley animal rescue form

- Development services contact uscity of edmontoncontactedmonton toweredmonton service centrecity of edmontonaboutedmonton tower form

- Loan guarantee form

- Icds survey form

Find out other Tn Bus 415

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile