St 50 Worksheet Form

What is the St 50 Worksheet

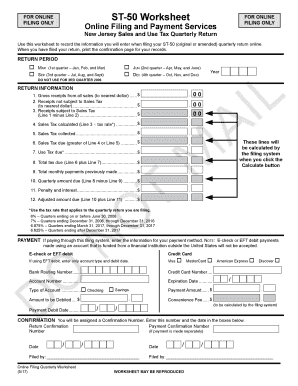

The St 50 Worksheet is a crucial document used in New Jersey for reporting sales and use tax. It serves as a means for businesses to calculate their tax obligations accurately. This form is specifically designed for those who are required to file sales tax returns in New Jersey, ensuring compliance with state tax laws. The worksheet helps in detailing taxable sales, exempt sales, and the total amount of tax due.

Steps to complete the St 50 Worksheet

Completing the St 50 Worksheet involves several key steps:

- Gather all necessary sales records, including invoices and receipts.

- Identify taxable and exempt sales, ensuring proper categorization.

- Calculate the total sales tax due based on the applicable rates.

- Fill out the worksheet accurately, entering all required information.

- Review the completed worksheet for any errors before submission.

Legal use of the St 50 Worksheet

The St 50 Worksheet is legally recognized as a valid document for reporting sales and use tax in New Jersey. To ensure its legal standing, businesses must adhere to the guidelines set forth by the New Jersey Division of Taxation. This includes maintaining accurate records and submitting the worksheet by the designated deadlines. Compliance with these regulations is essential to avoid penalties and ensure the legality of the submitted information.

Filing Deadlines / Important Dates

Timely filing of the St 50 Worksheet is essential for compliance. The deadlines for submitting this form typically align with the quarterly sales tax reporting schedule. Businesses should be aware of the specific due dates to avoid late fees and penalties. It is advisable to mark these important dates on a calendar to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

The St 50 Worksheet can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Many businesses opt to file electronically through the New Jersey Division of Taxation's online portal.

- Mail: Completed worksheets can be printed and mailed to the appropriate tax office.

- In-Person: Some may choose to submit the form in person at designated tax offices.

Required Documents

To complete the St 50 Worksheet, certain documents are necessary. These typically include:

- Sales invoices and receipts for the reporting period.

- Records of exempt sales and any supporting documentation.

- Previous sales tax returns, if applicable, for reference.

Quick guide on how to complete st 50 worksheet

Effortlessly handle St 50 Worksheet on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, alter, and electronically sign your documents promptly without any holdups. Manage St 50 Worksheet on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign St 50 Worksheet without hassle

- Find St 50 Worksheet and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the document or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all your data and click on the Done button to confirm your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and electronically sign St 50 Worksheet and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 50 worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to st 50?

airSlate SignNow is a comprehensive eSignature solution that enables businesses to send and eSign documents effortlessly. The st 50 plan offers powerful features designed to streamline your document signing processes while ensuring security and compliance.

-

What features does the st 50 plan include?

The st 50 plan includes essential features such as unlimited document signing, templates, team collaboration tools, and advanced security measures. These features help businesses enhance their document management processes and improve workflow efficiency.

-

How much does the st 50 plan cost?

The st 50 plan is competitively priced to offer great value for small to medium-sized businesses. Pricing includes a subscription model that ensures you receive ongoing updates and support without hidden fees, making it a cost-effective choice.

-

Can I integrate airSlate SignNow with other applications while using the st 50 plan?

Yes, the st 50 plan supports integration with various applications, including CRM systems, cloud storage services, and productivity tools. This flexibility allows businesses to create a seamless workflow and optimize their document management processes.

-

What are the benefits of using the st 50 plan for my business?

Using the st 50 plan provides numerous benefits, including improved turnaround times for document signing, enhanced security for sensitive information, and increased team collaboration. These advantages lead to greater productivity and a more efficient business operation.

-

Is the airSlate SignNow platform user-friendly for those considering the st 50 plan?

Absolutely! The airSlate SignNow platform is designed with user-friendliness in mind. Users of the st 50 plan can quickly learn to navigate the interface, making it easy to send and eSign documents without technical expertise.

-

What types of documents can be signed with the st 50 plan?

The st 50 plan allows you to sign a wide variety of documents, including contracts, agreements, and forms. This flexibility ensures that businesses can address all their document signing needs efficiently and securely.

Get more for St 50 Worksheet

- Fillable online supplemental application form bc housing

- John perkins memorial housing society form

- Mutual agreement to end a tenancy rtb 8 indd form

- Entre nous femmes housing society form

- City of ottawa community building facility rental general burns form

- How to request cctv footage for a personal injury claim form

- Va claims evaluation increase disability rating form

- South wigston health centre medical doctors in wigston form

Find out other St 50 Worksheet

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word