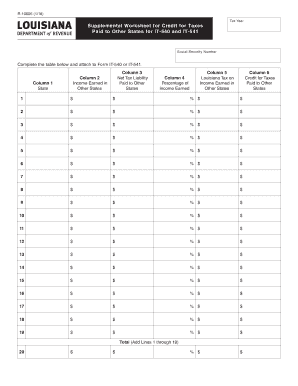

Form R 10606 2023

What is the Form R 10606

The Form R 10606 is a Louisiana tax form used primarily for reporting and claiming certain credits and deductions. This form is essential for individuals and businesses looking to ensure compliance with state tax regulations. Understanding its purpose helps taxpayers accurately report their financial activities and take advantage of available tax benefits.

Steps to Complete the Form R 10606

Completing the Form R 10606 involves several key steps to ensure accuracy and compliance:

- Gather necessary financial documents, including income statements and previous tax returns.

- Fill in personal information, such as your name, address, and Social Security number.

- Detail your income sources and any deductions or credits you are claiming.

- Review the completed form for accuracy and completeness.

- Sign and date the form to validate your submission.

Legal Use of the Form R 10606

The legal use of the Form R 10606 is governed by Louisiana tax laws. To be considered valid, the form must be filled out accurately and submitted by the designated deadlines. Compliance with these regulations ensures that the form is legally binding and can be used to support any claims or deductions made.

How to Obtain the Form R 10606

The Form R 10606 can be obtained through various channels:

- Visit the Louisiana Department of Revenue's official website for downloadable versions.

- Request a physical copy from local tax offices or state revenue offices.

- Consult with tax professionals who may provide the form as part of their services.

Form Submission Methods

Submitting the Form R 10606 can be done through several methods, depending on your preference:

- Online submission via the Louisiana Department of Revenue's e-filing system.

- Mailing the completed form to the appropriate state tax office address.

- In-person submission at designated tax offices across Louisiana.

Required Documents

To successfully complete and submit the Form R 10606, the following documents may be required:

- Proof of income, such as W-2 forms or 1099 statements.

- Documentation for any deductions or credits claimed.

- Previous tax returns for reference and accuracy.

Quick guide on how to complete form r 10606

Effortlessly Prepare Form R 10606 on Any Device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents quickly and without delays. Manage Form R 10606 on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to Edit and eSign Form R 10606 with Ease

- Find Form R 10606 and then click Get Form to begin.

- Use the available tools to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal significance as a traditional handwritten signature.

- Verify the details and then click the Done button to save your changes.

- Choose how you would like to send your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form R 10606 and ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form r 10606

Create this form in 5 minutes!

How to create an eSignature for the form r 10606

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form r 10606 and how does it work?

Form r 10606 is a specific document used for certain legal and financial processes. With airSlate SignNow, you can easily fill out, send, and eSign your form r 10606 in a secure manner, ensuring that all your signatures and information are validated electronically.

-

How much does airSlate SignNow cost for using form r 10606?

airSlate SignNow offers various pricing plans that cater to different business needs. Depending on your usage and the features you require for handling form r 10606, you can choose a plan that suits your budget while still enjoying all the essential functionalities.

-

What features does airSlate SignNow offer for form r 10606?

airSlate SignNow provides a range of features specifically designed to simplify the handling of form r 10606. These features include document templates, customizable fields, and advanced eSigning capabilities, allowing you to manage your documents efficiently.

-

Can I integrate airSlate SignNow with other applications while using form r 10606?

Yes, airSlate SignNow offers integrations with numerous applications and platforms, making it easy for you to streamline your workflow related to form r 10606. This allows you to sync data and access your documents from various tools you already use.

-

What are the benefits of using airSlate SignNow for form r 10606?

Using airSlate SignNow for form r 10606 brings many benefits, including enhanced security, reduced turnaround time, and increased productivity. The platform allows you to manage your documents digitally, reducing paper waste and the potential for human error.

-

Is airSlate SignNow user-friendly for filling out form r 10606?

Definitely! airSlate SignNow has a user-friendly interface that makes filling out form r 10606 easy for everyone. Whether you're a tech novice or an experienced user, the platform guides you through the process seamlessly.

-

How does airSlate SignNow ensure the security of form r 10606?

airSlate SignNow prioritizes security by implementing advanced encryption and compliance measures for documents like form r 10606. Your data is protected throughout the entire eSigning process to ensure confidentiality and integrity.

Get more for Form R 10606

- Attending physicians statement lc 7135 form

- California hospital association advance directive 520012679 form

- Sc town business license form

- Carelink electronic physician signature form

- The little clinic voucher for humanavitality living well ky gov form

- Showcase application ahima home ahima form

- Service area description form

- Hospital care assurance program ohio hospital association form

Find out other Form R 10606

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS