Form 8606

What is the Form 8606

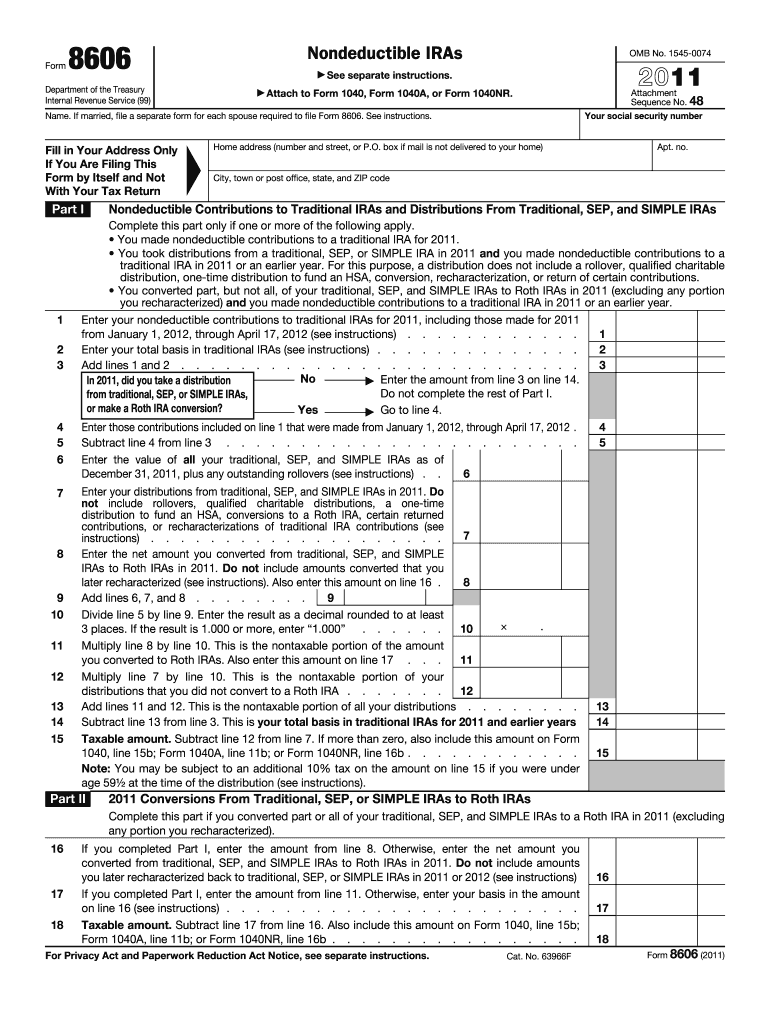

The IRS Form 8606 is a tax form used by individuals to report nondeductible contributions to traditional Individual Retirement Accounts (IRAs) and distributions from Roth IRAs. This form is essential for taxpayers who have made contributions to IRAs that were not tax-deductible, as it helps track the basis in the IRA. Additionally, it is used to report conversions from traditional IRAs to Roth IRAs and to calculate the taxable portion of distributions from these accounts. Understanding Form 8606 is crucial for ensuring accurate tax reporting and avoiding potential penalties.

How to use the Form 8606

Using IRS Form 8606 involves several key steps. First, determine if you need to file the form based on your IRA contributions and distributions. If you have made nondeductible contributions or have taken distributions from your Roth IRA, you will need to complete this form. Fill out the relevant sections, including reporting your contributions, conversions, and distributions. Ensure that you keep accurate records of your contributions, as this information will be necessary for future tax filings. Once completed, include the form with your annual tax return.

Steps to complete the Form 8606

Completing Form 8606 requires careful attention to detail. Follow these steps:

- Gather necessary information, including your total IRA contributions, distributions, and any conversions made during the tax year.

- Begin filling out the form by entering your personal information at the top.

- Complete Part I if you made nondeductible contributions to your traditional IRA, reporting the total contributions for the year.

- Fill out Part II if you converted amounts from a traditional IRA to a Roth IRA, detailing the conversion amounts.

- In Part III, report any distributions from your Roth IRA, calculating the taxable amount based on your contributions and conversions.

- Review the completed form for accuracy before submitting it with your tax return.

Legal use of the Form 8606

The legal use of IRS Form 8606 is important for compliance with tax regulations. Filing this form accurately ensures that taxpayers report their nondeductible contributions and distributions correctly, which helps avoid penalties. The IRS requires this form to track the basis of nondeductible contributions, which is essential for determining the taxable portion of distributions. Failure to file Form 8606 when required can result in significant tax liabilities and penalties, making it crucial for individuals to understand their obligations regarding this form.

Filing Deadlines / Important Dates

IRS Form 8606 must be filed by the tax return due date, which is typically April 15 of the following year. If you are unable to file your tax return by this date, you may request an extension, but this does not extend the deadline for any taxes owed. It is important to note that if you miss the deadline for filing Form 8606, you may face penalties and interest on any unpaid taxes. Keeping track of these important dates helps ensure compliance and avoids unnecessary complications.

Required Documents

To complete IRS Form 8606, you will need several documents. Gather the following:

- Your previous year's Form 8606, if applicable, to reference any prior nondeductible contributions.

- Records of all IRA contributions made during the tax year, including any nondeductible contributions.

- Documentation of any conversions from traditional IRAs to Roth IRAs.

- Statements from your IRA custodian detailing contributions and distributions.

Quick guide on how to complete form 8606

Handle Form 8606 effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly option to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage Form 8606 on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 8606 effortlessly

- Locate Form 8606 and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to deliver your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that require new printouts. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Edit and eSign Form 8606 and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8606

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 8606 and why is it important?

IRS Form 8606 is used to report nondeductible contributions to traditional IRAs and distributions from Roth IRAs. Understanding how to complete this form is crucial for accurately reporting your IRA transactions and ensuring compliance with tax obligations.

-

How can airSlate SignNow help with IRS Form 8606 and instructions?

airSlate SignNow streamlines the signing and sending of documents, including IRS Form 8606 and instructions. Our platform makes it easy to create, fill out, and eSign your tax forms in a secure and efficient manner.

-

What are the costs associated with using airSlate SignNow for IRS Form 8606 and instructions?

airSlate SignNow offers a range of pricing plans designed to fit different business needs. By selecting a plan, you can access features that allow for easy handling of IRS Form 8606 and instructions without additional hidden fees.

-

What features does airSlate SignNow offer for managing IRS Form 8606 and instructions?

airSlate SignNow provides features such as customizable templates, document tracking, and secure storage, which are ideal for managing IRS Form 8606 and instructions. These capabilities help you streamline your document processes and improve productivity.

-

Can I collaborate with others when completing IRS Form 8606 and instructions on airSlate SignNow?

Yes, airSlate SignNow allows for collaboration with team members when completing IRS Form 8606 and instructions. You can share documents, receive feedback, and make edits in real-time, ensuring that everyone stays informed and aligned.

-

Is airSlate SignNow compliant with legal requirements for IRS Form 8606 and instructions?

Absolutely! airSlate SignNow complies with legal standards, ensuring that your eSigned IRS Form 8606 and instructions are legally binding. Our platform prioritizes security and compliance to help you meet regulatory obligations.

-

What integrations does airSlate SignNow support for handling IRS Form 8606 and instructions?

airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and Microsoft Office. These integrations aid in efficiently managing IRS Form 8606 and instructions alongside your other important documents.

Get more for Form 8606

- Pedorthic assessment form bfootkneebackbbcomb

- Registration830 900am form

- Good samaritan clinic form

- 22 property inquiry form templates in pdfdoc

- Download the agreement form city of vancouver

- Winter poinsettia fundraiser coaldale christian school form

- Referral form fraser health authority

- Walkability checklist form

Find out other Form 8606

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement